Microsoft Excel is a critical tool in financial analysis, known for its capacity to simplify complex cash flow calculations and support data-driven decisions. It provides essential functions and formulas for understanding and managing cash flow, crucial for evaluating a company’s financial health.

This article delves into maximizing cash flow in Excel, highlighting its importance through practical examples and advanced techniques.

Key Takeaways

- Excel plays a vital role in financial analysis by easing cash flow calculations, which are key for making informed financial decisions.

- Understanding the three types of cash flow (Operating, Investing, and Financing) is critical for analyzing a company’s financial health.

- Essential Excel functions like SUM(), PMT(), NPV(), and others enable precise cash flow analysis.

- Real-world examples and forecasting best practices demonstrate Excel’s utility in financial management, emphasizing the need for accuracy and regular updates.

Download the spreadsheet and follow the tutorial on How to calculate max cash flow in Excel – Download excel workbookMax-Cash-Flow-in-Excel.xlsx

Table of Contents

Introduction to Maximizing Cash Flow in Excel

The Essential Role of Excel in Financial Analysis

Excel reigns supreme in the kingdom of financial tools, offering unrivaled capabilities for crunching numbers and making data-driven decisions. Whether you’re a seasoned financial expert or are beginning your journey into finance, mastering Excel can help streamline your analyses and unveil the insights hidden within the numbers.

Simplifying Complex Cash Flow Calculations

When it comes to financial analysis, few tasks are as essential yet potentially complex as calculating cash flows. However, Excel offers a lifeline, turning daunting equations into manageable tasks with just a few clicks. Excel’s functions and formulas empower you to simplify these calculations, providing clarity and precision in your financial assessments.

- Excel features numerous templates and built-in formulas to ease the process.

- It automates repetitive tasks, ensuring that even complex calculations become straightforward.

Understanding Cash Flow Concepts

What is Cash Flow and Why is it Crucial?

Cash flow, the lifeblood of any business, is the net amount of cash and cash-equivalents moving in and out of a company. It’s crucial because it measures the ability of a business to pay bills, reinvest, and provide returns to stakeholders. Without positive cash flow, businesses may struggle to maintain operations and make critical investments.

- Healthy cash flow indicates a company’s solid financial health and future growth potential.

- Poor cash flow can lead to insolvency, despite profits on paper.

Types of Cash Flows: Operating, Investing, and Financing

Cash flow is categorized into three types to provide a detailed financial picture of a business:

- Operating Cash Flow (OCF): This measures cash generated from a company’s regular business operations—reflecting the ability to generate sufficient positive cash flow to maintain and grow operations.

- Cash Flow from Investing Activities (CFI): This tracks the cash used for investments in the business, like purchasing equipment or securities—indicating the company’s growth and repayment ability.

- Cash Flow from Financing Activities (CFF): It includes cash transactions involving debt, equity, and dividends—a reflection of how a company finances its operations and manages its financial structure.

Understanding these distinctions helps stakeholders gauge the company’s financial sustainability and strategic direction.

- OCF focuses on the core business; high OCF suggests operational efficiency.

- CFI reflects investment in the future; negative CFI can be a healthy sign of expanding operations.

- CFF shows funding strategy; frequent fundraising through CFF might raise flags about solvency.

Mastering Max Cash Flow Formulas in Excel

Key Excel Functions for Cash Flow Analysis

Excel offers a suite of functions ideal for dissecting and understanding cash flow. Here are some of the key functions that analysts frequently use:

- SUM(): Quickly totals up specified cells, crucial for finding total cash inflows and outflows.

- PMT(): Calculates loan payments, an essential part of financing cash flows.

- NPV(): Computes the Net Present Value of cash flows, useful for evaluating the profitability of investments.

- IRR(): Determines the Internal Rate of Return, helping to gauge the efficiency of investments.

- XNPV() and XIRR(): Adjusted versions of NPV and IRR for irregular cash flow intervals.

