Financial ratios are indispensable tools for assessing business health, offering a quick snapshot of its financial well-being. Similar to checking vital signs during a medical exam, ratios provide essential insights into a company’s fiscal pulse, aiding informed decision-making. In this article, we will cover a detailed guide on how to calculate the fixed charge coverage ratio in Microsoft Excel.

Key Takeaways:

- Fixed Charge Coverage Ratio (FCCR) Unveiled: FCCR is a pivotal metric offering insights into a company’s ability to meet recurring fixed charges, essential for reassuring lenders and investors about its financial stability.

- Formula Fundamentals: The FCCR formula, (EBIT + fixed charges before taxes) / (fixed charges before taxes + interest), simplifies complex financial health into digestible information, illuminating a company’s fiscal endurance.

- Excel as a Financial Compass: Excel serves as a powerful ally in computing FCCR, providing a platform for efficient data organization and analysis, transforming complex data into actionable insights.

- Interpreting Results: Higher FCCR values signal robust financial resilience, whereas lower values may necessitate strategic reassessment to mitigate risks and optimize financial strategies.

- Strategic Enhancement: Businesses can strategically enhance their FCCR by streamlining efficiency, boosting revenue, reassessing expenses, managing debts effectively, and capitalizing on cost-saving opportunities.

Table of Contents

Introduction to Financial Mastery with Excel

The Importance of Financial Ratios in Business Health

Financial ratios are the Swiss Army knife of business health assessment. They give you a quick, yet comprehensive, snapshot of a company’s financial well-being. Like checking vital signs during a medical exam, ratios help you monitor the financial heartbeat of your business. By keeping your finger on these figurative pulses, you maintain crucial awareness of your financial standing and are better equipped to make informed decisions.

Unlocking the Concept of Fixed Charge Coverage Ratio

Understanding the Fixed Charge Coverage Ratio (FCCR) is like unlocking a secret level in your financial game. It’s one of those key metrics that take you from playing a guessing game with your company’s financial health to being strategically savvy about handling your fixed costs.

The FCCR provides a clear picture of your ability to pay recurring fixed charges, helping to assure lenders and investors that your business isn’t going to stumble when it comes to meeting its regular financial responsibilities.

Getting to Grips with the Fixed Charge Coverage Ratio

What is the Fixed Charges Coverage Ratio (FCCR)?

The Fixed Charge Coverage Ratio (FCCR) is your financial flashlight in a dark room of obligations. It shines a light on whether your business can comfortably handle its fixed expenses—think of debts, leases, and insurance, which you must pay regardless of your company’s sales performance. Picture this ratio as a stress test for your business’s fiscal endurance. A robust FCCR means you can take a deep breath knowing your company is standing on solid financial ground.

Decoding the FCCR Formula

The magic behind FCCR lies in its simple yet powerful formula that pares down your business’s fiscal health to its essence. Here’s how it breaks down: you take your Earnings Before Interest and Taxes (EBIT) and add it to your fixed charges before tax. Then you divide by the sum of your fixed charges before tax and any interest expenses.

In mathematical terms:

=(EBIT + fixed charges before taxes) / (fixed charges before taxes + interest)

This formula hands you a magnifying glass to scrutinize how well your earnings can cover costs that don’t waver with the tide of sales. It’s about distinguishing the must-haves from the nice-to-haves in your financial strategy.

Dive into Excel: Calculating FCCR Made Simple

Preparing Your Spreadsheet for Financial Analysis

Before they can charge headfirst into calculating ratios, one must set the stage with data neatly laid out in Excel. A clean, well-organized spreadsheet not only avoids confusion but also streamlines the process of data analysis. Start by gathering financial statements and any pertinent data regarding your earnings and fixed charges. Then, categorize and input this data into clearly labeled cells on your Excel worksheet.

Think of this as tidying up your financial room so that when it’s time to calculate FCCR, you’ll find what you need without any fuss. Make sure to include separate columns for your various fixed charges, interest expenses, and earnings, allowing for an efficient flow of calculations.

