Managing expenses is a crucial aspect of keeping my finances in check, whether for personal budgeting, tracking business costs, or managing project expenses. One of the most effective ways I’ve found to keep things organized is by using Excel Expense Sheet templates. These templates simplify the entire process, giving me a clear overview of my income and expenses, and helping me make better financial decisions.

In this article, I’ll walk you through how I use Excel Expense Sheet Templates to manage my spending and the benefits they offer.

Key Takeaways:

- Excel simplifies budgeting by offering customizable templates and user-friendly features that cater to both personal and business financial management.

- Effective expense sheets should include categories, date tracking, automated calculations, and clear summaries to provide better financial insights.

- Customization is key when building an expense tracker in Excel, with options for drop-down lists, formulas, and data validation to suit specific financial needs.

- Advanced Excel functions, like Pivot Tables, VLOOKUP, and SUMIFS, enhance the depth of financial analysis, making expense tracking more insightful.

- Limitations of Excel may arise when managing complex or large-scale expenses, signaling the need for more sophisticated tools or software.

Table of Contents

Streamlining Your Finances with Excel

The Simplicity and Versatility of Excel for Budgeting

Excel has proven to be an indispensable tool in the art of budgeting due to its simplicity and customization options. Those overwhelmed by the thought of tracking their finances can breathe easy, as Excel’s user-friendly interface allows for seamless navigation and management of financial data.

The real beauty lies in its versatility; it’s just as suitable for crafting a straightforward household budget as it is for managing complex business finances. With the plethora of templates available for a range of budget scenarios, Excel takes the edge off financial planning, injecting efficiency and clarity into what can often be a murky chore.

One can access these templates quite effortlessly. By navigating to templates.office.com, a treasure trove of Excel budgeting templates is at one’s fingertips. Collaboration features also shine here, allowing multiple users to interact with a budget document simultaneously – a boon for managing shared expenses or joint ventures.

Key Features of Effective Expense Sheets

Effective expense sheets are the backbone of sound financial management, where clarity and accuracy are paramount. Here are some key features that distinguish a well-designed expense sheet:

- Categorical Breakdown: It should facilitate organization by categorizing expenses, such as utilities, groceries, and transportation, enabling a clearer view of spending habits.

- Date Tracking: Recording the date of each transaction helps in chronological documentation, making it easier to follow expense patterns over time.

- Description Fields: Space to write detailed descriptions ensures that each expense is well-documented and identifiable for future reference.

- Automated Calculations: Formulas for sums, averages, and other calculations save time and reduce errors, ensuring the data is always up-to-date.

- Summary Insights: Visually appealing charts and summaries provide a snapshot of where money is going and help identify possible areas for savings.

- Customizable Fields: The ability to modify categories and fields means the sheet can grow and adapt to changing financial situations.

- Currency and Tax Considerations: Provisions for different currencies and tax calculations are vital for users handling international transactions or business expenses.

- Data Validation: Drop-down lists and conditional formatting help maintain consistency and accuracy in the entries.

An effective expense sheet is more than a means to track spending — it’s a financial dashboard that provides insight and informs smarter money management decisions.

Customizing Your Own Expense Tracker in Excel

Basic Steps to Create an Expense Sheet from Scratch

Creating an expense sheet in Excel from scratch can be a rewarding process as it allows for tailoring the document to specific financial needs. Here are the steps to get started:

STEP 1: Launch Excel and start with a clean slate by selecting a new blank workbook.

