Key Takeaways

- Master keyboard shortcuts to enhance efficiency and for swift navigation in Excel.

- Utilize the Paste Special feature to maintain the data integrity of complex financial spreadsheets.

- Employ advanced filtering options and data sorting techniques to accurately analyze vast accounting data with ease.

- Incorporate Pivot Tables for sophisticated data analysis, helping to summarize detailed financial data into digestible insights.

- Embrace the latest additions like Idea Button and Power Query, to streamline data analytics and improve decision-making.

Table of Contents

The Excel Evolution in Accounting

How Excel Became the Accountant’s Go-To Tool

Microsoft Excel’s role in the world of accounting has grown from a helpful tool to an indispensable part of the profession’s toolkit. In the past, the versatility of Excel gave it an edge, but today, its necessity is unquestionable. A staggering 63% of American companies have recognized Excel’s indispensability for accounting tasks. Its integration into the CPA exam underlines its stature in professional standards.

Key Changes and Updates for 2024

In 2024, Excel continues to broaden its horizons with pivotal updates enhancing user experience for accountants. Excel’s innovative features now lean heavily into AI-assisted analysis, which can predict trends and automate complex data tasks. The introduction of powerful error-checking algorithms significantly cuts down on manual checks, enhancing reliability. Seamless cloud integration has become more robust, allowing for real-time collaboration across the globe, a particularly vital aspect post-2020’s shift towards remote work. Significant formula upgrades cater to the complex demands of financial computation.

Mastery for Financial Accuracy

Keyboard Shortcuts for Speedy Data Entry

Excel’s keyboard shortcuts are lifesavers for accountants who manage vast amounts of data. They transform potentially time-consuming tasks into quick keystrokes. For instance, pressing Alt+N swiftly takes you to the Insert Tab, bypassing several mouse-clicks. Common shortcuts like Ctrl+Shift+L for toggling filters or Alt+= for AutoSum are pivotal for rapid data management, with proven time savings. Embracing these shortcuts not only accelerates your workflow but also minimizes the risk of errors associated with manual entry.

Advanced Formulas Accountants Can’t Live Without

For accountants, advanced Excel formulas are like the Swiss Army knife for data analysis and financial calculations. Mastering a range of functions is non-negotiable. They must be on top of formulas like VLOOKUP for searching through tables, SUMIFS for conditional sums, XNPV and XIRR for analysing cash flows, and INDEX(MATCH()) for more flexible lookups than VLOOKUP alone offers.

- AGGREGATE: Combines statistical functions while ignoring hidden rows and error values.

- ROUND: Ensures precise rounding of currency figures to prevent discrepancies.

- EOMONTH & EDATE: Manipulate and calculate dates, essential for financial projections and scheduling.

- WORKDAY: Calculate deadlines and due dates excluding weekends and holidays.

- 3D Formulas: Aggregate data across multiple sheets seamlessly.

- SUMIFS/AVERAGEIFS/COUNTIFS: Advanced conditional calculations for better data insights.

Remember, knowing when and how to apply these formulas can transform your spreadsheets from mere tables to powerful financial tools.

Structuring and Managing Data

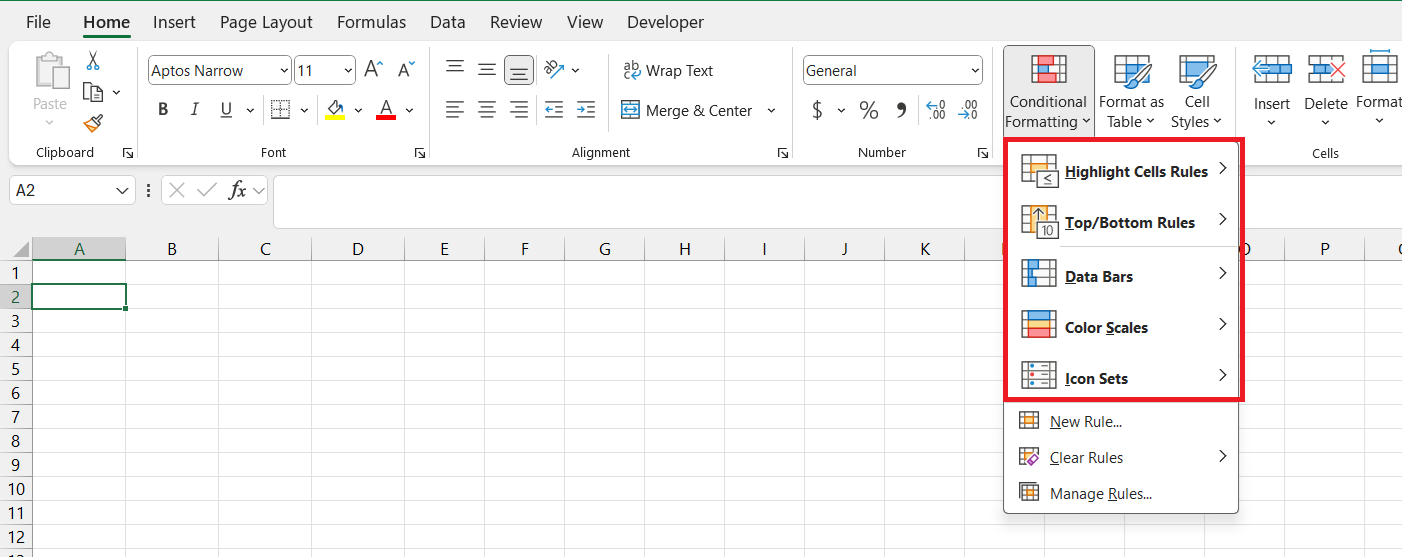

Data Validation and Conditional Formatting Techniques

Data validation and conditional formatting are two indispensable tools in Excel for accountants that transform raw data into understandable and error-free information.

Data Validation: It ensures the accuracy and quality of the data entering the spreadsheet. For instance, accountants at the Hotel California use data validation to restrict room booking inputs to whole numbers between 1 and 10. This ensures that the data entered is both meaningful and within a specified range, reducing the potential for errors and the need for time-consuming data cleanups later.

Conditional Formatting: When it comes to analyzing data at a glance, conditional formatting is a game-changer. You can highlight duplicate values with a single click, use the “Top Bottom Rules” to identify the top 10 expenses or revenues, and apply gradients, data bars, or icon sets that offer visual queues, making it easier to spot trends and outliers.

- Highlighting errors: Red flags can be set up to appear for anomalies.

- Visual trends: Data bars provide a quick understanding of comparative value sizes.

