Opportunity cost plays a pivotal role in financial planning and investment decision-making, representing the benefits foregone by not choosing the next best alternative. This article introduces an Opportunity Cost Calculator in Microsoft Excel, illustrating how to quantify these trade-offs to make informed financial choices.

Key Takeaways:

- Opportunity cost is crucial in financial planning, serving as a guide to making the most out of limited resources like time and money.

- For investors, calculating opportunity cost is vital for strategic planning, helping to illuminate the potential long-term impacts of their choices.

- An effective Opportunity Cost Calculator features simplicity, flexibility, accuracy, comparative functionality, and incorporates the time value of money.

- Utilizing Excel for financial analysis, especially concepts like opportunity cost, enhances accuracy and saves time through functions like FV, PV, NPV, RATE, NPER, and PMT.

Table of Contents

Introduction to Opportunity Cost in Financial Planning

Understanding the Concept of Opportunity Cost

Opportunity cost is an incredibly important yet often overlooked component when you’re tackling financial planning. Think of it as the road not taken; for every financial decision made, there is a potential benefit that’s missed out on. Understanding this helps in ascertaining whether you’re making the most out of your resources.

Opportunity cost isn’t just a concept, but a practical life guide. The next time you’re pondering a major purchase or investment, remember that what you choose to forgo can sometimes have more value than the benefit gained from what you decide to go after. This is especially true when resources like time and money are limited.

Why Calculating Opportunity Cost is Essential for Investors

For investors, calculating opportunity cost isn’t just helpful—it’s a critical aspect of strategic financial planning. Seeing that the investment world is brimming with options, recognizing the true cost of choosing one investment over another can significantly impact long-term gains.

Imagine being at a crossroads where each path leads to different potential futures. That’s how investors often feel when presented with numerous investment opportunities. Calculating opportunity cost effectively illuminates which path may lead to a better financial outcome by revealing the potential benefits that could be missed by not choosing the alternative option. It’s about comparisons, clarity, and ultimately making choices that align with financial objectives.

The Fundamentals of an Opportunity Cost Calculator

Key Features of an Effective Opportunity Cost Calculator

When it comes to an effective Opportunity Cost Calculator, certain features are non-negotiable:

- Simplicity and Usability: A design that’s easy to navigate ensures anyone can use it without confusion.

- Flexibility: Adaptable inputs for different scenarios and financial variables cater to varying investment analyses.

- Accuracy: Reliable algorithms that produce precise calculations give confidence in the decision-making process.

- Comparative Functionality: The ability to juxtapose various investment outcomes side-by-side can be a game-changer.

- Incorporation of Time Value of Money: Adjustment for the time value of money ensures a more nuanced financial assessment.

These features lay the groundwork for financial success, telling you not just about the cost of opportunities but also about the ramifications of your choices against your long-term financial goals.

Examples of How Opportunity Cost Calculators Work

Understanding how to put an Opportunity Cost Calculator to use is best showcased through examples:

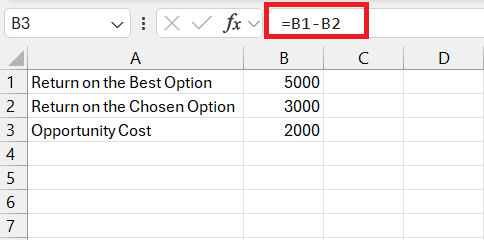

Example Problem:

- Return on the Best Option (RB): $5,000

- Return on the Chosen Option (RC): $3,000

- Opportunity Cost (OC): ? Using the formula

OC = RB - RC, we find that the opportunity cost is $2,000.

These examples illuminate the direct financial repercussion of choices. An Opportunity Cost Calculator simplifies this calculation, providing investors with immediate insights into the value of foregone alternatives.

By implementing these examples in real-life scenarios, one can appreciate the prudence behind quantifying lost benefits and thereby optimize financial choices.

Crafting Your Financial Blueprint with Excel

Streamlining Financial Analysis Using Excel Functions

Excel functions are the unsung heroes that streamline financial analysis, especially when grappling with complex concepts like opportunity cost. Excel’s powerful suite allows you to perform sophisticated calculations with ease, ensuring accuracy, and saving precious time.

