Creating a biweekly budget in Excel is a fantastic way to keep track of your finances, especially if you get paid every two weeks. This method helps you manage your money effectively by planning for recurring expenses and ensuring you have enough left over for savings or discretionary spending. In this article, I’ll walk you through the steps to set up a simple yet effective biweekly budget in Excel.

Key Takeaways:

- Biweekly budgeting syncs with your paycheck schedule, helping you maintain financial awareness and better spending habits.

- A template approach simplifies budgeting by providing a clear structure, making it easier to track income and expenses aligned with your pay periods.

- Regularly reviewing and adjusting your budget allows you to fine-tune expenses, allocate savings, and ensure you’re living within your means.

- Excel’s features, like conditional formatting and charts, enhance your budget by providing visual insights into spending patterns and areas for improvement.

- Biweekly budgeting is effective even for variable income, offering a consistent way to manage finances and prepare for fluctuations in earnings.

Table of Contents

Jump-Start Your Financial Planning

The Advantages of Biweekly Budgeting

Embarking on a biweekly budgeting journey means you’re choosing a method that enhances financial awareness by syncing with your paycheck schedule. It’s a significant shift from monthly budgeting, where the length between check-ins can lead to spending slip-ups.

A biweekly framework encourages me to review my finances in shorter, consistent intervals. This closer attention can lead to better spending habits and a more real-time understanding of where my money is going.

Embracing the Template Approach to Manage Paychecks

Embracing a template approach for managing paychecks is a powerful strategy. It simplifies the often-complex process of budgeting by providing a clear and organized structure. Templates like the ones I use not only streamline the tracking of income and expenses but also match perfectly with biweekly pay schedules, making it easier for me to plan and allocate funds accordingly.

By setting up automated calculations and categories tailored to specific financial goals, I can spend less time managing numbers and more time focusing on achieving my financial aspirations.

Step-by-Step Guide to Create Biweekly Budget in Excel

STEP 1: Enter Work Period

Enter the start date and end date of the biweekly period.

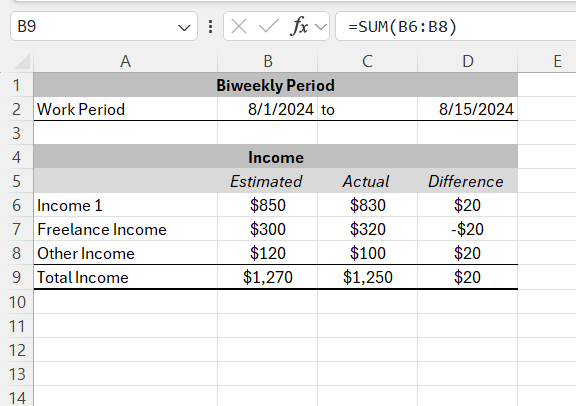

STEP 2: Set Up Your Spreadsheet

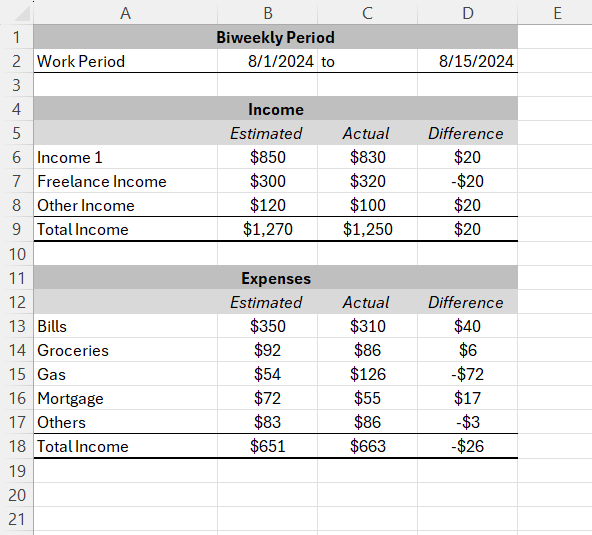

First, open Excel and start with a blank workbook. I like to organize my budget into three main sections: Income, Fixed Expenses, and Variable Expenses.

- Income Section: In the first column, list all your sources of income. This might include your paycheck, any freelance work, or other income streams. In the next column, enter the amount you receive from each source.

- Fixed Expenses Section: Below your income, create a section for fixed expenses. These are the bills and payments that stay the same every month, such as rent, mortgage, insurance, car payments, or loan repayments. List these in the first column and their corresponding estimated and actual amounts in the next column.