Understanding and utilizing these functions allows for more thorough and accurate cash flow analysis, enabling strategic financial decisions grounded in quantitative evidence.

Step-by-Step Guide to Using Max Function for Cash Flow

Using the MAX function in Excel can greatly aid in cash flow analysis by identifying the highest cash inflows during a specific period, providing insights into your peak liquidity. Let’s break down the process:

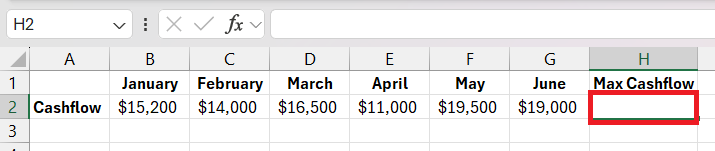

STEP 1: Click on a cell where you want the maximum cash flow figure to be displayed.

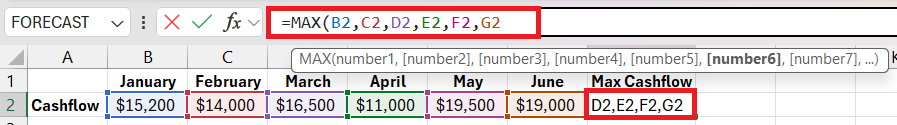

STEP 2: Type =MAX( and then select the range of cells containing your cash flow amounts.

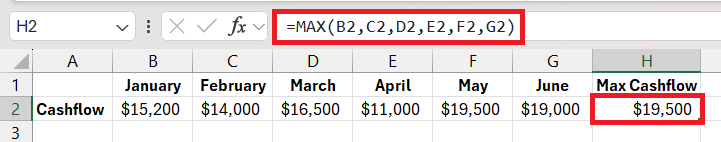

STEP 3: Close the function with ) and hit Enter.

By executing these steps, you can quickly pinpoint the most lucrative periods and plan your finances accordingly.

Real-World Applications: Cash Flow Formulas at Work

Case studies provide a valuable lens through which companies can learn best practices in cash flow management. Here are two illustrative examples:

- Streamlining Receivables: A retail company implemented automated invoice reminders through Excel, which shortened their average receivables period, enhancing their cash flow.

- Costs Optimization: A manufacturing firm used Excel to conduct a thorough analysis of their spending, identifying non-essential costs and improving their free cash flow by redirecting funds to growth-driven investments.

By analyzing these cases, businesses can draw actionable insights on managing cash flow more effectively, often translating into more strategic decision-making and improved operational efficiencies.

Tips for Accurate and Efficient Cash Flow Forecasting

Best Practices for Reliable Cash Flow Projections

Creating reliable cash flow projections in Excel requires a mix of accurate historical data analysis and prudent forecasting. Here are best practices to consider:

- Regular Updates: Keep your data current to reflect the most accurate financial status of your business.

- Conservative Estimates: When in doubt, underestimate inflows and overestimate outflows to safeguard against unexpected shortages.

- Account for Seasonality: Businesses with fluctuations should incorporate seasonal trends into their projections.

- Scenario Planning: Develop best-case, worst-case, and most likely cash flow scenarios to prepare for various business conditions.

- Monitor Key Metrics: Keep an eye on ratios like the quick ratio or operating cash flow ratio for financial health indications.

By embedding these practices into your routine, you’ll enhance the reliability of your cash flow projections, positioning your business for a more secure financial future.

Troubleshooting Common Errors in Cash Flow Formulas

Even the most seasoned Excel users can encounter errors when working with cash flow formulas. To maintain the integrity of your analysis, be diligent in troubleshooting:

- Check Cell References: Incorrect cell references can lead to miscalculations or #REF! errors.

- Ensure Correct Date Formats: Date-related errors can invalidate functions like NPV or IRR, which depend on the correct periods.

- Confirm Consistent Units: Mixing different units (e.g. months vs. years) can distort your cash flow analysis.