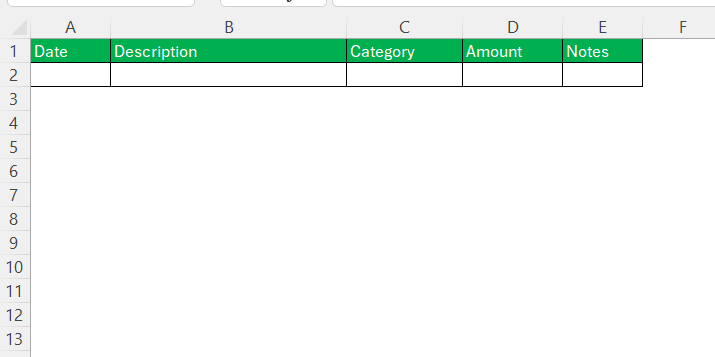

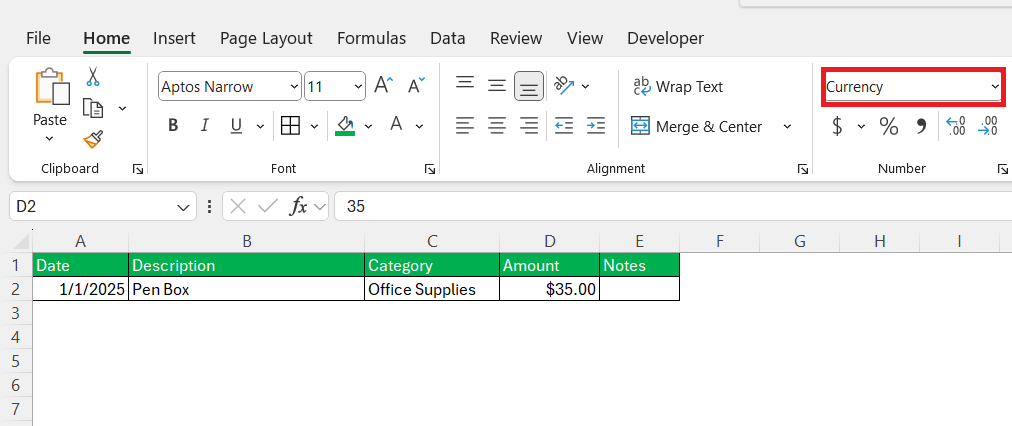

STEP 2: Define the columns that will be used. Typical columns include Date, Description, Category, Amount, and Notes.

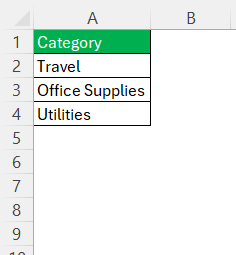

STEP 3: Decide on the expense categories that are relevant to your operations such as travel, office supplies, or utilities.

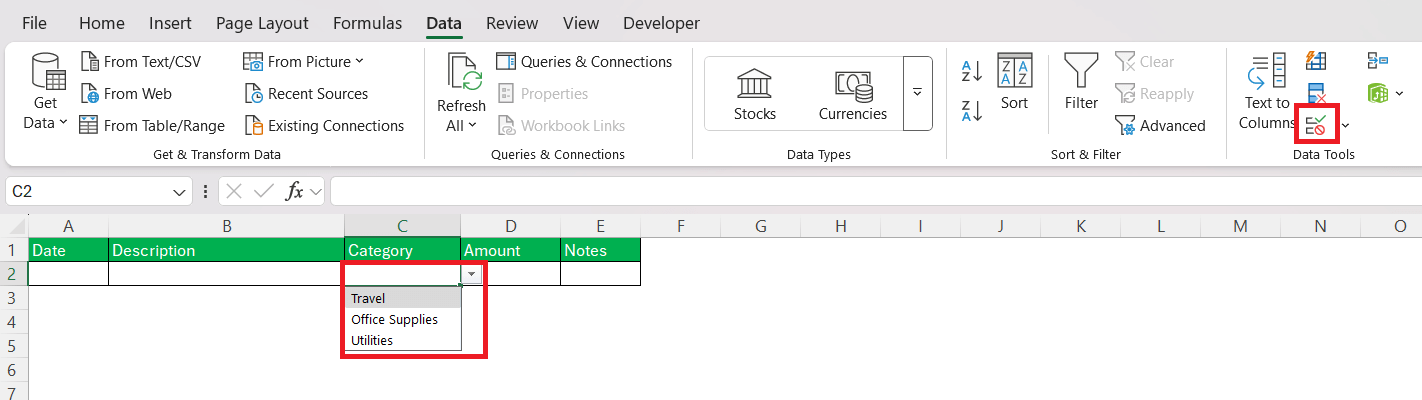

STEP 4: To keep data entry consistent, use the Data Validation feature under the Data tab to create drop-down lists for the Category column.

STEP 5: Apply number formatting to the Amount column to ensure that all entries are consistent (e.g., $1,234.56).