- Aiding quick decision-making: Color scales can indicate the status of financial metrics instantly.

- Identifying duplicates: Instantly see data entry repetitions that might denote errors.

- Focus attention: Use icon sets to draw eyes to important figures like high-priority debts.

With these techniques, accountants can enforce data integrity and visually enhance their spreadsheets for swift analysis and decision-making.

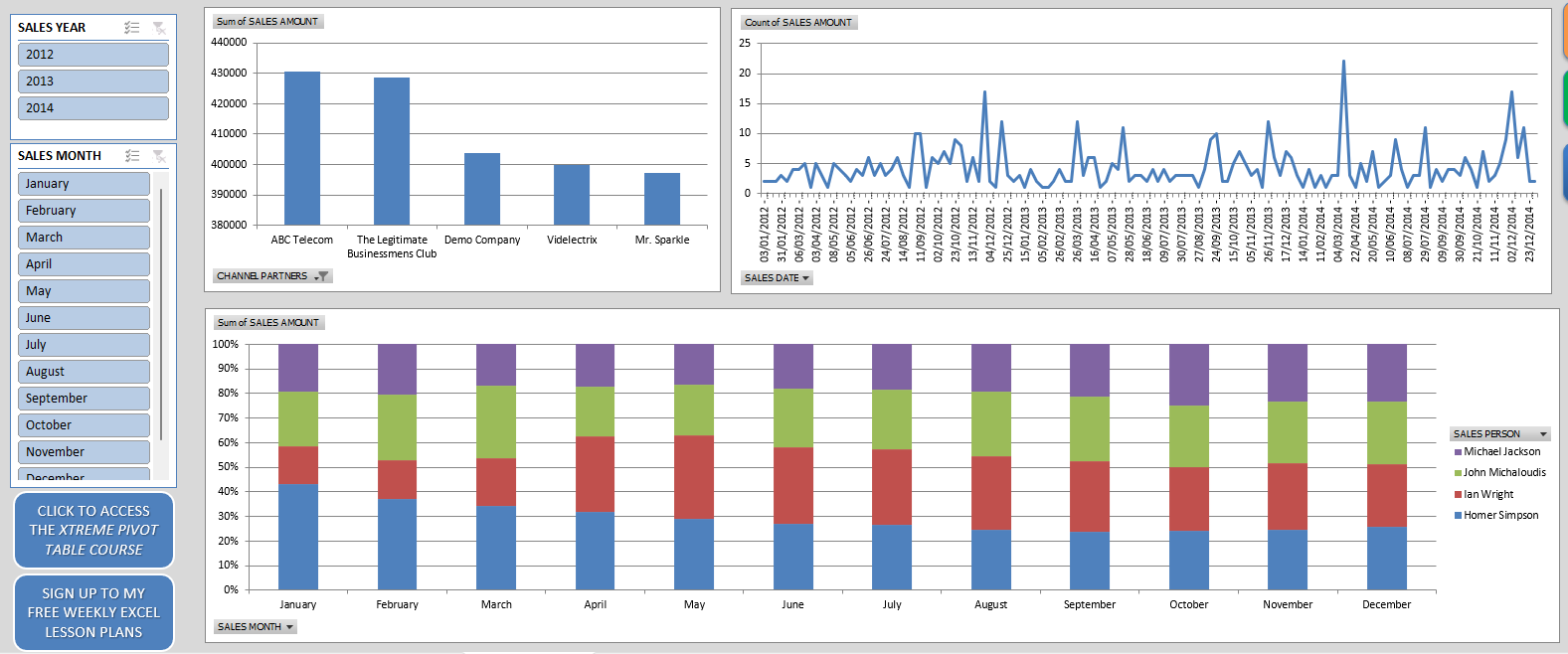

Mastering Pivot Tables for Comprehensive Analysis

Pivot tables are the cornerstone of powerful data analysis in Excel, and accountants benefit immensely from mastering them. They harness the raw data and offer insights through succinct summaries. Pivot tables allow for the easy arrangement, sorting, and drilling down of data, leading to effective trend recognition.

- Organized Data: Say goodbye to chaos. Pivot tables enable you to group and summarize your data with drag-and-drop simplicity.

- Custom Calculations: Calculate the sum, average, or other statistical measures across vast datasets effortlessly.

- Filtering Options: Sift through the noise and focus on what’s relevant by filtering data based on your criteria.

- Data Comparisons: Use pivot tables to compare figures across different periods, categories, or any other data segmentation.

- Interactive Reports: Create dynamic reports that can be manipulated by end-users for different perspectives.

The most impactful feature for accountants is the ability to pivot data to see various summaries without altering the base data—providing a lens through which financial data becomes insightful narrative.

Cons:

- Overwhelming for large datasets: With substantial data, pivot tables can become complex and unwieldy.

- Refresh management: Remembering to refresh pivot tables to include recent data can sometimes trip users up.

Ideal for:

Accountants who need to quickly identify trends, prepare detailed reports, and provide strategic financial insights will find pivot tables especially useful.