Step-by-Step Guide to Computing FCCR in Excel

Computing FCCR in Excel can be broken down into simple steps:

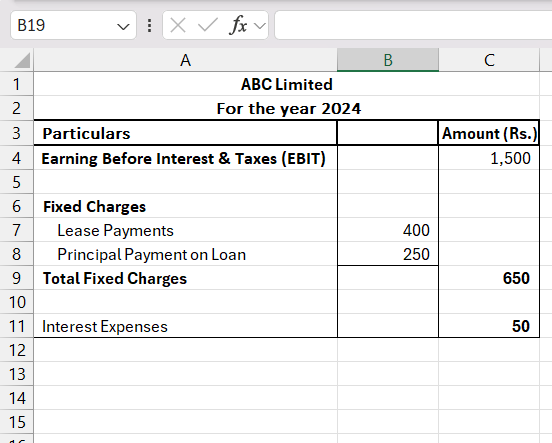

STEP 1: Begin by entering your EBIT, Fixed charges & interest expenses in Excel.

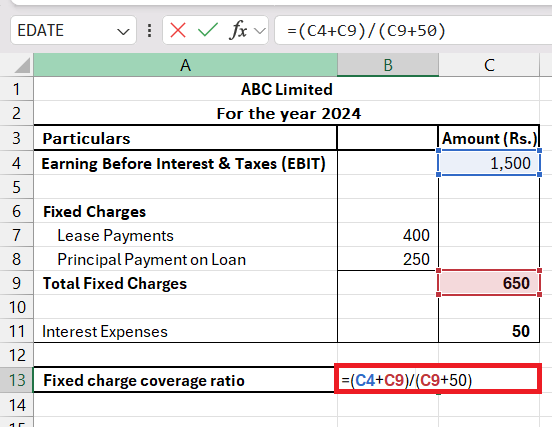

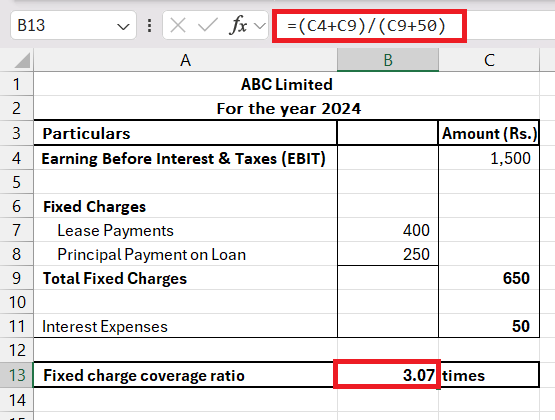

STEP 2: Formula Input: In a new cell, input the FCCR formula: =(EBIT+Fixed Charges)/(Fixed Charges+Interest Expense) or =(C4+C9)/(C9+50).Make sure to reference the correct cells in your spreadsheet.

STEP 3: Calculation: Press Enter, and Excel will do the heavy lifting, giving you the FCCR value.

Examine the results to ensure all numbers and formulas have been entered correctly. For instance, if a company’s FCCR is 3.07, it means that for every dollar of fixed charges, the company generates $3.07 of operating income. This indicates a healthy financial position, as it shows that the company’s earnings are more than three times its fixed charges.

Remember, a financial calculator embedded into a spreadsheet can turn complex data into digestible information, allowing you to see where your business stands with just a glance.

Understanding Your FCCR Results

Interpreting Higher vs. Lower FCCR Values

When you crunch the numbers and your FCCR value pops up, think of it as a financial compass pointing toward your company’s fiscal resilience. A higher FCCR signals that you’re sailing smoothly, with ample earnings to cover fixed costs — the more significant this number is, the wider the safety net for your venture.

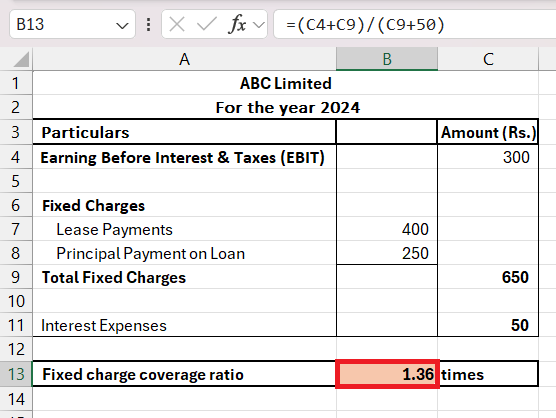

Conversely, a lower FCCR can flash warning lights. It might indicate your earnings are tight-roping just above your fixed expenses, meaning there’s less wiggle room for financial maneuvering. This could call for a strategic reassessment to enhance your business’s earning capacity or reduce fixed costs.