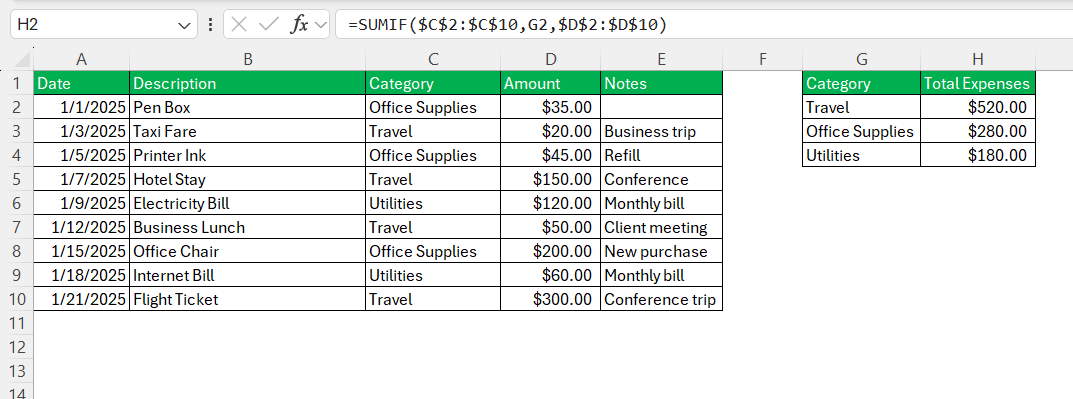

STEP 6: In a separate row or column, use formulas, such as SUMIF, to calculate totals for each category and overall expenses.

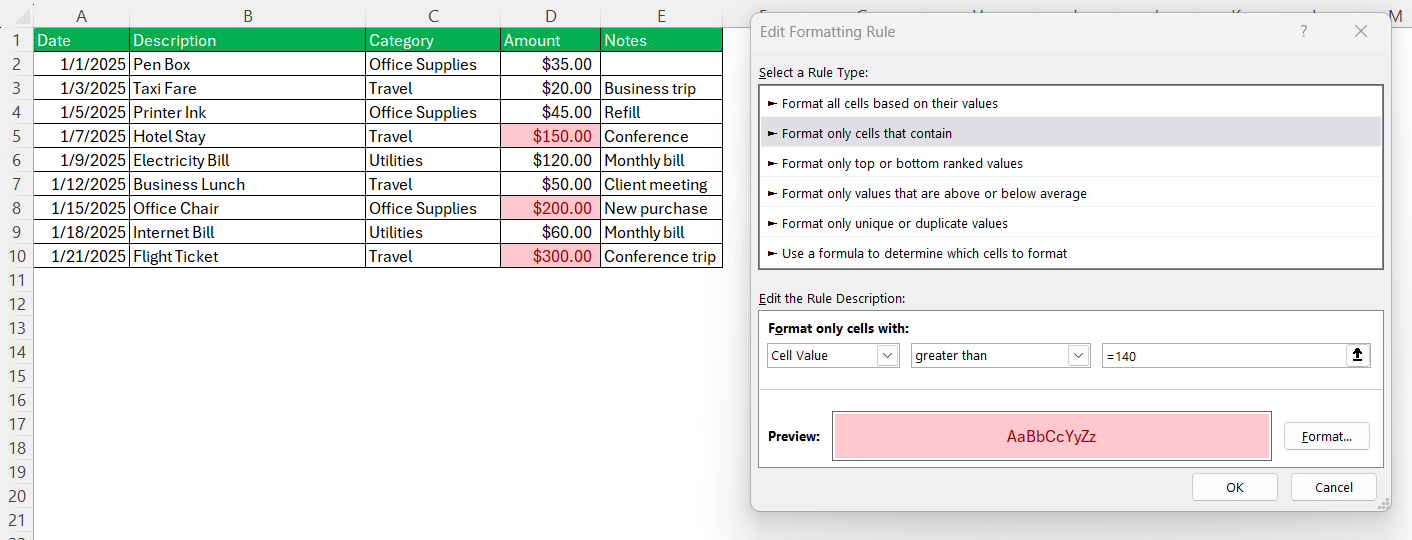

STEP 7: Highlight certain transactions that require attention, such as expenses over a certain amount.

