Calculating overtime (OT) pay in Excel can save you hours of manual calculation, reduce human error, and make your payroll process way more efficient. In this guide, I’ll walk you through a simple, step-by-step method on how to calculate OT pay using Excel. Let’s dive in!

Key Takeaways:

- Automating overtime calculations in Excel saves time and reduces errors.

- Advanced functions, such as

IFandTIME, are useful varying overtime scenarios. - Data validation ensures accurate time entries.

Table of Contents

How to Make Overtime Calculations in Excel

Understand the Basics of Overtime Pay

In the U.S., for instance, the standard rule is that any time worked over 40 hours in a week is considered overtime and is paid at a higher rate—usually 1.5 times the regular hourly rate (this is commonly referred to as “time and a half”).

So, to break it down:

- Regular Pay = Regular Hours worked × Hourly Rate

- Overtime Pay = Overtime Hours worked × Overtime Rate (which is 1.5 × Regular Hourly Rate)

With that in mind, we can now tackle the task of calculating this in Excel.

Calculating overtime pay doesn’t have to be complicated. By using Excel, you can quickly automate the process, saving time and reducing errors. In this guide, I’ll walk you through the steps to set up a simple spreadsheet that will handle everything from regular pay to overtime calculations. Let’s jump in!

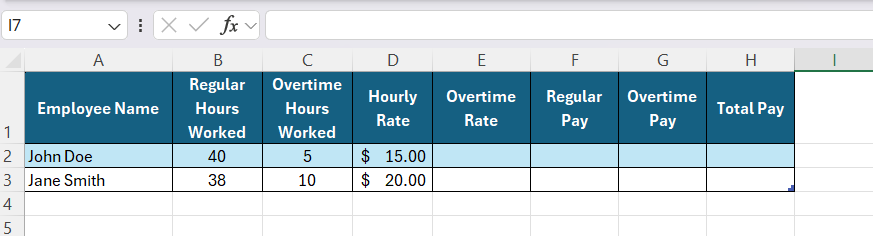

STEP 1: Set Up Your Excel Spreadsheet. Start by setting up a simple table in Excel to track the information you need for your overtime calculations. Here’s how I would do it:

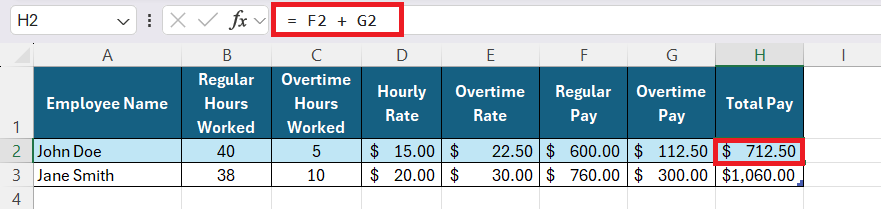

In this table, you have the columns for:

- Employee Name (so you know who worked)

- Regular Hours Worked (the usual 40-hour week)

- Overtime Hours Worked (anything above 40 hours)

- Hourly Rate (the standard rate of pay)

- Overtime Rate (which will be calculated as 1.5 times the hourly rate)

- Regular Pay (to be calculated)

- Overtime Pay (to be calculated)

- Total Pay (which will be the sum of Regular Pay + Overtime Pay)

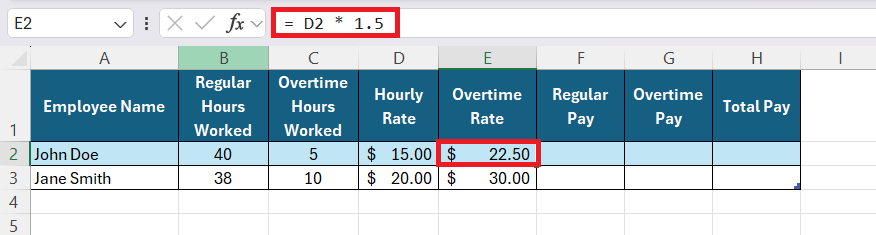

STEP 2: Calculate Overtime Rate Automatically. In the Overtime Rate column, you can use a simple formula to automatically calculate the overtime rate based on the hourly rate. If your hourly rate is in column D (starting from cell D2), here’s the formula you can use in cell E2: “= D2 * 1.5”