Visual Representations of Financial Data

Creating Impactful Charts and Graphs

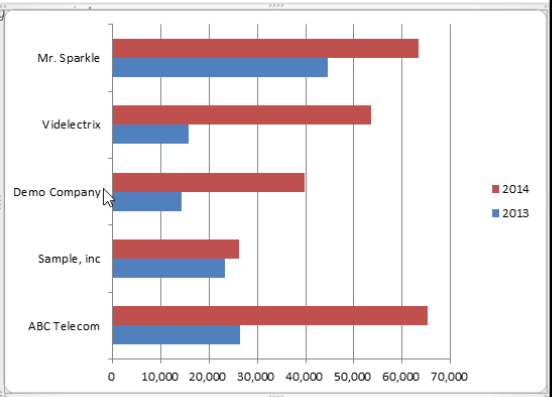

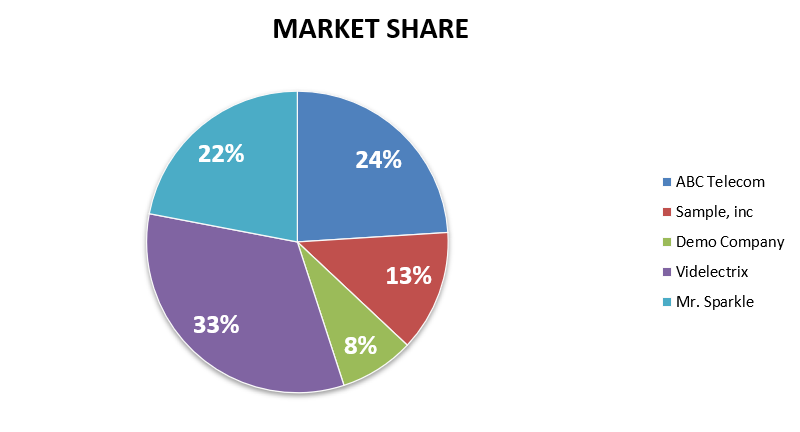

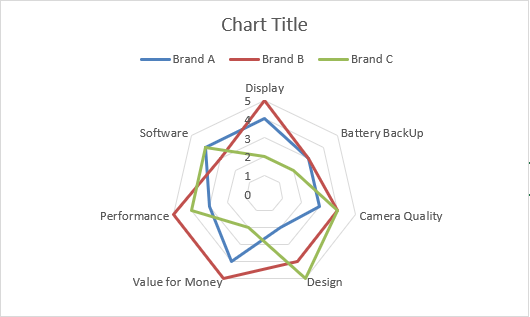

To convey complex financial data with clarity, accountants turn to Excel’s arsenal of charts and graphs.

Creating Impactful Charts and Graphs:

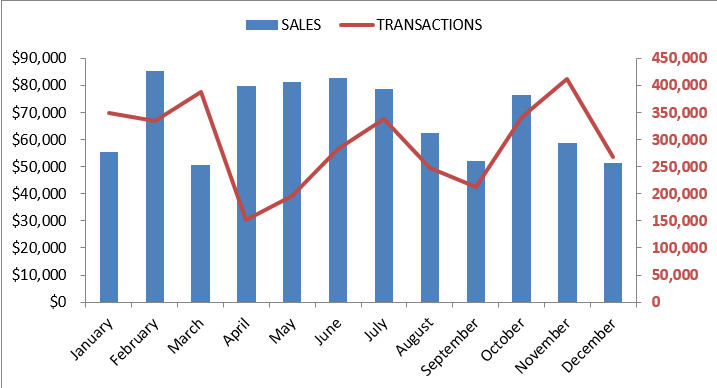

- Bar and Line Charts: These are essential for showcasing time series data, such as monthly revenue trends. Remember, a clustered bar chart might be more effective than a line chart if you’re comparing different categories side-by-side.

- Pie Charts: Use these to demonstrate the breakup of a figure or percent contribution. For instance, a pie chart vividly illustrates the share of total expenses represented by different departments.

- Radar Charts: These are less common but can be quite effective for showing performance metrics across multiple variables or categories.

- Combinations: Sometimes combining chart types, like a line chart with a bar chart, can provide dual perspectives within the same visual.

When creating charts:

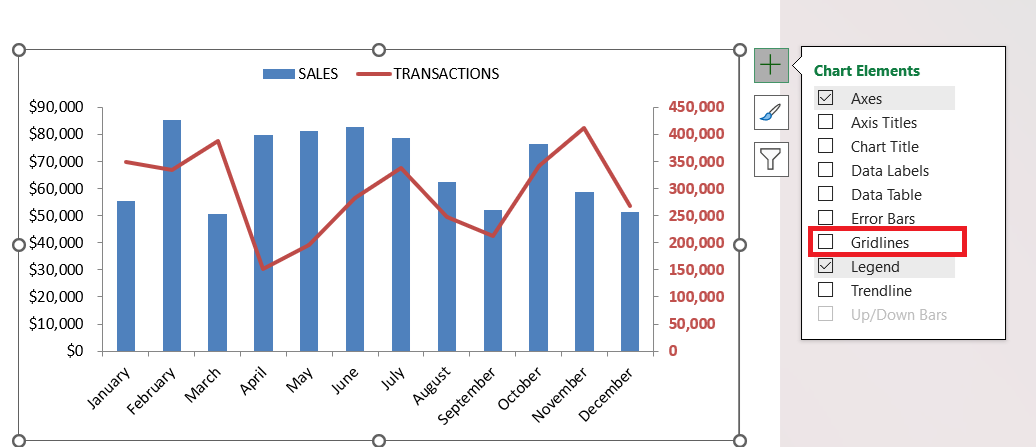

- Avoid clutter: Keep charts uncluttered by eschewing unnecessary vertical lines.

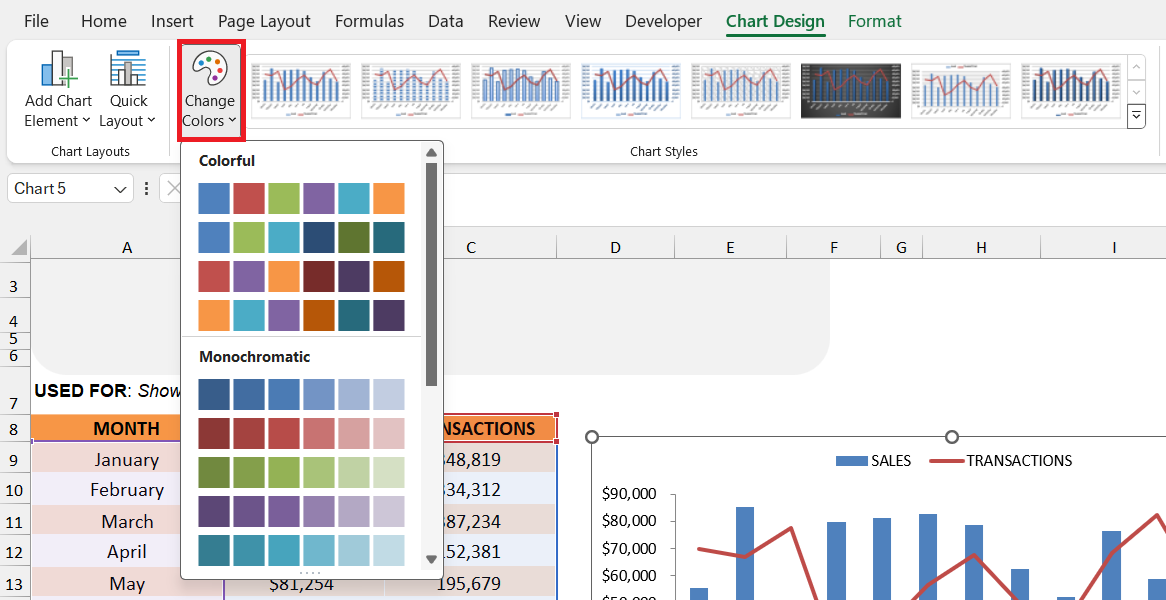

- Color harmony: Use a harmonious color palette for better visualization and understanding.