- Validate Formula Logic: An incorrect order of operations or misused functions may produce unexpected results.

By carefully verifying these aspects and understanding the logic behind the formulas, you’ll be better equipped to prevent and fix errors, ensuring that your cash flow calculations remain accurate and reliable.

Enhancing Your Financial Toolkit with Advanced Excel Techniques

Integrating MAX IF Functions for Detailed Analysis

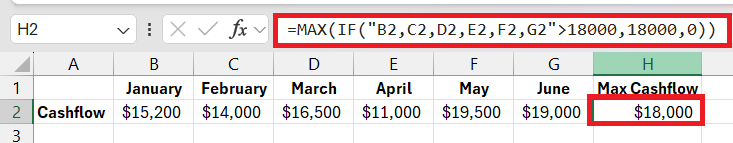

To dig deeper into your cash flow data, integrate the MAX IF combination in Excel. This powerful duo allows you to extract the maximum cash inflow or outflow under specific conditions, providing nuanced insights into your financials. Here’s your game plan:

- Since Excel doesn’t have a built-in MAX IF function, you’ll need to combine MAX with IF in an array formula.

- Enter

=MAX(IF(range=criteria, max_range))while holding down Ctrl + Shift + Enter to create an array formula.

The insights derived from this technique can illuminate patterns and inform strategic decisions regarding cash management, budgeting, and planning.

Beyond the Basics: Leveraging Macros for Cash Flow Automation

Moving beyond standard functions, macros in Excel can be a game-changer for automating repetitive tasks in cash flow analysis. Here’s how they can revolutionize your process:

- Recording Macros: Create a macro by recording a sequence of actions in Excel, such as formatting cash flow statements or calculating financial ratios.

- Writing VBA Scripts: For more control and customization, develop Visual Basic for Applications (VBA) scripts. Even simple scripts can automate data entry and complex calculations.

- Scheduled Updates: Use macros to refresh your cash flow projections automatically at regular intervals or trigger actions based on specific financial events.

Leveraging macros not only saves time but also reduces the risk of human error, ensuring that your cash flow analysis remains consistently accurate and up-to-date.

Frequently Asked Questions

Can You Automate Cash Flow Analysis with Excel?

Yes, you can automate cash flow analysis with Excel. Use built-in functions for calculations, pivot tables for data organization, and macros or VBA scripts for repetitive tasks. This automation can save time and ensure accuracy in your financial reports.

How Do Different Cash Flow Formulas Compare in Excel?

Different cash flow formulas in Excel serve varied purposes:

- The NPV formula evaluates the profitability of an investment considering the time value of money.

- IRR offers the rate of return at which the present value of cash flows equals the initial investment.

- XNPV and XIRR handle irregular interval cash flows, providing more flexibility than standard versions.

- The MAX IF array locates the highest value under certain conditions, great for specific insights.

Each formula caters to different aspects of cash flow analysis, providing a comprehensive toolset for financial evaluation.

How to do a max calculation in Excel?

To do a max calculation in Excel:

- Click on the cell where you want the maximum value to appear.

- Type

=MAX(, followed by the range of cells you’re considering, for example,A1:A10. - Close the parenthesis with

)and press Enter.

The cell will display the highest number from the selected range.

How do I find the maximum value in Excel using criteria?

To find the maximum value in Excel using criteria, use an array formula combining MAX and IF functions:

- Type

=MAX(IF(in the cell where you want the result. - Define the first range for criteria, for example,

B1:B10="Product A". - Add a comma, then specify the range with values, for example,

C1:C10). - Close the formula with

))and press Ctrl+Shift+Enter to make it an array formula.

This action gives you the max value for “Product A” from the specified range.

What is the largest (highest) amount of total sales?

The largest (highest) amount of total sales within a dataset can be found by using the MAX function in Excel. Enter the formula =MAX(D2:D11) if your total sales data is in cells D2 through D11. Press Enter, and Excel will display the highest number from that range, which represents the maximum sales amount.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.