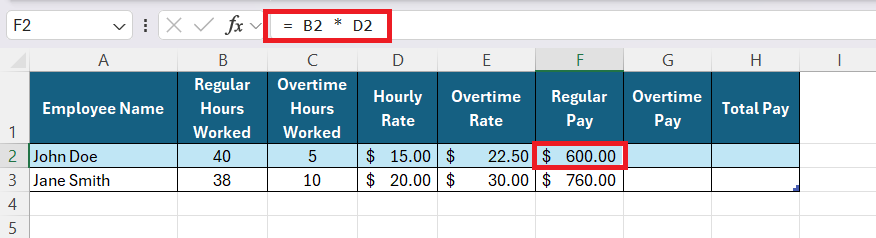

STEP 3: Calculate Regular Pay. Regular Pay is simply the regular hours worked multiplied by the regular hourly rate. If regular hours worked are in column B and hourly rate is in column D, you can calculate Regular Pay in column F (starting in F2) with the following formula: “= B2 * D2”

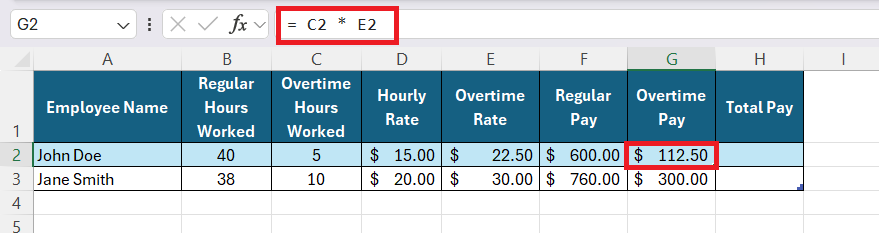

STEP 4: Calculate Overtime Pay Now for the magic part: calculating the overtime pay. In the Overtime Pay column (G), you’ll want to multiply the overtime hours worked by the overtime rate. If overtime hours worked are in column C and the overtime rate is in column E, the formula for overtime pay (starting from G2) would be: “= C2 * E2”

STEP 5: Calculate Total Pay Finally, to calculate the total pay (including regular and overtime pay), just add the regular pay and overtime pay. In the Total Pay column (H), you can use the following formula in cell H2:

Advanced Excel Functions for Complex Overtime Scenarios

Integrating IF and TIME Functions for Varied OT Rates

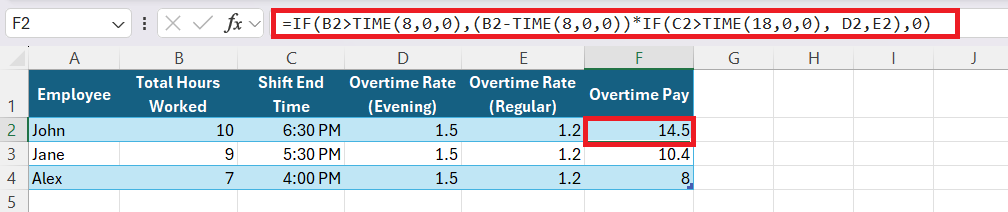

I’ve learned that integrating IF and TIME functions in Excel can cater to more nuanced scenarios where overtime rates may vary based on certain conditions—like evening shifts or weekend work. By deploying a formula like =IF(B2>TIME(8,0,0),(B2-TIME(8,0,0))*IF(C2>TIME(18,0,0), D2,E2),0), we can tailor the overtime calculations to respond to different thresholds or rates specified by workplace agreements or statutory compliance.

It’s not just about number-crunching; rather it’s choreographing those numbers to dance to the rhythm of organizational rules and regulations.