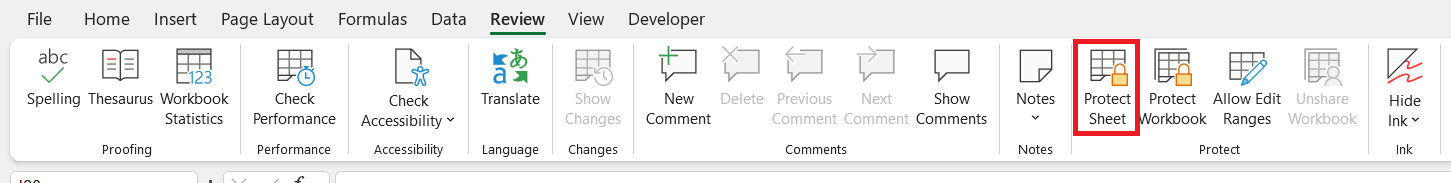

STEP 8: Use the Protect Sheet feature to lock specific cells or the entire sheet to prevent unintentional edits.

Once these steps are completed, you’ll have a functional expense sheet tailored to your specific financial tracking needs.

Enhancing Functionality with Pivot Tables, Charts, and Conditional Formatting

To elevate the analysis of expenses in Excel, I incorporate Pivot Tables, Charts, and Conditional Formatting—they are powerful features that bring depth to the data.

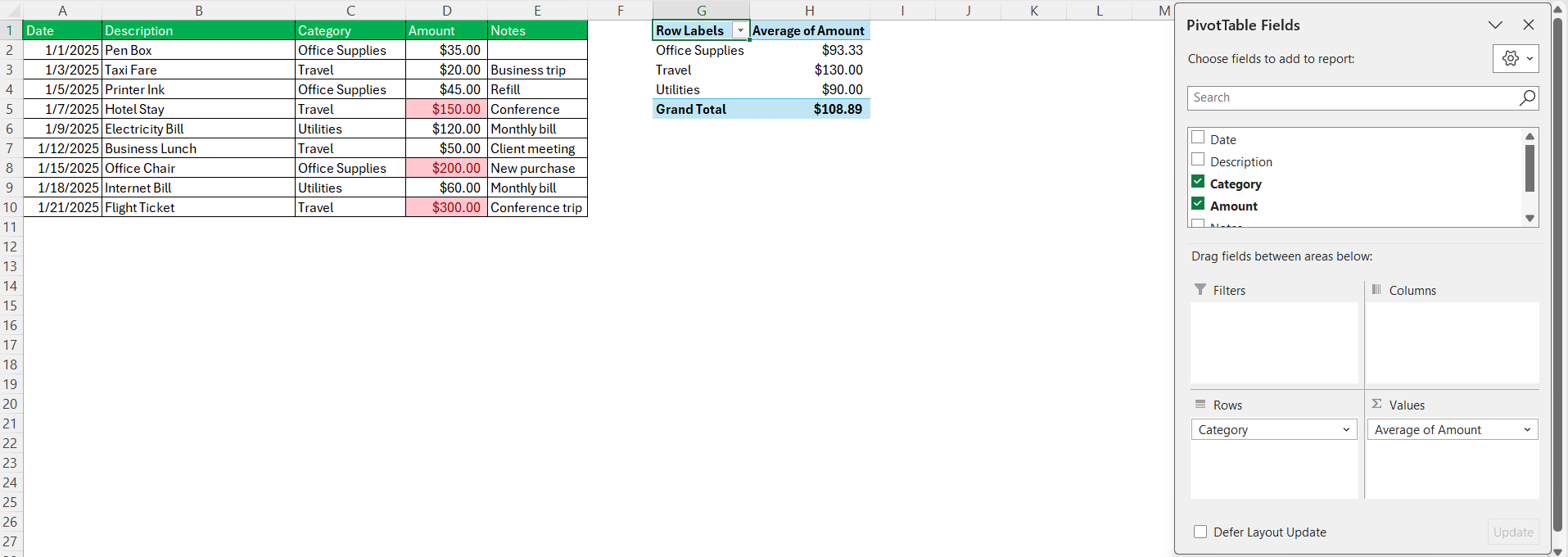

Using Pivot Tables, I effortlessly amalgamate extensive financial data into a digestible form. By selecting relevant columns and applying the Pivot Table tool, I can organize expenses by category or date, thereby elucidating patterns and trends in spending. The beauty of Pivot Tables lies in their flexibility—allowing swift adjustments to the represented data without altering the source, perfect for financial reviews where different stakeholders may require varying data perspectives.

