I’ve often found that one of the most insightful metrics for evaluating project investments is the Profitability Index (PI). PI helps me determine the value created per dollar invested, offering a clear way to prioritize projects based on their financial merit. In this guide, I’ll walk you through the steps I use to calculate the Profitability Index in Excel.

Key Takeaways:

- The Profitability Index (PI) evaluates investment profitability by comparing the present value of future cash flows to the initial investment.

- PI helps prioritize projects by showing the value generated per dollar invested.

- In Excel, PI is calculated by dividing the Net Present Value (NPV) of future cash flows by the absolute value of the initial investment.

- A PI greater than 1 indicates potential profitability, while less than 1 suggests a project may not be worth pursuing.

- Using PI aids in strategic decision-making by highlighting efficient investments, though it should be considered alongside other financial metrics.

Table of Contents

Introduction to Profitability Index and Its Importance

Unveiling the Concept of Profitability Index

The Profitability Index, often referred to as PI, is a financial metric that measures the potential profitability of an investment project. As someone immersed in the field of business and finance, I see PI as a ratio that compares the present value of future cash flows generated by a project to the initial investment cost.

Essentially, it quantifies the bang for your buck for each unit of currency invested.

Why Measuring Profitability Index is Crucial for Your Business

Measuring the Profitability Index is not just a financial formality; it’s a crucial compass for navigating the potentially stormy seas of business investment. Businesses use PI to ensure that their capital is not just idly parked, but actively generating returns. We rely on PI to make informed decisions by identifying which projects are likely to contribute more significantly to our overall growth and financial health.

For instance, a PI greater than 1 signals a thumbs-up for profitability—the higher the index, the larger the profit relative to the investment. Failing to calculate PI could mean missing out on lucrative ventures or, conversely, walking into financial misadventures. It’s an indispensable tool that allows us to compare opportunities and pinpoint the ones that align best with our financial strategy and objectives.

Breaking Down the Formula for Profitability Index

The Mathematical Path to Calculating Profit

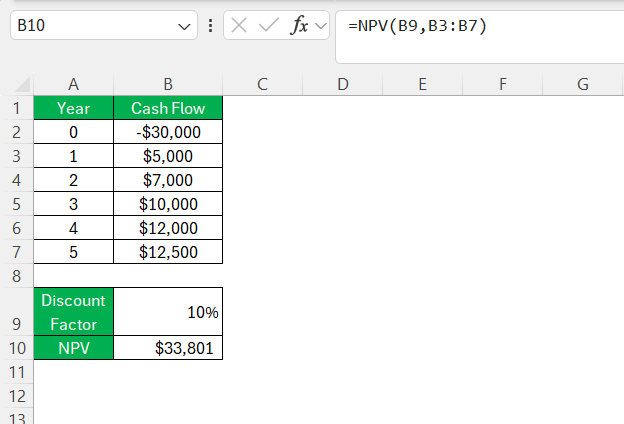

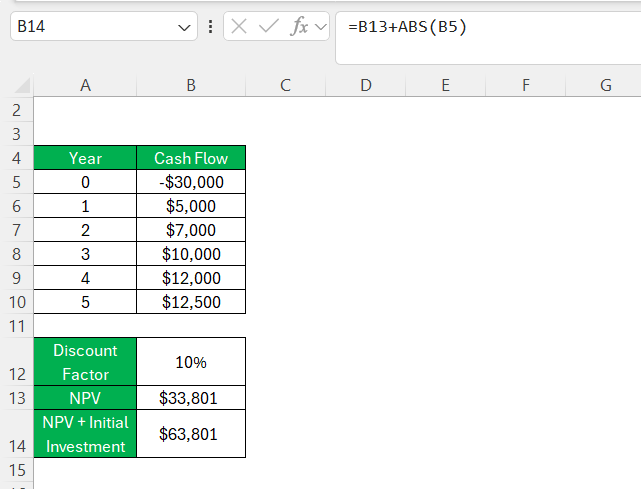

When we delve into the mathematical universe of financial calculations, the pathway to calculating profit via the Profitability Index is refreshingly straightforward. The formula for PI is essentially Net Present Value (NPV) divided by the initial investment, to which we add 1.

To paint a clearer, more digestible picture, here’s the formula broken down: PI = (NPV + Initial Investment)/ Initial Investment.

Applying this formula helps us ascertain whether each dollar invested will generate a value more (PI > 1), less (PI < 1), or equal (PI = 1) to a dollar in return. It’s a calculation that balances simplicity and profundity, providing a numerical representation of an investment’s attractiveness.

Interpreting the Ingredients of the Profit Index Formula

To really grasp the Profit Index Formula, we must sift through its ingredients and understand their significance. At its core, the formula consists of two components: the present value of future cash flows and the initial investment.