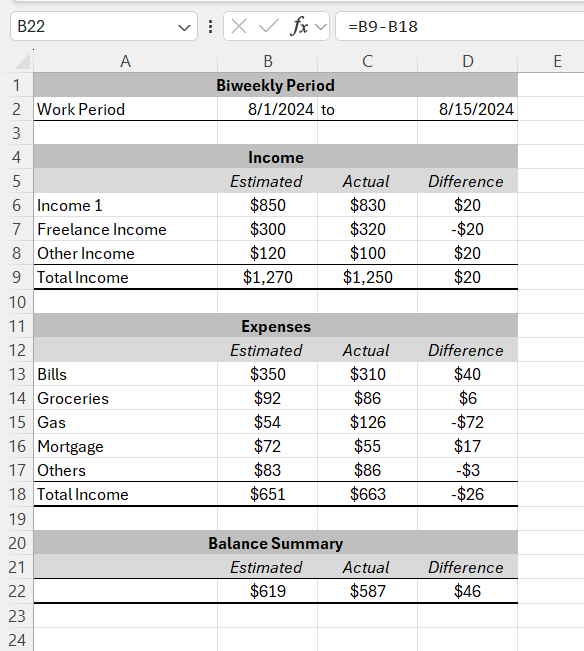

STEP 3: Determine Your Net Income

Your net income is what’s left after subtracting all your expenses from your total income. This is a crucial number because it shows you whether you’re living within your means or if you need to make adjustments.

- Net Income Calculation: Create a cell for Net Income, and use the formula:

=Total Income - Total Fixed Expenses - Total Variable Expenses. This will give you a snapshot of how much money you have left after covering your essential expenses.

STEP 4: Adjust and Fine-Tune

At this point, you might notice that your net income is lower than expected, or perhaps you have more money left over than you thought. This is where you can start fine-tuning your budget.

- Cutting Back on Expenses: If your net income is negative or lower than you’d like, consider cutting back on variable expenses like dining out or entertainment. You can adjust the amounts in your spreadsheet and see how it affects your overall budget.

- Allocating Savings: If you have a positive net income, think about allocating a portion to savings or paying down debt. You can create an additional row for savings and subtract this from your net income to see how much discretionary income you have left.

STEP 5: Using Excel’s Features to Enhance Your Budget

Excel offers several features that can make managing your biweekly budget even easier.

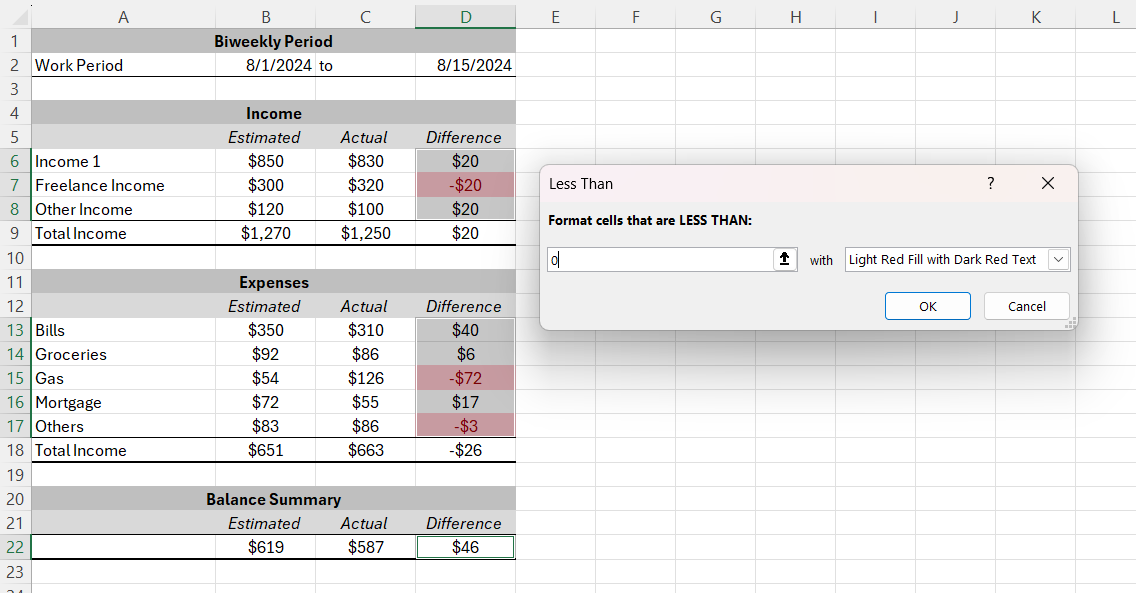

- Conditional Formatting: Use conditional formatting to highlight when your actual spending exceeds your budgeted amount. This visual cue helps you quickly identify problem areas.