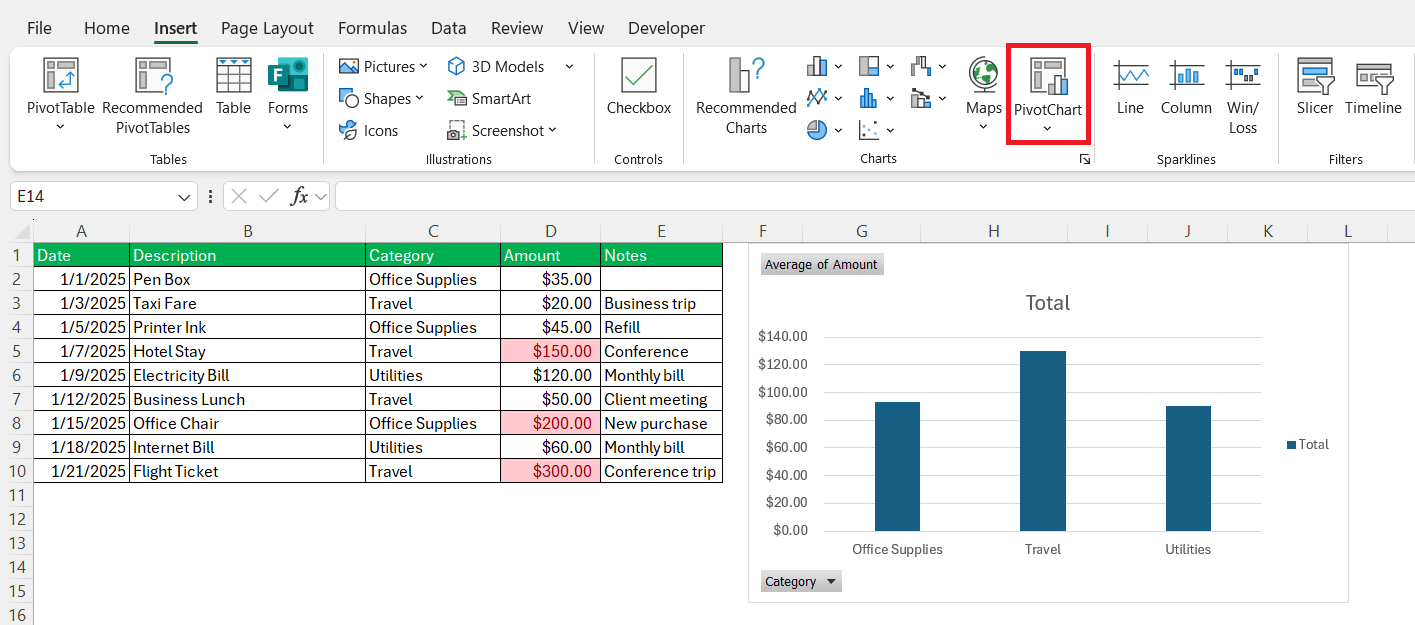

Pivot Charts complement this analysis; they’re invaluable for visual learners or when presenting financial data. By quickly converting a Pivot Table into a chart, the narrative behind the numbers emerges, facilitating more impactful discussions around financial planning and budget allocation.

Driving these functionalities together not only saves time but also endows a spreadsheet with analytical prowess, turning a simple expense tracker into a dynamic tool for financial insight.

Smart Tips for Managing and Categorizing Expenses

Techniques for Efficient Data Entry and Validation

For streamlined data entry and ensuring the accuracy of an expense sheet, mastering certain Excel techniques is crucial. Here are some efficient strategies:

- Utilize Shortcuts: Keyboard shortcuts for copy-pasting and filling down data dramatically speed up the process. The ‘Ctrl’ (‘Cmd’ on Mac) plus arrow keys can also rapidly navigate the spreadsheet.

- Leverage Fill Handle: Click and drag the Fill Handle—a tiny square at the bottom-right corner of a selected cell—to quickly replicate values or formulas across adjacent cells.

- Data Validation: To prevent entry errors, under the Data tab, the Data Validation feature restricts inputs to specific formats and ranges, ensuring the integrity of the data collected is maintained.