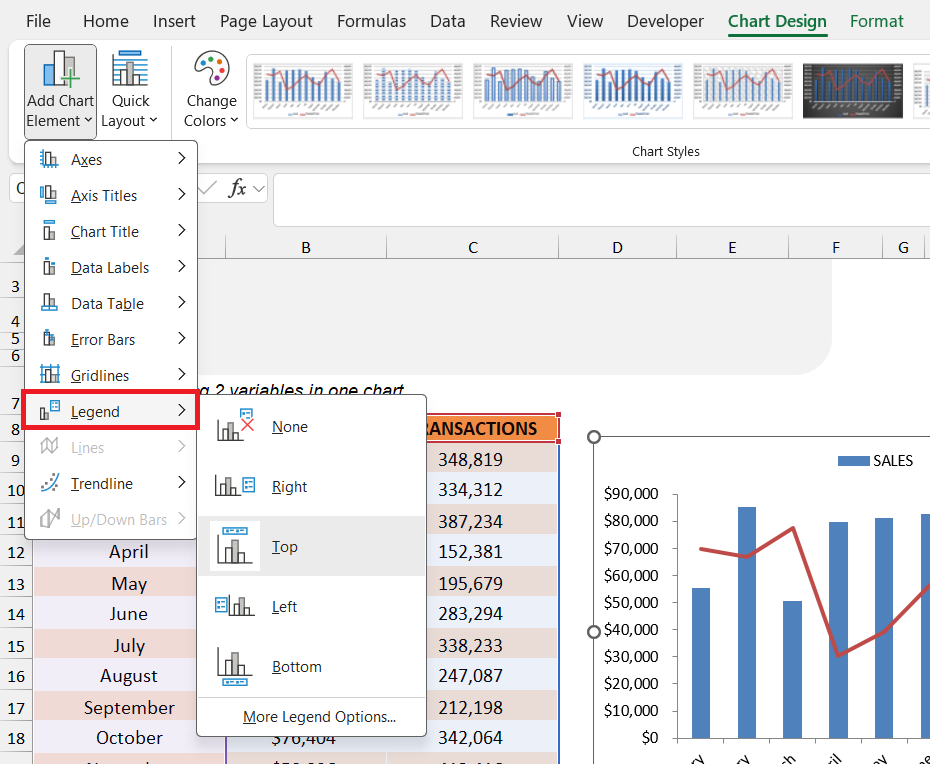

- Clarity in communication: Ensure legends and labels are clear and concise. A chart’s purpose is to simplify data comprehension, not complicate it.

Best For:

- Communicating financial results and forecasts to non-accounting stakeholders who may benefit from visual representation.

- Spotting trends, patterns, and outliers quickly in large sets of data.

Cons:

- Misinterpretation: Using the wrong type of chart can lead to misunderstanding the financial data.

- Over-designing: Excessive styling can make charts less readable.

Remember, the goal is to make financial data less intimidating and more digestible for decision-makers.

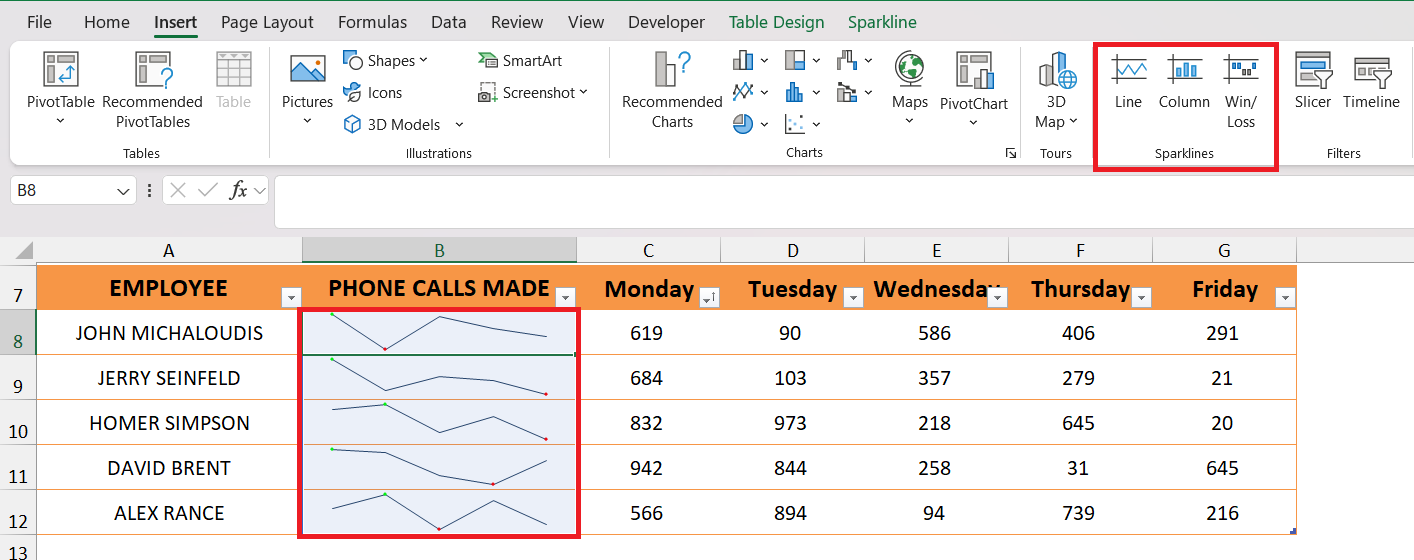

Utilizing Sparklines for At-a-Glance Insights

Sparklines in Excel are like the financial world’s mini-chart powerhouses. They offer instantaneous visual cues about data trends right within a cell, ideally suited for dashboards or alongside tabular data.

Benefits of Sparklines:

- Compact Representation: Sparklines fit in just one cell, efficiently summarizing trends without hogging valuable spreadsheet real estate.

- Data Trends: At a glance, sparklines allow you to track progress or changes, for example, monthly sales fluctuations or expenditure trends.

- No Chart Clutter: Unlike regular charts, sparklines keep the workspace clean, focused only on essential data points without axes or coordinates.

- Immediate Visual Cues: Instantly understand which items are performing well or poorly, aiding quicker decision-making.

Customization: You’ve got the flexibility to tailor sparklines. Change line colors to reflect performance, highlight the highs and lows, or choose between line, column, and win/loss types based on what best represents your dataset.

Best For:

Accountants tracking numerous line items over time, such as monthly revenue streams or individual expenses, will find sparklines especially impactful for spotting trends swiftly.

Cons:

- Limited Detail: Sparklines are great for trends but don’t convey detailed information like exact values.

