When it comes to managing finances, understanding how compound interest works is invaluable. Whether you’re saving for retirement, planning an investment, or managing a loan, Excel can make calculating compound interest a breeze. In this guide, I’ll walk you through everything you need to know to calculate compound interest semiannually using Excel. By the end, you’ll have the tools to perform these calculations effortlessly.

Key Takeaways:

- Compound interest grows investments exponentially by earning interest on both principal and accumulated interest over time.

- Semiannual compounding accelerates growth by calculating interest twice a year, offering higher returns than annual compounding.

- Excel simplifies compound interest calculations with formulas like =B1*(1+B2/B4)^(B4*B3) and built-in functions like FV().

- Accurate results require precise formulas, consistent time units, and fixed cell references in Excel.

- Unlike compound interest, simple interest calculates only on the principal, making it suitable for short-term loans or investments.

Table of Contents

Unlocking Financial Growth: The Power of Compound Interest

What Is Compound Interest and How Does It Work?

Understanding compound interest has been a game-changer for me. It’s like planting a seed that grows into a tree, and then that tree sprouts new seeds, creating even more growth. This is the essence of compound interest—where my initial investment earns interest, and that interest earns interest on itself over time, leading to exponential growth.

Compound interest is a powerful concept in finance that allows your investments to grow exponentially over time. Unlike simple interest, which is calculated only on the principal amount, compound interest is calculated on both the principal and the accumulated interest.

When we talk about calculating compound interest semiannually, it means that the interest is compounded twice a year. Excel is a fantastic tool for performing these calculations efficiently.

Excel Strategies for Calculating Semiannual Compound Interest

Understanding Semiannual Compounding

Semiannual compounding means interest is added twice a year, which helps wealth grow faster than annual compounding. The formula for calculating future value is:

FV = P (1 + r/n)^(nt)

Where:

- FV is the future value,

- P is the principal,

- r is the annual interest rate,

- n is the number of compounding periods per year (2 for semiannual),

- t is the number of years.

For example, if I invest $100 at 8% interest compounded semiannually for 3 years:

FV = $100 * (1 + 0.08/2)^(2*3) = $126.53

So, my $100 grows to $126.53 after 3 years.

The key takeaway is that more frequent compounding increases returns, even with the same annual interest rate.

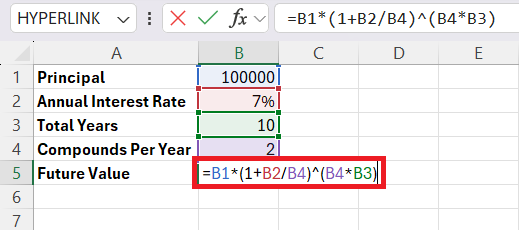

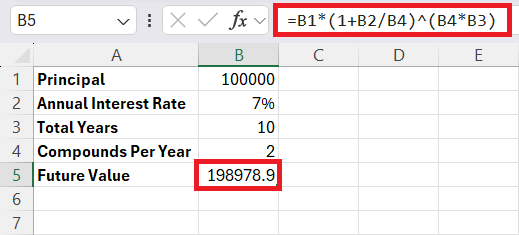

Step-by-Step Guide: Setting Up Excel for Semiannually Calculations

When working with semiannual compounding, Excel can make the process quick and efficient. Here’s how I set up my worksheet to calculate the future value of an investment that compounds interest twice a year.

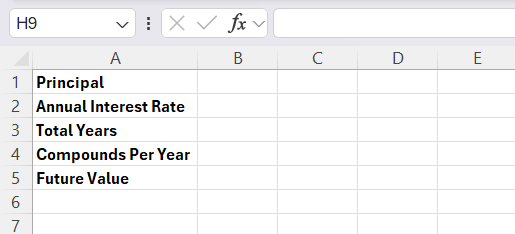

STEP 1: Start by opening a new Excel workbook.

STEP 2: In column A, label the following:

- A1: “Principal”

- A2: “Annual Interest Rate”

- A3: “Total Years”

- A4: “Compounds Per Year”

- A5: “Future Value”

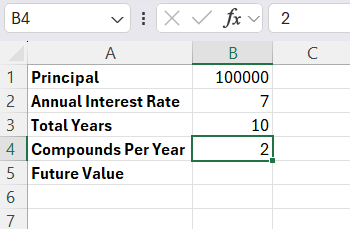

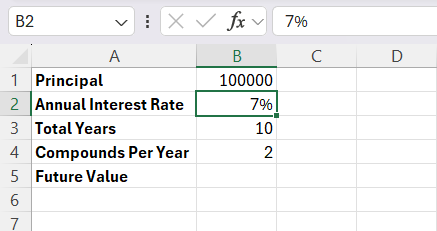

STEP 3: In column B, enter the corresponding values:

- B1: Your principal (initial amount).