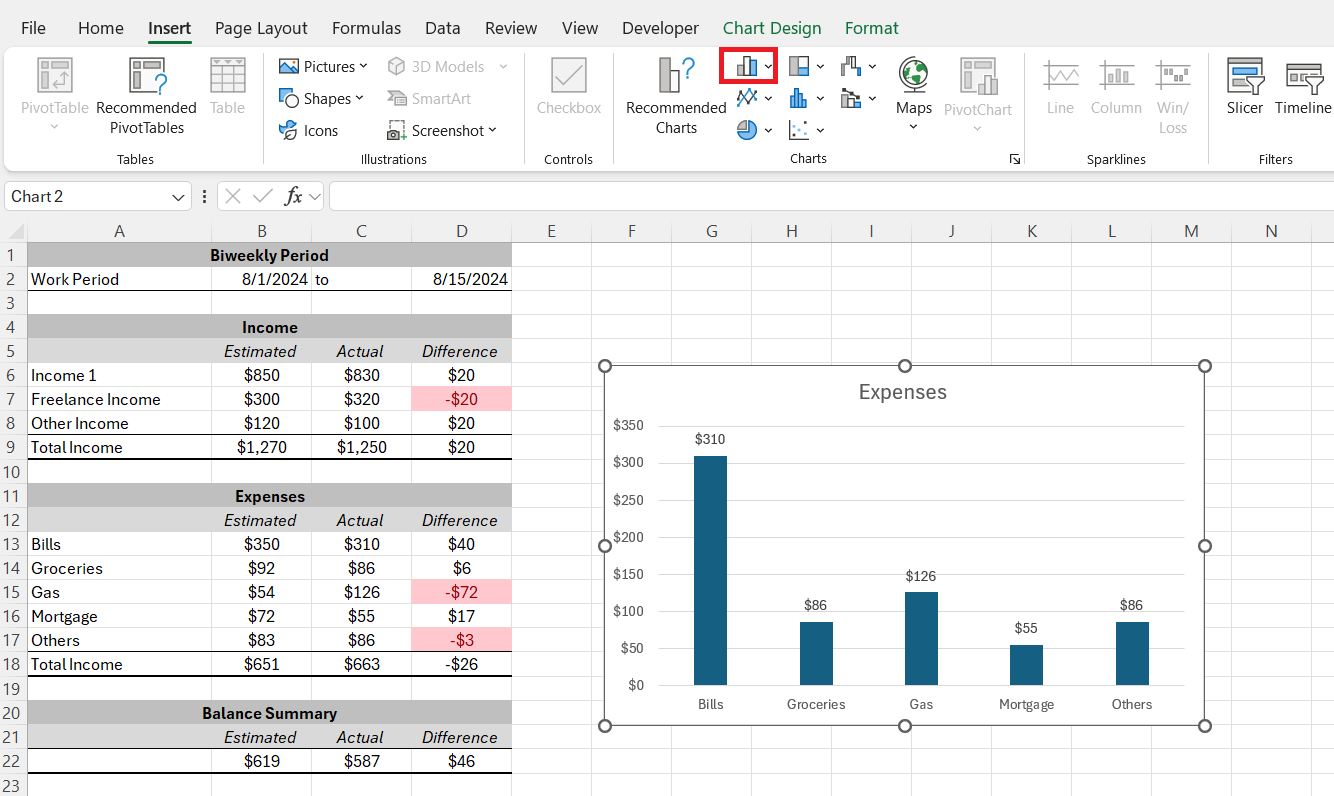

- Charts: Create simple charts to visualize your spending habits. For instance, a pie chart can show you what percentage of your income goes toward different expense categories.

- Formulas and Functions: Explore other Excel functions like

IF,SUMIF, orAVERAGEto add more sophistication to your budget. For example, you can useSUMIFto sum expenses by category.

Real-Life Applications of a Biweekly Budget

Case Studies: Biweekly Budgeting in Action

In exploring case studies of biweekly budgeting in action, I’ve observed its impact on diverse financial situations. One family managed to halve their credit card debt in a year by meticulously aligning their expenses with their biweekly income, prioritizing debt repayment with each paycheck.

Another case involved a freelancer who used a biweekly budget to smooth out erratic income fluctuations, setting aside a portion of larger paychecks to cover leaner periods. These real-life examples evidence the tangible benefits that come from a disciplined approach to biweekly budgeting, from debt reduction to income stabilization.

Testimonials: Transformations Through Biweekly Budgeting

The testimonials I’ve come across offer powerful narratives of transformation through biweekly budgeting. For instance, a young professional shared how switching to a biweekly budgeting system helped them save enough for a down payment on a home much sooner than anticipated.

Another user credited the clarity and control gained from biweekly budget tracking with helping them to finally stick to a budget and significantly improve their financial situation. Such personal accounts not only underscore the potential of biweekly budgeting to bring about positive change but also serve as motivational proof of its effectiveness in diverse circumstances.

FAQs About Biweekly Budgeting and Templates

What are the advantages of biweekly budgeting over monthly budgeting?

Biweekly budgeting syncs with my paycheck schedule, encouraging more frequent financial check-ins and better spending habits, making it easier to stay on track.

How do I start creating a biweekly budget in Excel?

Begin by setting up a spreadsheet with sections for income, fixed expenses, and variable expenses. Then, calculate your net income to see if adjustments are needed.

Why should I use a template for managing my biweekly budget?

A template simplifies the budgeting process by providing an organized structure that matches your pay schedule, helping you allocate funds more efficiently.

How can Excel features enhance my biweekly budget?

Excel’s features like conditional formatting, charts, and functions such as SUMIF and AVERAGE can help you visualize spending patterns and refine your budget.

Can biweekly budgeting work for variable income?

Yes, biweekly budgeting is effective for variable income, as it allows me to allocate funds from larger paychecks to cover leaner periods, ensuring consistent financial management.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.