- Interpretation: Without contextual data, they might be misunderstood, so accompanying data points are helpful.

Remember, sparklines are a stepping stone to deeper analysis. While they highlight trends and patterns effectively, further investigation is usually needed for comprehensive insights.

Efficiency Through Advanced Features

Leveraging Power Query and Power Pivot

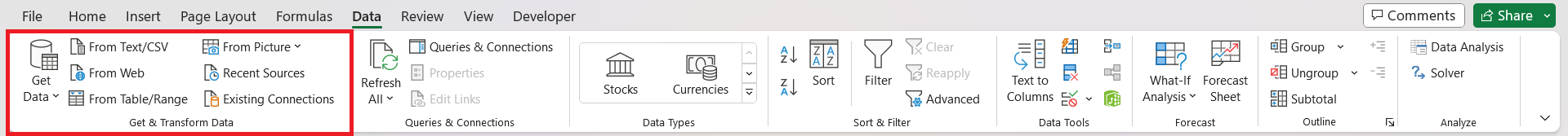

The dynamic duo of Power Query and Power Pivot is a force multiplier for accountants delving deep into data analysis in Excel.

Leveraging Power Query:

- Data Consolidation: Imagine pulling data from various sources such as ERP systems, databases, and spreadsheets into one coherent dataset. That’s Power Query magic!

- Cleaning and Transforming: They easily cleanse data, fixing bad formats, removing duplicates, and preparing data for analysis.

- Automated Refreshes: Set your data transformation steps once, refresh with a click, and your data renews itself—saving you countless hours.

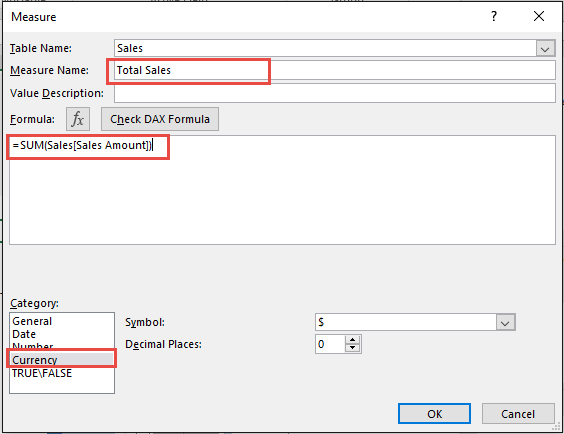

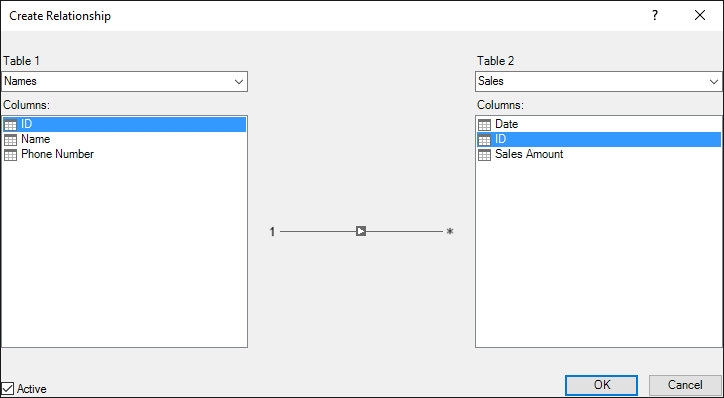

Leveraging Power Pivot:

- Advanced Data Modeling: Create sophisticated data models that handle millions of rows of data, which traditional pivot tables can’t manage.

- Complex Calculations: Utilize DAX formulas to perform heavy-duty calculations and create calculated columns, measures, and KPIs.

- Relationship Building: Link different data tables together without cluttering your Excel with VLOOKUP formulas.

Together, Power Query and Power Pivot enable accountants to tame unwieldy data sets, extract meaningful insights, and elevate reporting to strategic heights.

Best For:

Accountants dealing with voluminous datasets who require refined control over data manipulation and presentation. If you’re aspiring for a data analyst role, these tools are your stepping stones towards a promising career trajectory.

Cons:

- Learning Curve: To fully harness their potential, a significant time investment in learning and practice is required.

- Performance: With very large datasets, performance might be affected—requiring optimization.

With the right training, Power Query and Power Pivot could have accountants feeling like data wizards, transforming and analyzing data with unprecedented agility and depth.

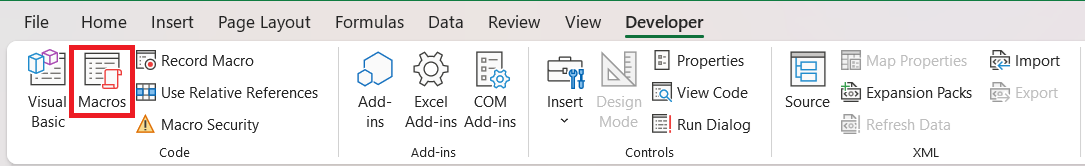

Automating Repetitive Tasks with Macros

Automating repetitive tasks in Excel with macros is like setting up a skilled virtual assistant for your accounting work. Macros record and perform tasks ranging from simple data entry to complex report generation—reflecting significant time savings and consistency in tasks.

- Efficiency Boost: Macros replicate routine tasks accurately and quickly, allowing you to redirect focus to more critical analytical work.

- Error Reduction: By automating repetitive actions, macros minimize the risk of human error in data processing.

- Customization: Tailor macros to your specific accounting tasks, ensuring that the output meets your exact requirements.

- Trigger-Based Actions: Set macros to run with specific triggers, such as opening a workbook or pressing a button.

Before diving into macros, accountants should familiarize themselves with VBA (Visual Basic for Applications), Excel’s programming language.

Best For:

Accountants who find themselves bogged down by monotonous tasks, such as monthly reconciliation or report generation, will appreciate the value of macros.

Cons:

- Security Considerations: Macros can pose security risks if not properly regulated—ensure macro settings and sources are safe.

- Overdependence: There might be a reliance on macros, which could be problematic if they break due to updates or changes in data structure.

While macros are potent, they’re most effective when used judiciously. Strategic automation can be a game-changer for accountants, freeing them to invest in high-value pursuits like analysis and strategy.

