This article demystifies a vital Microsoft Excel function, NPER, which calculates the number of payment periods for investments or loans based on a consistent interest rate and regular payments. This tool is crucial for financial planning, helping users understand how long it will take to reach financial goals.

Key Takeaways

- Fundamental Usage: NPER calculates the number of payment periods required for a financial goal using inputs like interest rate, payment amount, and present value.

- Parameter Essentials: Accurate calculations require inputs such as the rate (interest per period), Pmt (payment per period), PV (present value), and optional inputs like FV (future value) and type (timing of payments).

- Practical Applications: The NPER function is versatile, aiding in calculating timeframes for paying off various loans or determining the maturity period for investments.

- Essential Knowledge Points: To effectively use NPER, align the payment frequency with the interest rate, understand the role of present and future values, and ensure consistent payment amounts.

- Common Pitfalls: Avoid mistakes by aligning payment and interest periods, correctly using positive and negative values for cash flows, and accounting for all necessary parameters in your calculations.

Table of Contents

Unlocking the Mystery of the NPER Function in Excel

What is NPER Function in Excel?

Imagine you’ve stumbled upon an enigma within Excel’s treasure trove – a function that propels your financial savvy to new heights. That’s the power of the NPER function. It’s quite the game-changer, adept at computing the number of periods required for an investment or loan, using a steady interest rate and consistent payments. Think of it as a trusty calculator for long-term planning, ready to demystify your financial trajectory.

The Core Purpose of Using NPER for Financial Calculations

The core purpose of leveraging the NPER function lies in bringing clarity and precision to your financial strategy. Whether you’re saving diligently for a sun-soaked tropical vacation, aiming to unshackle yourself from the grips of a mortgage, or meticulously charting a course toward a comfy retirement, NPER stands as your arithmetic ally. It translates your financial aspirations into tangible timelines, answering the pivotal question: “How many payments will it take?” By understanding this, you can plan better, save smarter, and invest with an informed endgame in sight.

Diving Into the Basics: How to Use NPER

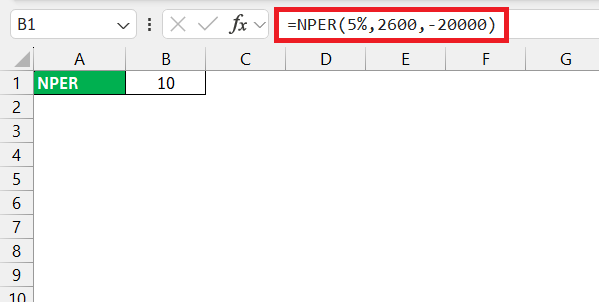

Basic Usage of NPER Function

When you’re ready to get hands-on with Excel and the NPER function, you’ll find it’s a straightforward process. Open up a new spreadsheet, target the cell where you need this financial wizardry to unfurl and input your formula starting with =NPER(. You’ll then feed it the interest rate per period, followed by the payment made each period, and the present value or total amount of the loan. Close your formula with a ), hit enter, and like magic, you now know how many payments it’ll take to reach your financial goal.

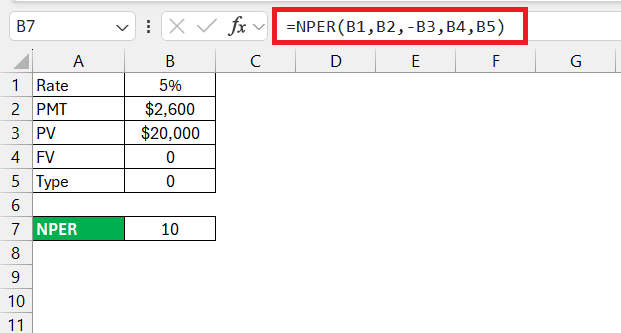

List all input parameters for Accurate NPER Calculation

For an accurate NPER calculation, you’ll need to have all your ducks — or rather, your parameters — in a row. Carefully compile these details to ensure the most precise outcome:

- Rate: The interest rate per period. For monthly payments, divide the annual interest rate by 12.

- Pmt: The payment amount per period. This is the amount you plan to pay each time — monthly, quarterly, whatever suits your case.

- PV: The present value, or the total amount of the loan or investment right now.

- FV (optional): The future value, or the cash balance you’re shooting for after the last payment. Omit this, and Excel assumes you want it to be zero.