A lower FCCR of 1.36 times means that the company’s operating income is only 1.36 times its fixed charges.

How FCCR Influences Business Decisions and Loan Agreements

FCCR can act as a compass for navigating business decisions and loan agreements. A sturdy FCCR reassures lenders of your capacity to manage debts, potentially leading to favorable loan terms. They see less risk in a business that demonstrates it can comfortably cover fixed charges, raising their confidence in your financial stability.

For internal business decisions, FCCR serves as a health check before taking on additional financial responsibilities. If your FCCR indicates ample room above your fixed charges, it might be the right time to invest in growth opportunities. But if it’s flagging up concerns, it might signal a period for consolidation rather than expansion.

Strategically Improving Your FCCR

Tips to Enhance Your Company’s Financial Health

To bolster your company’s financial health and elevate your FCCR:

- Streamline Efficiency: Analyze operations to pinpoint areas where you can reduce costs without compromising quality.

- Boost Revenue: Develop strategies to increase sales such as expanding your market reach or enhancing product offerings.

- Reassess Expenses: Regularly review your ongoing expenses and negotiate better terms on leases and contracts.

- Debt Management: Consolidate debts or refinance to lower-interest options to reduce interest expenses.

- Cost Savings: Take advantage of early payment discounts and bulk purchase deals.

Every financial maneuver should aim to solidify your business’s economic foundation while safeguarding against unnecessary risks.

FCCR in Action: Real-World Scenarios and Case Studies

Industry Benchmarks and What They Mean for Your Business

Industry benchmarks for FCCR are like navigational stars—by knowing their position, you can chart where your company stands in the industry seascape. If your FCCR is above the industry average, pat yourself on the back; you’re likely managing your charges effectively and could be a stronger candidate for investment or loans.

However, if your FCCR is below average, it’s a signal to tighten your sails. It could mean industry peers are navigating the financial waters more efficiently, and it might be time to delve into their practices or innovate your own to boost your standing.

Lessons from Companies Excelling with High FCCR

Companies with high FCCR set a shining example, demonstrating financial dexterity that every business can learn from. They maintain a balance between strong earnings and controlled fixed charges, reflecting strategic prowess in negotiating terms with lenders and suppliers. They often reinvest their free cash flow judiciously, fostering sustainable growth and resilience against economic headwinds.

Moreover, these companies may enjoy a position of advantage during negotiations, as their strong FCCR can command lower interest rates and better credit terms. By emulating their approach to financial management and risk assessment, other businesses can aim to achieve similar results and strengthen their own FCCR.

FAQs: Mastering Your Fiscal Responsibilities with FCCR

What Constitutes a Good FCCR for My Business?

A good FCCR for your business typically hovers above 2.0. This ratio suggests that you have twice as much in earnings as you need to cover fixed charges, signaling strong financial health and low insolvency risk. Keep in mind, though, that a “good” ratio can vary by industry and individual business circumstances.

Can FCCR be Used as a Standalone Financial Metric?

While FCCR offers valuable insight, it’s not wise to use it as a standalone financial metric. It should be part of a suite of ratios for a more comprehensive financial health check, as it doesn’t capture all aspects of your business’s fiscal picture, such as liquidity or profitability.

What is the formula for fixed charge coverage ratio?

The formula for fixed charge coverage ratio is:

=(EBIT + fixed charges before taxes) / (fixed charges before taxes + interest)

This measures your ability to cover fixed charges with your earnings.

Why is fccr valuable to investors?

FCCR is valuable to investors because it shows a company’s ability to meet its fixed financial obligations—indicating financial stability and lower risk of default. A high FCCR can suggest a strong prospect for investment returns.

How do you calculate coverage ratio in Excel?

To calculate the coverage ratio in Excel:

- Input your earnings and expenses in separate cells.

- Use the SUM function to tally any grouped expenses.

- Enter the appropriate formula in a cell, referencing the cells containing your data.

- Hit

Enterto compute the ratio.

Excel simplifies the calculation and visualization of financial ratios.

What’s a good fixed charge coverage ratio?

A good fixed charge coverage ratio generally stands at 1.25:1 or higher, ensuring that you have sufficient earnings to cover your fixed charges comfortably.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.