Ensuring Data Integrity

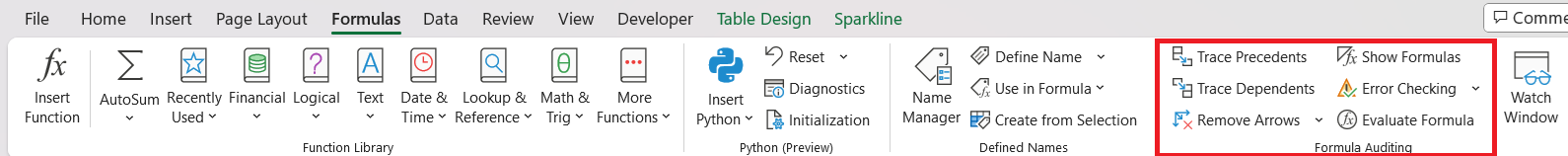

Auditing Tools to Trace and Fix Errors

Excel’s Formula Auditing tools are essential for accountants to trace and fix errors in their worksheets—functioning as the profession’s meticulous proofreaders.

- Error-Checking: Quickly identify and diagnose errors in formulas, which is crucial when dealing with complex calculations.

- Tracing Precedents and Dependents: Visualize the relationships between cells—see which cells impact or are impacted by the currently selected cell.

- Showing Formulas: Swap between viewing formulas and their results to make it easier to scan for inconsistencies.

- Evaluating Formulas Step-by-Step: Understand complex formulas by breaking them down into their individual components.

- Highlighting Formula Cells: Instantly see all cells that contain formulas, which aids in reviewing and auditing your work.

By using these tools, accountants can ensure the accuracy and integrity of their financial data, upholding the trust placed in their analyses and reports.

Best For:

Accountants who are responsible for creating, managing, and verifying financial models and reports. It’s particularly useful for those who perform monthly and year-end closing processes, where accuracy is paramount.

Cons:

- Complexity: Some of Excel’s advanced auditing tools can have a steep learning curve for users unfamiliar with them.

- Overlooked Simplicity: Basic mistakes may still require a good old-fashioned manual review to catch.

Embracing these auditing tools equips accountants with the means to present flawless financial data—a clear reflection of their professional diligence.

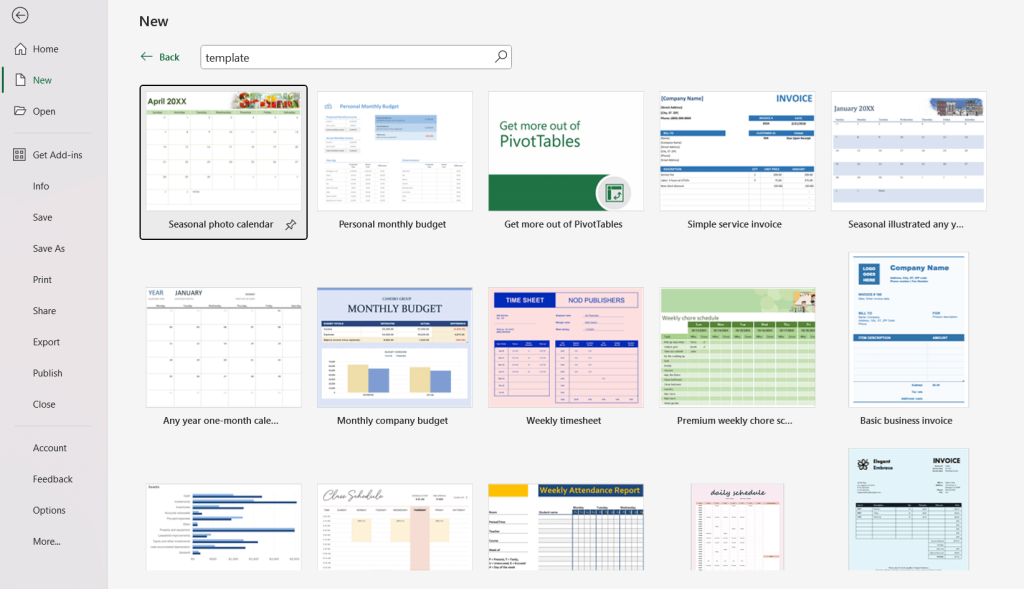

Making Use of Templates for Consistent Reporting

Templates in Excel provide accountants with a framework for consistent and efficient reporting. They’re the unsung heroes that standardize financial document layout, calculations, and structure.

- Uniformity: Every report adheres to the same professional format, reinforcing brand and reporting standards.

- Quick-start: Templates let you skip the setup and jump straight into inputting data —a real time-saver.

- Customizable: While off-the-shelf, templates can be tailored to a company’s specific needs or industry standards.

- Minimized Errors: Pre-defined formulas and formats in templates reduce the risk of manual entry mistakes.

- Knowledge Sharing: With templates, less experienced team members have a guide, promoting best practices and consistency across the team.

Best For:

Templates are fantastic for accountants charged with generating regular reports like balance sheets, profit and loss statements, or budget forecasts. They’re also a boon to those in training or fields where reporting formats are standardized.

Cons:

- Inflexibility: At times, templates may not match your exact needs, and modifying them can be challenging.

- Update Management: Template versions require careful management to ensure everyone uses the most current version.

In a world where reporting accuracy and quality are non-negotiable, templates serve as a starting point for excellence in financial documentation.

Navigating Complexities with Confidence

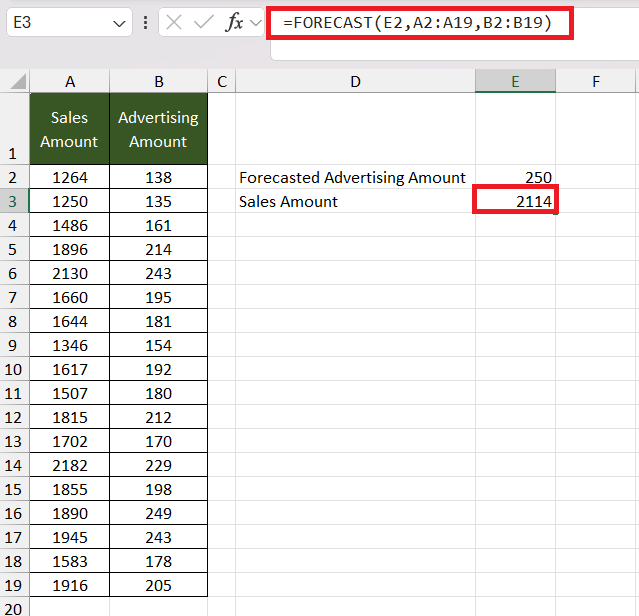

What-If Analysis for Forecasting and Decision Making

What-If Analysis in Excel is akin to a crystal ball for accountants—allowing you to peer into potential financial futures based on varying assumptions and scenarios.

