The article provides a detailed guide on reverse sales tax calculation in Microsoft Excel, crucial for businesses and individuals to extract pre-tax prices from totals with tax. Highlighting its importance for financial accuracy, pricing, and tax compliance, it walks through creating a reverse sales tax calculator, supplemented with examples and tips for improved precision and efficiency

Key Takeaways

- Reverse sales tax calculation is crucial for accurate financial management and compliance.

- The article provides a detailed guide on setting up an Excel sheet for reverse sales tax calculation.

- It introduces a specific formula for extracting the pre-tax price from the total cost.

- Practical examples and Excel pro tips are provided to master the process and avoid common pitfalls.

Download the spreadsheet and follow along with the tutorial on Reverse Sales Tax Calculator in Excel – Download excel workbookReverse-Sales-Tax-Calculator-in-Excel.xlsx

Table of Contents

Unveiling the Magic of Reverse Sales Tax Calculation in Excel

What is Reverse Sales Tax?

Reverse sales tax involves calculating the original price of goods or services before tax when only the total price after tax is known. This process is essential for accurate financial management, allowing businesses and individuals to distinguish between the actual sales price and the tax amount within a total cost. The use of a reverse sales tax calculator streamlines this task, providing a quick and precise method for back-calculating from the total cost to obtain the pre-tax value, which is crucial for bookkeeping, tax reporting, and budgeting.

The Relevance of Knowing How to Calculate It Backwards

Understanding how to calculate reverse sales tax isn’t just a nifty trick—it’s a fundamental skill for maintaining transparency and accuracy in financial records. If you’re in business, you might use it to ensure the price you’re charging customers allows for a comfortable profit margin after taxes are taken out. For individuals, it’s all about budgeting and understanding the true cost of purchases.

Let’s break it down:

- Accurate Bookkeeping: To keep records straight, it’s important to dissect your total revenue into taxable sales and tax collected. This ensures you’re not over or under-reporting any figures come tax time.

- Pricing Strategy: When deciding the sale price of goods or services, you need to consider the sales tax to hit the right profit targets.

- Tax Compliance: Knowing the actual tax amount on your sales is key to remitting the correct amount to the government and avoiding costly penalties for underpayment.

The utility of a reverse sales tax calculator extends to various sectors—from retail to services, ensuring that you stay financially informed and compliant.

Step-by-Step Guide to Building Your Own Reverse Sales Tax Calculator

Setting Up Your Excel Sheet for the Task

Preparing your Excel sheet the right way is your first step towards efficient reverse sales tax calculation.

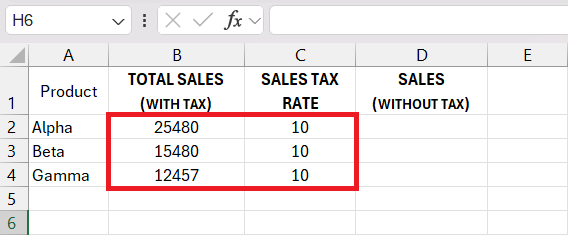

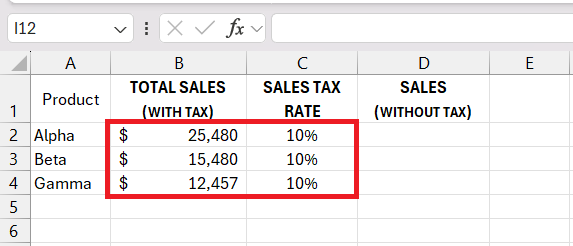

Step 1: Identify Your Data Points: You’ll need columns for the Total Sales (which includes tax) and the Sales Tax Rate.

Step 2: Format Your Cells: Ensure that the Total Amount and Sales Tax Rate are formatted for currency and percentage, respectively. This keeps calculations precision-managed.

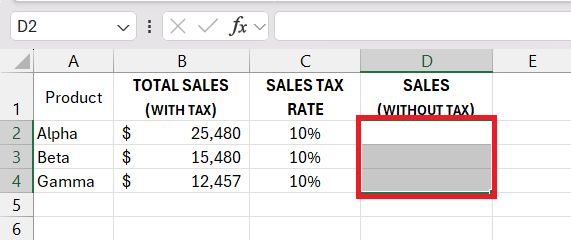

Step 3: Leave Space for Results: Designate cells where your before-tax amount and actual tax amount will be displayed after the computation.

With this setup, you’re providing a clear roadmap for where data should go and where results will be displayed, streamlining the process.