- B2: Annual interest rate (as a percentage).

- B3: Total years for the investment.

- B4: 2 (for semiannual compounding).

STEP 4: Ensure B2 is formatted as a percentage and B3 as a number (years).

STEP 5: In cell B5, enter the formula for future value:

=B1*(1+B2/B4)^(B4*B3)

This calculates the future value with semiannual compounding.

STEP 6: Hit Enter to calculate the future value. Excel will display the result.

By following these steps, you can easily set up Excel to calculate semiannual compounding and track your investment’s growth.

Advanced Excel Features for Easier Compound Interest Calculations

Excel has some powerful built-in functions that make working with compound interest easy. These tools help us calculate things like future value and payments quickly and accurately, especially when dealing with semiannual compounding. Here’s how I use these features to simplify the process:

Use the FV Function for Future Value

The ‘FV’ function in Excel helps calculate the future value of an investment. For semiannual compounding, the formula looks like this:

=FV(rate, nper, pmt, pv, type)

- Rate: The interest rate per period (divide the annual rate by 2 for semiannual).

- Nper: The total number of periods (years * 2).

- Pmt: Payments made per period (enter as 0 if there are no periodic payments).

- Pv: The present value (initial investment).

- Type: Enter 0 if payments are made at the end of the period, or 1 if made at the beginning.

This function is like a shortcut, giving me the future value without manually calculating each step.

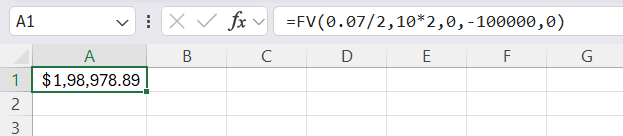

Let’s say, you’re investing $100,000 at an annual interest rate of 7%, compounded semiannually (twice per year), for 10 years.

To Calculate Future Value Using the FV Function in Excel – Open Excel and select the cell where you want to display the result (for example, cell A1). Enter the FV formula in the selected cell: excel Copy code =FV(0.07/2, 10*2, 0, -100000, 0).

Here’s what each part of the formula means:

- Rate (0.07/2): The annual interest rate is 7%, but since the interest is compounded semiannually, I divide 7% by 2, so the rate per period is 0.035 (3.5%).

- Nper (10*2): I am calculating for 10 years with semiannual compounding (compounding 2 times per year). So, I multiply 10 years by 2, giving me 20 periods (because the interest compounds twice each year).

- Pmt (0): There are no additional periodic payments made (no deposits or withdrawals) after the initial investment. So, I enter 0 here.

- Pv (-100000): The present value is the initial investment, which is $100,000. I enter it as a negative number because it’s an outflow (money I am investing).

- Type (0): Payments are made at the end of each period (standard for compound interest). So, I enter 0.

FAQs on Semiannual Compound Interest

How Do I Set Up Semiannual Compounding Frequencies in Excel?

Enter the principal in a cell (e.g., B1), the annual interest rate in another (e.g., B2, as a percentage), and the duration in years in B3. Type 2 in B4 for semiannual compounding. Use the formula =B1*(1+B2/2)^(2*B3) in B5 to calculate the future value.

How do you compound interest annually in Excel?

Input the principal in A1, the annual interest rate in A2 (formatted as a percentage), and the number of years in A3. Use =A1*(1+A2)^A3 in A4 to compute the compounded amount.

Can Excel Calculate Future Values with Semiannual Compounding Automatically?

Yes, Excel’s FV function handles this. Divide the annual rate by 2 for the semiannual rate and multiply the years by 2 for the total periods. Use =FV(rate, nper, -payment, -principal) to get the future value.

What Are the Best Practices for Ensuring Accuracy in Compound Interest Calculations?

For ensuring accuracy in compound interest calculations in Excel, it’s crucial to adopt best practices:

- Double-check your formula for precision, including correct cell references and structure.

- Use the exact interest rate and adhere to the designated compounding period.

- Maintain consistency with time units; accurately specify as years or months..

These steps are your safeguards to avoid miscalculations and ensure reliable results.

What is simple interest?

Simple interest is a straightforward way of calculating interest that’s based solely on the original amount of a loan or investment, known as the principal. It’s computed by multiplying this principal by the interest rate per period, and then by the number of periods.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.