- Forecasting: Use Excel’s ‘FORECAST’ function to predict future cash flows based on historical data—a staple for budgeting and planning.s

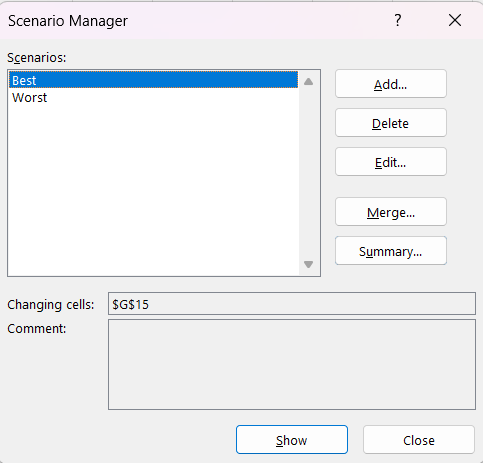

- Scenario Testing: Implement ‘Scenario Manager’ to create, store, and evaluate different financial scenarios, such as best-case and worst-case projections.

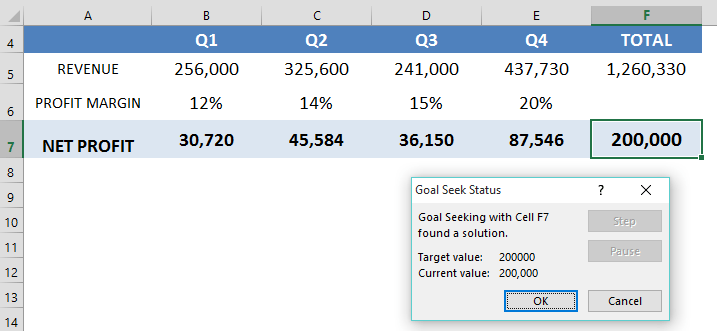

- Goal-Oriented Planning: Take advantage of ‘Goal Seek’ to find the necessary inputs to achieve a desired financial outcome, particularly helpful for profitability targets.

- Comparative Analytics: Data Tables let you juxtapose multiple outcomes side-by-side for easy comparison, enriching strategic decision-making.

Best For:

Accountants who are responsible for creating financial projections, exploring strategic initiatives, or advising on risk management will find What-If Analysis tools indispensable.

Cons:

- Complexity: Building and interpreting these scenarios requires a good grasp of both Excel and financial modeling.

- Assumption Dependency: The accuracy of the What-If Analysis is highly dependent on the assumptions used, which can be speculative.

With an ability to forecast and prepare for various financial scenarios, accountants enhance their role as strategic advisors within their organizations.

Building Dynamic Dashboards for Real-Time Financial Monitoring

Dynamic dashboards in Excel are the control hubs for financial monitoring. They enable accountants to distill complex datasets into accessible, real-time insights, and forecast-driven visuals.

- Centralized Metrics: Dashboards centralize key performance indicators (KPIs), making monitoring critical financial metrics a breeze.

- Interactivity: Use slicers and timelines to create interactive elements that allow users to filter data and change what they view as per their need.

- Automated Updates: Connect dashboards to live data feeds or databases, ensuring the information displayed is always current.

- Visual Appeal: Incorporate a mix of charts, conditional formatting, and sparklines to make the dashboard as informative as it is visually engaging.

- Customizable Views: Allow stakeholders to view personalized data sets relevant to their department or role, enhancing strategic discussions.

Accountants equipped with dynamic dashboards can deliver cutting-edge financial insights, driving informed decision-making across the organization.

Best For:

Accountants who need to provide executives and decision-makers with a snapshot of the company’s financial health will find dynamic dashboards a powerful tool.

Cons:

- Upfront Time Investment: Creating a comprehensive dashboard takes time and effort upfront, though it pays dividends in efficiency later.

- Overcomplexity: There’s a risk of overcrowding the dashboard with too much information, making it confusing rather than clarifying.

In our fast-paced digital world, the ability to access and interpret financial data quickly is paramount, and dynamic dashboards empower accountants to meet this need head-on.

Skills Integration and Workflow Improvement

Linking Excel with Other Financial Systems

Linking Excel with other financial systems is like creating a bridge that allows seamless flow of information, streamlining your financial processes.

- Enhanced Data Integrity: Import data directly into Excel from your financial systems to minimize the risk of manual entry errors.

- Real-Time Data: Some integrations allow for real-time data updates, providing the most current financial status for analysis and decision-making.

- Comprehensive Analysis: Combine Excel’s robust analytical tools with the detailed data from your ERP or accounting software for comprehensive reports.

- Efficient Workflow: Save time by reducing the number of steps needed to transfer data between systems, which can be especially valuable during period-end reporting.

- Automated Reconciliation: Use Excel to reconcile data from various systems, spotting discrepancies and potential issues quickly.

Best For:

Accountants who manage a large amount of data from different sources, and those who need to ensure data consistency across systems will immensely benefit from integrating Excel with other financial systems.

Cons:

- Compatibility Issues: Potential challenges with data formats and integration between systems may arise.

- Security Risks: Ensuring that data remains secure during transfer is paramount and can require additional oversight.

By skillfully linking Excel to other financial systems, accountants can leverage the strengths of each tool, optimizing their workflow and enhancing the quality of their financial analysis.

Streamlining Month-End Processes with Advanced Excel Skills

Streamlining month-end processes with advanced Excel skills for Accountants is all about efficiency and precision. By harnessing Excel’s advanced capabilities, accountants can significantly shorten the timeframe of the month-end close and ensure high levels of accuracy in their financial reporting.

- Automated Data Aggregation: Quickly consolidate financial data from various ledgers and sub-ledgers, minimizing the manual aggregation process.

- Efficient Reconciliations: Utilize macros and advanced formulas for swift and accurate bank reconciliations or intercompany settlements.

- Dynamic Checklists: Create interactive checklists that automatically update based on completed tasks and outstanding items.

- Advanced Conditional Formatting: Spot variances and exceptions as you review month-end figures, which accelerates the identification and resolution of issues.

- Template Standardization: Employ standardized closing templates across all departments, ensuring consistency and reliability in your reporting.

Best For:

Accountants responsible for the month-end closing process, and those keen on reducing the time and potential for errors in preparing periodic financial statements, will find these skills invaluable.

Cons:

- Complexity: Advanced Excel features often have a learning curve that requires time and dedication to master.

- Dependence: Be cautious of creating complex systems that can become difficult to manage without the creator or Excel specialist.

Armed with these advanced Excel skills, accountants can execute month-end processes swiftly, with greater accuracy, leaving more time for analysis and strategic pursuits.