Real-World Applications and Examples

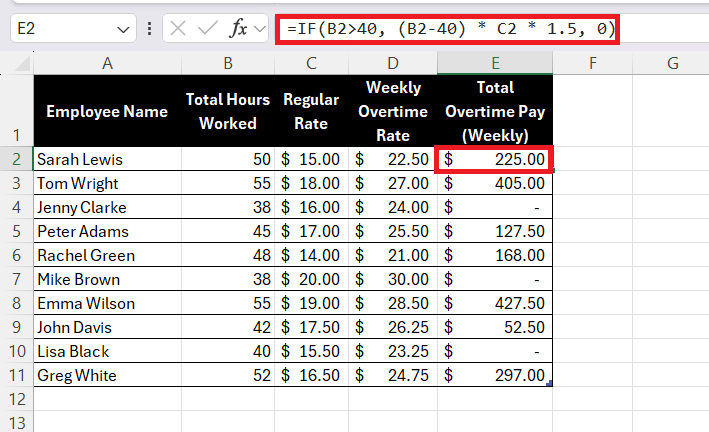

Calculating Overtime for a Retail Store

A retail store operates on a weekly schedule where employees sometimes work beyond their regular hours due to sales events or busy weekends. The company has 10 employees, each with varying hours worked. The regular hourly rate for employees is based on their roles, and overtime (1.5x the regular rate) applies after 40 hours of work per week. If you want to calculate overtime such that overtime is paid only for hours worked beyond 8 hours in a single day, and if an employee works less than 8 hours, no overtime should be calculated, here’s how you can approach it with an Excel formula.