- The FV (Future Value) function forecasts what your investment will be worth in the future.

- PV (Present Value) helps in determining the current value of a future sum of money.

- NPV (Net Present Value) calculation shows the value of a series of future cash flows by comparing against the initial investment.

- The RATE function uncovers the implied interest rate in a financial transaction.

- NPER (Number of Periods) reveals how long it will take to reach financial goals.

- Use the PMT (Payment) function to find out the periodic payment for an annuity.

These functions not only assist in performing time value of money analysis but also hone in on the most profitable course of action by calculating opportunity costs with precision and speed.

Calculate NPV of a Project

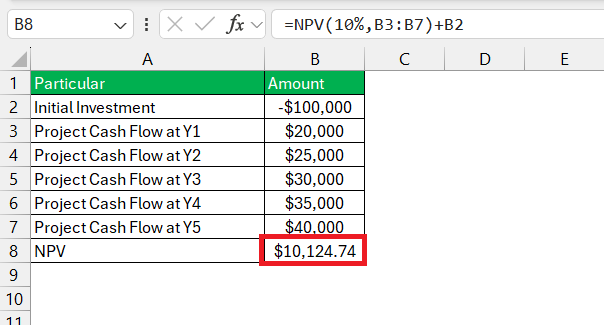

Calculating the Net Present Value (NPV) of a project in Excel is a straightforward process that involves using the NPV function. NPV helps in assessing the profitability of a project by discounting all cash flows (both positive and negative) back to the present value and subtracting the initial investment.

Here’s a basic example to guide you through the process:

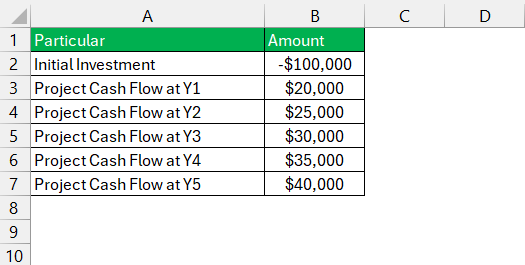

Example Scenario:

- Initial Investment: $100,000 (This amount is usually put in as a negative number since it’s an outflow).

- Discount Rate: 10% (The rate at which future cash flows are discounted back to their present value).

- Projected Cash Flows over the next 5 years are as follows:

- Year 1: $20,000

- Year 2: $25,000

- Year 3: $30,000

- Year 4: $35,000

- Year 5: $40,000

Steps to Calculate NPV in Excel:

STEP 1: Organize your data in Excel, preferably in a single column or row. For this example, let’s assume your initial investment and projected cash flows are listed from cells B2 to B7, with B2 containing the initial investment (as a negative number), and B3:B7 containing the projected cash flows for years 1 through 5.

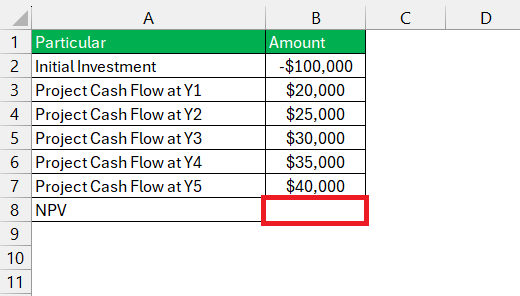

STEP 2: Click on the cell where you want the NPV result to appear.

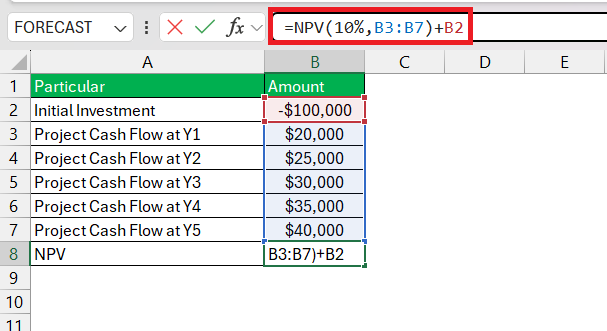

STEP 3: Enter the NPV formula: To calculate NPV, you’ll use the formula =NPV(rate, value1, [value2], …) + initial investment. For our example, assuming your discount rate is 10%, you would enter the formula as follows: =NPV(10%, B3:B7) + B2.