Preparing for the Unexpected

Scenario Management Skills for Uncertain Times

Scenario Management using Excel’s What-If Analysis tools equips accountants to effectively plan for and respond to fluctuating financial conditions and business uncertainties.

- Flexibility in Forecasting: Accountants can create multiple financial models based on varying scenarios to anticipate and prepare for change.

- Informed Decision-Making: Assess the financial impact of different business decisions before committing resources.

- Risk Assessment: Proactively gauge the potential risks associated with market fluctuations, economic shifts, and internal business changes.

- Strategic Planning: Align financial forecasts with long-term business strategies under various scenarios.

- Stress Testing: Ensure your financial resilience by testing against extreme conditions and worst-case scenarios.

Best For:

Accountants in roles that require robust financial planning and analysis will benefit from scenario management skills—especially in industries where external factors heavily impact business performance.

Cons:

- Overcomplexity: Building too many scenarios can become overwhelming, making it difficult to draw clear conclusions.

- Assumption Sensitivity: Scenarios are only as good as the assumptions they’re based on—garbage in, garbage out.

In turbulent economic times, possessing strong scenario management skills allows accountants to become invaluable advisors to their organizations, guiding them with data-driven strategies and insights.

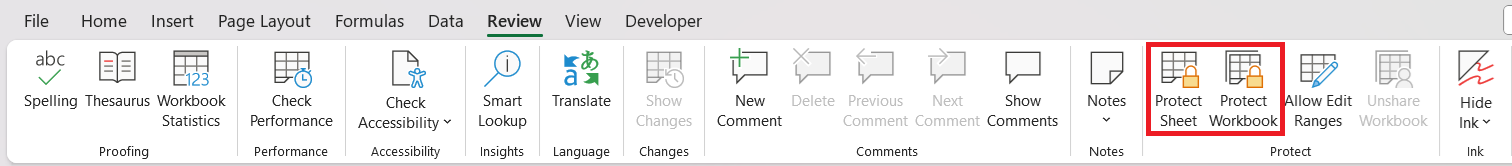

Security Measures Every Accountant Should Implement in Excel

Security in Excel is critical, especially for accountants handling sensitive financial data. By implementing these security measures, you can protect data integrity and confidentiality:

- Password Protection: Secure workbooks and sheets with passwords to prevent unauthorized access. Never share passwords via email or text, and regularly update them.

- Restrict Editing: Limit the cells that users can edit by locking all others. This way, critical formulas remain untouched, while users can input data where needed.

- Data Encryption: Use Excel’s built-in encryption feature to add an extra layer of security to your files, making it nearly impossible to read without the correct password.

- Backup Regularly: Keep regular backups of your Excel files in a secure location not easily accessible to others. Consider automatic cloud backup solutions for real-time saving.

- Audit Trails: Set up an audit trail to track changes made to the workbook, providing a record of who did what and when.

Best For:

Any accountant who wants to minimize the risk of data breaches, maintain the confidentiality of sensitive financial information, and ensure compliance with data protection laws will find these measures essential.

Cons:

- User Restrictions: Heavy security may restrict the flow of work if colleagues require access to protected files.

- Password Management: Remembering multiple strong passwords can be cumbersome without a reliable password manager.

Implementing these Excel security measures isn’t just about protecting data; it’s about safeguarding the trust placed in accountants by their clients and organizations.

Training and Continuous Learning

Where to Find Excel Training Tailored for Accountants

Seeking Excel training tailored specifically for accountants is easy; numerous resources are available both online and offline to boost your skills:

- Webinars and Workshops: Many industry associations and professional organizations host webinars and workshops focused on Excel skills for accountants.

- YouTube Channels: Learn for free from experienced professionals who share tips and tutorials on YouTube channels dedicated to Excel training.

- Community Colleges: Local community colleges may provide affordable, in-person Excel classes that focus on accounting applications.

- Peer Learning: Join forums or groups, such as the Excel subreddit or dedicated Slack channels, where you can ask questions and share knowledge with peers.

Best For:

Accountants of any level, from novices looking to strengthen their foundational knowledge to seasoned veterans aiming to stay updated with the latest Excel features and best practices, will find training to suit their needs.

By tapping into these training resources, accountants will not only refine their Excel skill set but also position themselves as invaluable assets in the continuously evolving field of finance and accounting.

Keeping Abreast with Excel Updates and Community Support

Staying current with Excel updates and tapping into community support ensures that accountants maintain a competitive edge and make the most out of Excel’s evolving capabilities:

- Microsoft’s Office Updates: Regularly check Microsoft 365’s update page or sign up for their newsletter to receive information on the latest features and fixes.

- Professional Forums: Platforms such as the Microsoft Tech Community and accounting-specific forums offer space to discuss updates and share insights.

- Social Media Groups: LinkedIn groups and Twitter accounts focused on Excel offer news on updates and community support.

- Excel User Conferences: Attend annual conferences such as the Excel and Power BI Summit, where experts share knowledge on the latest trends and best practices.

- Internal Network Updates: In corporate settings, IT departments often disseminate crucial update information and training resources.

Best For:

Accountants at all levels benefit from keeping up with Excel updates; it’s essential not only for those responsible for financial reporting and analysis but also for those aiming to enhance their technical expertise.

By actively engaging with the Excel community and keeping abreast of the latest updates, accountants can leverage Excel’s full potential to drive accuracy, efficiency, and insight in their work.

FAQs: Honing Your Excel Skill Set

What are the most critical Excel functions for today’s accountants?

The most critical Excel functions for today’s accountants include VLOOKUP or XLOOKUP for data lookup, SUMIFS for conditional summing, IF for logical operations, PMT for loan payments, and array formulas for complex calculations. Mastery of PivotTables and Power Query is also crucial for data analysis.

Are there specific Excel certifications that can benefit accountants?

Yes, certifications like Microsoft Office Specialist: Excel Expert and the AICPA’s Certified Information Technology Professional (CITP) can significantly benefit accountants by showcasing their expertise in Excel. These are widely recognized credentials that validate advanced Excel skills for Accountants.

What is the most used Excel function in accounting?

The SUM function is the most used Excel function in accounting. It’s a basic yet powerful tool for adding numbers, and it’s a fundamental part of almost every financial spreadsheet.

How has the role of Excel in financial analysis evolved over time?

Excel’s role in financial analysis has evolved from simple spreadsheet software to a sophisticated tool capable of handling large datasets, complex modeling, and real-time data analysis, thanks to advanced features like Power Query and Power Pivot, integration with AI, and collaboration capabilities.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.