- Dropdown Lists: Using dropdown lists minimizes mistakes and standardizes entries. I create these for categories or frequently used notes to maintain consistency.

- Table Structures: Converting data range to a Table (using ‘Ctrl’ + ‘T’) organizes information efficiently, enabling better sort and filter options, and automatic adjustments to data ranges used in formulas as new data is added.

- Templates and Macros: For recurring data entry tasks, building templates with predefined formats and employing macros to automate repetitive actions save significant time and effort.

By integrating these data entry and validation techniques, the task of managing an expense sheet becomes not only more efficient but less prone to error, ensuring that the financial data one relies on remains credible.

Utilizing Advanced Functions for In-depth Financial Analysis

Digging deeper into financial health requires more than just a rudimentary understanding of Excel. Utilizing its advanced functions, I can dissect complex data and garner substantial insights. Here’s how I make the most of these features:

- Advanced Filtering: This allows me to sift through expenses based on several criteria at once, such as date ranges, amounts, or specific categories, enabling targeted analyses.

- SUMIFS & COUNTIFS: These functions calculate totals and counts based on multiple conditions. By using them, I can, for instance, sum all expenses above a certain threshold or within a particular category.

- VLOOKUP & HLOOKUP: With these, I can integrate data from separate tables, linking expenses to additional data for a more comprehensive financial overview.

- INDEX & MATCH: When it’s about versatility, these functions together are unmatched. They can perform more flexible lookups than VLOOKUP, especially in large datasets with numerous variables.

- XNPV & XIRR: Especially useful for projects or investments, these functions assess net present value and internal rate of return, accounting for irregular cash flow timings.

In employing these advanced functions, I can tailor my analyses to specific needs, whether tracking irregular spending patterns or forecasting future expenses based on historical data. They are fundamental tools for anyone serious about taking their financial analysis to the next level.

Overcoming the Limitations of Excel Expense Sheets

Recognizing When to Move Beyond Spreadsheets

When managing expenses becomes a herculean task, it’s a telltale sign to move beyond traditional spreadsheets. There are several red flags to watch for that signal it’s time to upgrade:

- Complexity Overwhelms Simplicity: If the spreadsheet becomes laden with macros, complex formulas, and extensive manual data entry, it can become unwieldy and prone to errors.

- Collaboration Challenges: When multiple team members need to input data simultaneously and version control issues emerge, a solution with real-time collaboration features is essential.

- Reporting Limitations: If generating insightful reports requires substantial manual work due to the limitations of Excel’s built-in capabilities, more sophisticated reporting tools should be considered.

- Data Integration Needs: As a business expands, integrating financial data with other systems (like CRM or ERP) becomes crucial. If Excel can’t accommodate these requirements efficiently, it’s time for a change.

- Scale and Performance Issues: Spreadsheets have their thresholds. If the file size balloons and performance lags with a spinning cursor becoming a familiar sight, a more robust system may be needed.

Adopting dedicated expense management software offers more advanced features, security, and can seamlessly grow with the business, delivering insights that a static spreadsheet simply cannot match.

FAQs about Excel Expense Trackers

What is a business expense report?

A business expense report is a formal document where employees report their business-related expenses for reimbursement, and companies track these expenses for accounting and tax purposes. It typically includes details such as the date, nature of the expense, the amount spent, and receipts or proof of purchase.

How can I start an expense sheet in Excel?

To start an expense sheet in Excel, open a new workbook, label columns for Date, Category, Description, and Amount, and start recording your expenses. Utilize in-built formulas for totals and data validation to keep entries consistent.

What is the best way to categorize expenses in my Excel template?

The best way to categorize expenses is by aligning them with your financial goals and habits. Start with broad categories like Utilities, Transportation, and Food, and get more specific as needed for detailed tracking and analysis. Use data validation in Excel to ensure consistency.

Can I automate data entry in an Excel expense report?

Yes, you can automate data entry in Excel using features like form controls, importing data from bank statements, or creating macros that perform repetitive tasks based on predefined rules.

Are there any advanced features that help track unusual or fraudulent expenses?

Yes, advanced Excel features like Conditional Formatting can highlight anomalies or outliers in expenses, and formulas like SUMIFS can track deviations from average spending to help identify unusual or potentially fraudulent expenses.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.