- Type (optional): Specifies when payments are due. Zero means the end of the period, while one indicates the beginning.

Remember, the rate and payment amount should correspond to the same period for the formula to work its magic without a hitch.

Practical Applications of NPER in Financial Planning

Calculate Payment Periods for Different Loan Types

Calculating the payment periods for various loan types is a breeze when you have the NPER function at your disposal. You just need to ensure that your interest rate matches the payment frequency. For instance, a car loan requiring monthly payments would involve chopping an annual interest rate into twelve pieces, whereas a semiannual payment plan for a business loan would only halve the annual rate.

Input these adjusted rates into the NPER formula, and you’ll promptly discover how many payments it’ll take to zero out your loan balance, whether you’re dealing with a straight-edited student loan or a more complex mortgage with fluctuating rates.

Determine Time to Maturity for Investments

When your financial gaze is set on the horizon of investment maturity, the NPER function becomes an indispensable tool in estimating the journey’s time. You might be feeding a college fund piggy or laying bricks in your retirement fund wall — whatever the goal, NPER can reveal just how many contributions you’ll need before your investment blooms to its desired value.

To get this insight, plug in your regular contribution amount, the expected interest rate, and your initial investment. With a tap of the enter key, Excel will unfold the number of periods needed for your financial seedling to flourish into a full-grown money tree.

Tips and Tricks for Excel Masters-in-Training

4 Critical Things to Know About the NPER Function

When it comes to mastering the NPER function, there are four key aspects that’ll elevate your Excel game:

- Consistent Payments: NPER assumes payments are fixed and made regularly, so it’s not the go-to for varying payment amounts.

- Period Matching: Ensure your interest rate and payment frequency are synced (annual rate with yearly payments, or monthly rate with monthly payments, etc.).

- Present and Future Value Relationship: Comprehend that the present value (what you currently have invested or owe) and future value (the end goal of your investment or debt) are crucial reference points for NPER calculations.

- Interest Rate Nuances: For loans that compound more frequently than payments are made, you’ll need to adjust the interest rate to reflect the compounding periods accurately.

Keeping these tidbits in mind ensures NPER won’t just be a function to you — it’ll be a financial compass.

Common Pitfalls and How to Avoid Them

Steer clear of the common bumps and hiccups on your NPER journey by keeping these pointers at the forefront of your planning:

- Misaligned Periods: Always align your payment frequency with the interest rate period. Monthly payments mean monthly interest rates.

- Signs Matter: In financial formulas, cash outflow (payments) is a negative value and inflows (loan amounts) are positive. Mixing these up can cause errors.

- Forgetting Optional Arguments: Not accounting for future values or type of payment (beginning or end of the period) can skew your timelines.

- Overlooking the True Cost: Interest rates should reflect the real cost of borrowing, including fees and charges, for an accurate period calculation.

Navigate these common errors, and you’ll keep your financial calculations on a sure and steady course.

FAQs

What is the Nper in a PMT function?

The NPER in a PMT function is the total number of payment periods required to repay a loan or reach an investment goal, based on regular, fixed payments and a constant interest rate.

Is NPER Calculated in Years or Months?

NPER can be calculated in years or months, depending on the interest rate and payment frequency you use. If using annual rates and payments, NPER is in years; if using monthly, it’s in months.

Why Might the NPER Result Be a Negative Number?

The NPER result might be negative if the present value (loan amount) and payment have the same sign, violating Cash Flow Sign Convention. Ensure outflows are negative and inflows are positive.

What is NPV in Excel?

In Excel, NPV stands for Net Present Value, a function used to calculate the present value of a series of future cash flows, discounted at a specified rate.

How to apply the nper function in excel vba?

To apply the NPER function in Excel VBA, write a VBA Sub procedure that uses the NPer method with required arguments (rate, pmt, pv) and assign the result to a cell, like so:

Sub CalculateNPER()</pre>

</div>

<div class="ql-code-block" data-language="plain">Range("B10").Value = NPer(Range("B5").Value / 4, Range("B6").Value, Range("B7").Value)</div>

<div class="ql-code-block" data-language="plain">End Sub

In this code, B5 is the interest rate, B6 is the payment amount, B7 is the present value, and B10 is where the result will be placed. Remember to adjust your rate if it’s not annual.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.