The numerator, the present value of future cash flows, is the sum we expect to receive over the project’s lifespan, discounted back to present value using our required rate of return. This accounts for the time value of money, a crucial principle in finance that reflects the idea that money available today is worth more than the same amount in the future due to its earning potential.

The denominator is the initial investment, the upfront cost needed to undertake the project. It’s a negative figure in the equation, ensuring the index calculates positive values for profitable projects. The resulting figure tells us about the efficiency and effectiveness of our investment in generating value. A Profitability Index score amplifies the clarity with which we eyeball the potential return on investments, giving us a quantifiable edge in decision-making.

Step-by-Step Guide to Calculating Profitability in Excel

Preparing Your Spreadsheet for the Calculation

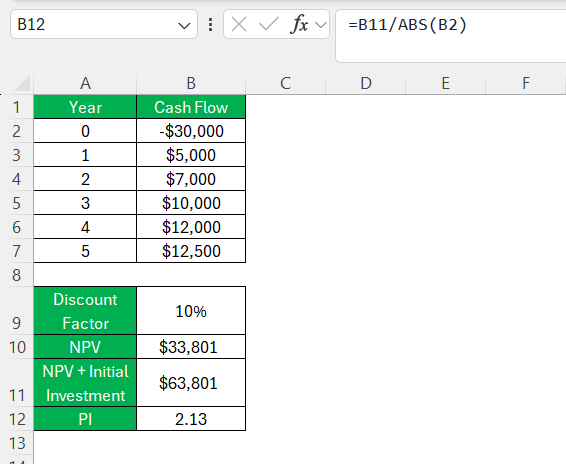

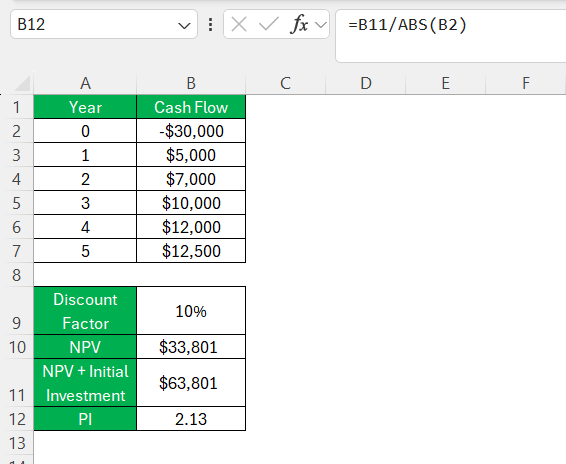

Before diving into the calculations, preparing the spreadsheet is crucial to make the process seamless. Start by organizing the financial data. Create columns titled ‘Year’ and ‘Cash Flow’ in Excel. Under ‘Year,’ list each year of the project duration, beginning with year 0 for the initial investment, which is logged as a negative value. Subsequent years should contain the projected cash inflows.

This initial setup ensures that the data is neatly arranged, making the calculation process that follows more intuitive and less prone to errors.

A helpful tip is to keep the layout of the spreadsheet clean and organized. This not only aids in the calculation process but also makes the data more comprehensible when revisiting the analysis or presenting it to stakeholders.

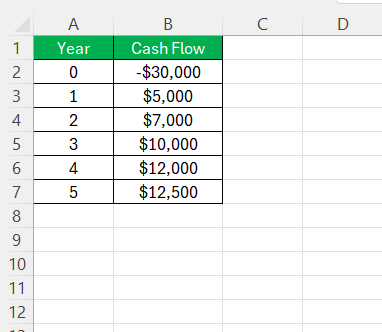

Inputting Data and Applying the Easy Excel Formula

Once the spreadsheet framework is set up, inputting data and applying the profitability index formula in Excel is quite manageable. Here’s what we do: In the cell adjacent to our cash flows, we calculate the present value of future cash inflows using Excel’s built-in Net Present Value (NPV) function. This takes into account our discount rate and different cash flows.

Next, in another cell, we add the absolute value of the initial investment amount to the NPV value.

Finally, to compute the PI, we simply divide the present value of future cash flows by the absolute value of the initial investment amount.

The outcome is our Profitability Index, conveniently calculated through the power and precision of Excel.

Always ensure that figures are accurate and that the formulas are correctly entered, as even minor mistakes can lead to large discrepancies in financial analysis.

Practical Examples: Applying Profitability Index in Various Scenarios

Making Investment Decisions with Profitability Index

Making investment decisions is part science, part art. The Profitability Index offers a quantitative lens through which we can view the likely success of a prospective investment. With PI, we can sift through a multitude of possibilities and prioritize projects that promise the highest returns relative to their costs. It’s especially useful in situations where capital is scarce and must be allocated efficiently. In my professional toolkit, the PI sits alongside other analytical standards such as NPV and IRR, serving as a vital decision-making aide that ensures investments are not just viable but also optimal.