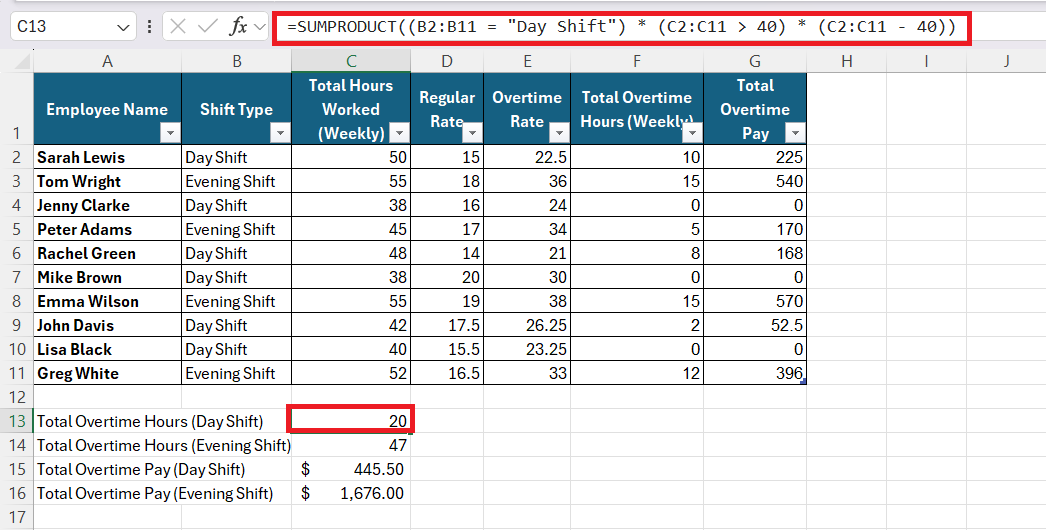

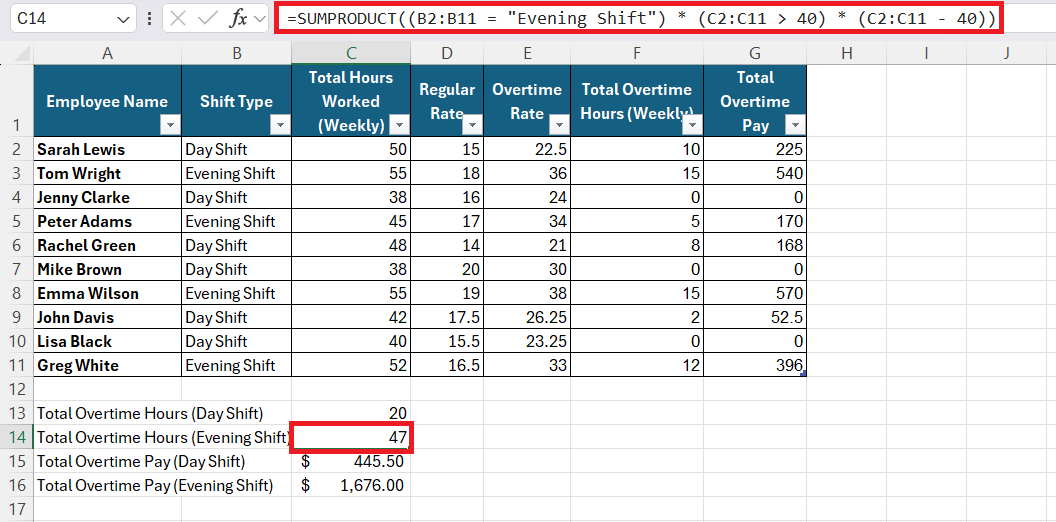

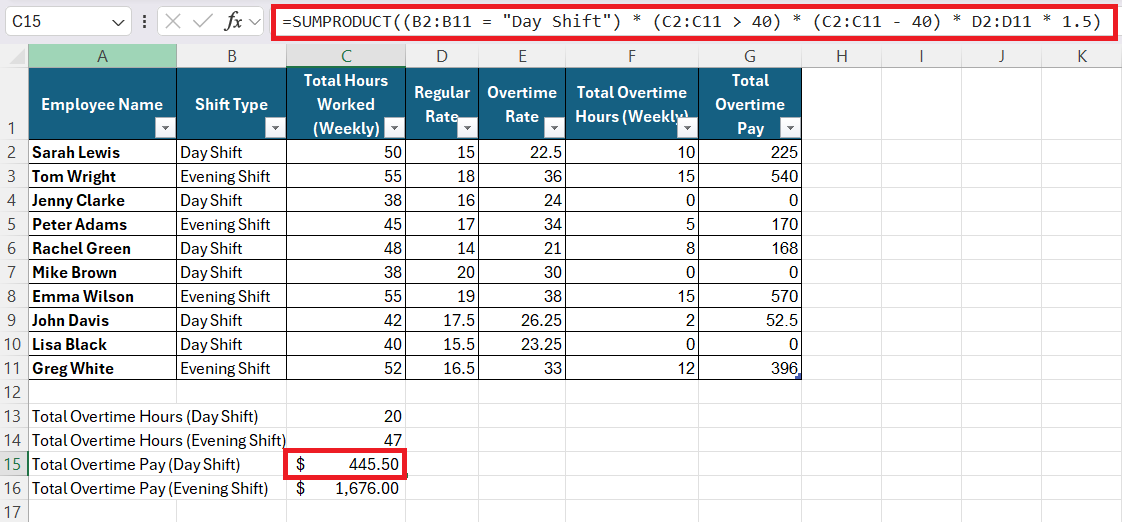

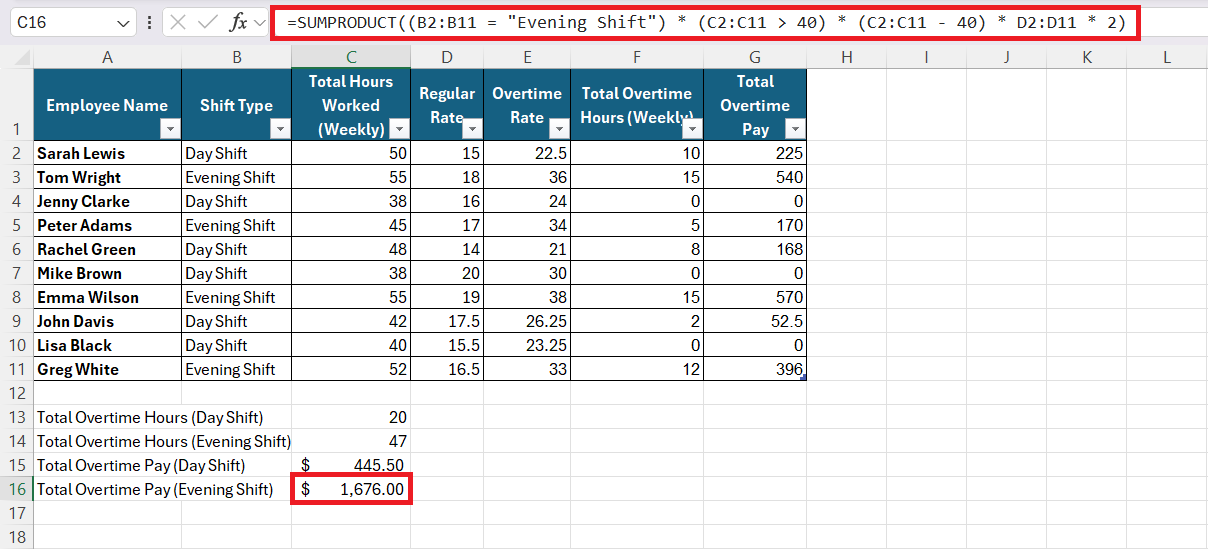

Calculating Total Overtime for Teams on Different Pay Schedules

Imagine a scenario where team members work varying shifts with differential overtime rates. Here, Excel shows its true colors. We’d summarize regular and overtime hours separately for each pay schedule, using unique rate multipliers where needed. By employing SUMIFS or SUMPRODUCT, we can aggregate individual totals while respecting the distinct schedules. Thus, total overtime isn’t just an amalgam of numbers but a refined summation which aligns with the diverse payroll fabric of the team.

Total Overtime Hours (Day Shift) =SUMPRODUCT((B2:B11 = “Day Shift”) * (C2:C11 > 40) * (C2:C11 – 40))

Total Overtime Hours (Evening Shift) =SUMPRODUCT((B2:B11 = “Evening Shift”) * (C2:C11 > 40) * (C2:C11 – 40))

Total Overtime Pay (Day Shift) =SUMPRODUCT((B2:B11 = “Day Shift”) * (C2:C11 > 40) * (C2:C11 – 40) * D2:D11 * 1.5)

Total Overtime Pay (Evening Shift) =SUMPRODUCT((B2:B11 = “Evening Shift”) * (C2:C11 > 40) * (C2:C11 – 40) * D2:D11 * 2)

Frequently Asked Questions

How to calculate OT amount in Excel?

To calculate the overtime amount in Excel, determine the number of overtime hours worked by subtracting standard hours from total hours. Multiply this by the overtime rate. For example, =(TotalHours-StandardHours)*OvertimeRate. If overtime rate is 1.5x and regular pay is $20/hr, formula could be: =(TotalHours-40)*30 assuming a 40-hour workweek.

How Do I Adjust Overtime Calculations for Holiday Pay or Bonuses?

To adjust overtime calculations for holiday pay or bonuses in Excel, add conditional checks within your IF formula to apply enhanced rates or bonuses when applicable. For example, use =IF(IsHoliday, RegularHours*HolidayRate, RegularHours*RegularRate) + OvertimeHours*OvertimeRate.

What is the OT formula?

The basic OT formula in Excel to compute overtime pay is =(RegHours*PayRate)+(OTHours*PayRate*OvertimeMultiplier). OvertimeMultiplier is usually 1.5 times for the hours worked beyond the standard workweek.

What % of overtime pay makes up actual compensation?

The percentage of overtime pay that makes up actual compensation varies based on the amount of overtime worked. Generally, it’s the product of total overtime hours multiplied by the overtime rate, divided by total compensation including base pay and overtime. The specific percentage would depend on the individual’s work schedule and pay structure.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.