STEP 4: Press Enter. Excel will calculate and display the NPV of your project in the selected cell.

Case Studies: Real-world Applications of Opportunity Cost Analysis

Success Stories: Enhanced Investment Decisions Through Opportunity Cost

Success stories often shed light on the practical benefits of integrating opportunity cost into investment decisions. Many investors have enhanced their decision-making process and achieved greater financial success by examining the road not taken.

For example, consider a tech startup that used an Opportunity Cost Calculator to decide whether to allocate funds to marketing or product development. The calculator revealed that investing in marketing yielded a 20% higher return compared to developing new features in the short-term. This insight led to a reallocation of funds which ultimately resulted in increased revenue.

Key Takeaways:

- Opportunity cost analysis can shed light on the most lucrative areas for investment.

- The clarity provided by such calculations can turn a struggling business into a profitable venture.

- Regular use encourages strategic thinking and can prevent financial missteps.

By learning from these success stories, you can apply similar principles and strategies to make well-informed decisions that positively impact your financial future.

From Theory to Practice: Tips for Maximizing Your Financial Potential

Avoiding Common Pitfalls in Opportunity Cost Estimation

Navigating the intricacies of opportunity cost estimation can be tricky, but being aware of common pitfalls goes a long way in avoiding them:

- Overlooking Hidden Costs: Remember to factor in indirect costs such as time and effort, not just direct monetary expenses.

- Failing to Update Estimates: As circumstances change, so should your opportunity cost estimations to remain relevant.

- Ignoring Non-Financial Factors: Opportunity costs aren’t just about money. Consider qualitative aspects like customer satisfaction and brand reputation.

- Short-term Thinking: While immediate gains are tempting, don’t undervalue long-term benefits that may outweigh short-term returns.

- Confirmation Bias: Stay objective. Don’t let your preconceptions influence the estimation process.

By being meticulous and holistic in your approach, you’ll minimize the risk of making decisions that could negatively affect your financial health.

Pro Strategies for Aligning Opportunity Cost with Financial Goals

Aligning opportunity cost with financial goals requires a strategic approach that harmonizes your immediate decisions with your long-term objectives. Here are some pro strategies:

- Clear Goal Setting: Define your financial goals distinctly to measure opportunity costs against them effectively.

- Regular Monitoring: Periodically review and adjust your financial plan to ensure consistency with opportunity cost evaluations.

- Diversification: Spread resources across different investments to mitigate risks associated with opportunity costs.

- Risk Assessment: Understand your risk tolerance and factor it into your opportunity cost analysis for balanced decision-making.

- Continual Learning: Stay informed on financial trends and concepts that can refine your approach to calculating opportunity costs.

By adopting these strategies, your financial decisions become more robust, resilient, and reflective of your future aspirations.

Frequently Asked Questions

What is the Opportunity cost calculator?

The Opportunity Cost Calculator is a tool that helps quantify the potential benefits you forgo when choosing one investment or action over another alternative. It’s designed to provide clarity on financial trade-offs, ensuring you make informed decisions aligned with your economic goals.

What is the formula for opportunity cost in Excel?

The formula for opportunity cost in Excel is simply OC = RB - RC, where OC stands for Opportunity Cost, RB is the Return on the Best Alternative, and RC is the Return on the Chosen Option. Input these as cell references to calculate the cost automatically.

How Do I Determine What Costs to Include in Opportunity Cost Calculations?

In opportunity cost calculations, include all relevant monetary and non-monetary factors such as potential income, cost savings, time, and personal satisfaction that are associated with the next best alternative forgone.

Can Opportunity Cost Calculators Account for Variable Expenses and Risks?

Yes, Opportunity Cost Calculators can be tailored to factor in variable expenses and risks by using dynamic inputs and probability assessments, providing a more comprehensive financial analysis.

How do I interpret NPV?

Interpret NPV (Net Present Value) as the difference between the present value of cash inflows and outflows over time. A positive NPV indicates an investment is expected to generate more value than it costs, and vice versa for a negative NPV.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.