We should also bear in mind that while PI is a powerful indicator, it doesn’t work in isolation. We must consider it alongside qualitative factors such as market trends, competitive landscape, and regulatory impacts before finalizing our investment decisions.

Comparing Projects with Different Lifespans and Cash Flows

Comparing projects with different lifespans and cash flows can be challenging, but the Profitability Index provides a level playing field for such analyses. For projects with different durations, we normalize the potential profitability by calculating an equivalent annual annuity. This adjustment ensures we’re comparing apples to apples by considering the time horizon of returns.

In practice, let’s say I’m comparing a 3-year project with a 5-year one. The PI enables me to distill the varied cash flows into a common metric that harmonizes the time value of money, regardless of the project’s length. By examining the PI, we quickly identify which project offers a better return per dollar invested over its lifespan. This is invaluable for long-term strategic planning, where misallocation can mean loss of capital and opportunity.

Advantages and Limitations of Using Profitability Index

Unlocking the Strategic Benefits for Financial Decision-Making

The strategic benefits of using the Profitability Index for financial decision-making are nothing short of transformative. This metric empowers us to perform a deep financial analysis that goes beyond mere gut feelings or intuition. We can realistically forecast the value each investment brings to the table and prioritize capital allocation accordingly. It embodies the discipline of rigorous financial planning and sensitivity analysis, pushing us to think in probabilities rather than possibilities.

For example, the Profitability Index can be instrumental in scenarios such as capital rationing, where we must decide the most efficient way to deploy limited resources. By calculating PI for each potential project, we shine a light on which to pursue, ensuring our investments are not just safeguarded but strategically optimized for sustainable growth.

Navigating Through the Potential Pitfalls and Limitations

Understanding the pitfalls and limitations of the Profitability Index is just as important as harnessing its strategic benefits. One potential limitation is that while the PI can indicate which projects generate the most value per unit of investment, it doesn’t account for the absolute size of investments. A project with a high PI but small scale might contribute less overall value than a larger project with a lower PI.

Furthermore, PI assumes future cash flows are reinvested at the discount rate, which may not be realistic. The accuracy of PI also hinges on the reliability of projected cash flows and the chosen discount rate. Optimistic forecasts can skew PI toward seemingly lucrative but ultimately unprofitable ventures.

Being aware of these caveats is essential. They remind us to perform due diligence and peer beyond the numbers. Rigorous scenario analysis and comprehensive risk assessment must accompany the use of PI for it to be truly effective in our financial decision-making toolkit.

FAQ Section

What is the formula for profitability index?

The formula for the Profitability Index (PI) is straightforward: PI = (Present Value of Future Cash Flows) ÷ Initial Investment. Alternatively, when incorporating Net Present Value (NPV), the formula becomes PI = (Net Present Value + Initial Investment) ÷ Initial Investment. It’s a handy indicator which tells us how many dollars of value are created for every dollar invested.

How does Profitability Index Differ from Net Present Value (NPV)?

The Profitability Index and Net Present Value are closely knitted concepts in finance, yet they offer distinct perspectives. NPV provides an absolute measure of an investment’s value by calculating expected cash flows minus the initial outlay. In contrast, PI offers a relative measure, indicating the value created per dollar invested. It’s the difference between knowing the total profit (NPV) and understanding the efficiency of your investment (PI).

Can Profitability Index be Negative and What Does that Indicate?

No, the Profitability Index cannot be negative. By definition, PI is a ratio with a positive numerator (the present value of future cash flows cannot be negative) and a positive denominator (the initial investment, even when represented as a negative value in calculations). If a PI is less than 1, it suggests that the project’s present value is less than the initial investment, indicating it’s unprofitable and should typically be rejected.

What are Common Mistakes to Avoid When Calculating Profitability Index in Excel?

Common mistakes to avoid when calculating the Profitability Index in Excel include not aligning cash flows with the correct periods, overlooking the initial investment in the NPV calculation, and using inconsistent units for discount rates and time periods. Additionally, ensure that the cash flows are all either in present or future value before calculation, to avoid mixing values which could lead to an inaccurate PI.

Why is the profitability index useful in project evaluation?

The Profitability Index is highly useful in project evaluation because it not only assesses the relative profitability of projects but also considers the scale of the investment. It allows us to rank competing projects based on the value they add per invested dollar, helping to identify the most efficient use of limited capital. PI is particularly beneficial in capital budgeting to evaluate the desirability of investments or projects with constrained funding.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.