The Formula for Deducting Sales Tax from the Total

When it’s time to reverse-engineer sales tax from the total amount, Excel becomes a powerful ally. Here’s the formula you’ll need:

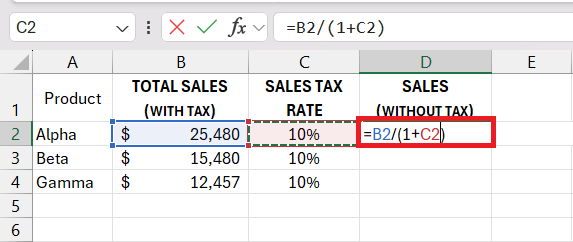

Price before Sales Tax = Total Price with Tax / (1 + Sales Tax Rate)

Follow these steps in Excel to put the formula to work:

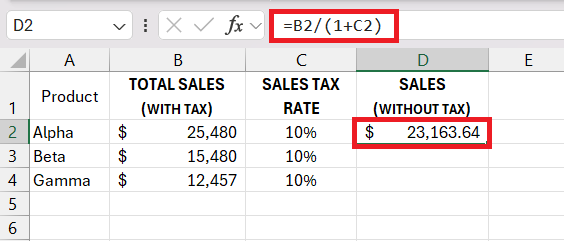

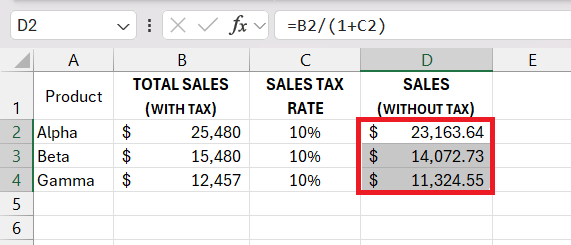

Step 1: Input the Formula: In the designated cell for the Price before Tax, type in =CellWithTotalPrice/(1+CellWithTaxRate). Replace CellWithTotalPrice and CellWithTaxRate with the actual cell references i.e. B2 and C2 respectively in your sheet.

Step 2: Press Enter: After typing the formula, press Enter. Excel will display the price before tax in the cell where you entered the formula.

Step 3: Drag or Copy the Formula: If you’re working with multiple items, you can drag the formula down or copy it to apply to other rows.

Remember to verify that your Sales Tax Rate is input as a decimal in Excel (e.g., 6% should be input as 0.06).

Practical Examples to Master the Process

Case Study: Calculating Sales Tax for Business Expenses

In the corporate world, financial acumen can greatly enhance the management of business expenses. Consider this scenario:

- Situation: A company is auditing its expenses and finds that some receipts only show the total amount paid, without itemizing the sales tax.

- Objective: To extract the exact sales tax amount for accurate expense reporting and tax deductions.

By employing a reverse sales tax calculator in Excel, they can distinguish between the taxable purchase and the tax itself. This not only streamlines the auditing process but also provides clarity for budgetary adjustments and financial forecasting.

Here’s what they did:

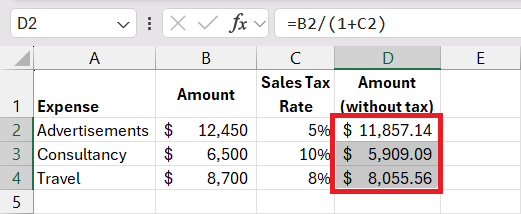

- Data Organization: They utilized their Excel sheet to list all total amounts inclusive of tax.

- Formula Application: For each entry, they calculated the original price before sales tax using the formula provided, ensuring the sales tax rate was correct for each jurisdiction.

- Results: The calculated pre-tax prices and tax amounts were then used to adjust financial records, highlighting areas where tax savings could be optimized.

By taking these steps, the company was able to achieve an accurate financial report, which is essential for internal audits, compliance, and maintaining the bottom line.

Excel Pro Tips for Improved Accuracy and Efficiency

Leveraging Excel Functions for Precision

Excel is stocked with functions that can bring precision to your reverse sales tax calculations. Let’s look at how you can make the most of them:

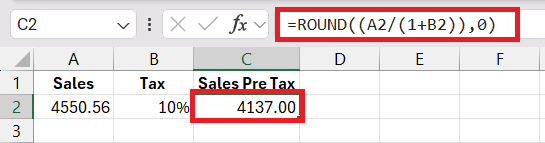

- ROUND Function: to ensure your calculated prices aren’t just accurate but also practical for pricing strategies, use

=ROUND(formula, 0)to get the result rounded to 0 decimal places.

- ABS Function: perhaps the formula yields a negative number due to incorrect data entry;

=ABS(value)makes sure you get the absolute value for comparison. - IF Function: to build in some logic, such as checking if the tax rate applied corresponds to your criteria, you can use the IF function like

=IF(condition, value_if_true, value_if_false).

With the right combination of these functions, your reverse sales tax calculator won’t just deliver the correct numbers, it will ensure they’re usable and error-free.

Common Pitfalls to Avoid When Using a Reverse Sales Tax Calculator in Excel

Ensuring Correct Tax Rates Are Applied

To ensure the accuracy of your reverse sales tax calculations, applying the correct tax rates is crucial. Here’s what to keep in mind:

- Stay Updated: Tax rates can change, so you must continually update the rates in your Excel calculator. Cross-reference with official state or federal tax websites.

- Localization: If you’re dealing with multiple locations, be aware that city, county, and state tax rates can differ. Ensure you’re using the appropriate rate for each transaction.

By vigilantly managing these details, you protect against costly miscalculations that could affect both customer trust and compliance.

Verifying the Integrity of Your Data Inputs

Ensuring the integrity of the data you enter into your reverse sales tax calculator is paramount. After all, the output is only as reliable as the input. Here are key practices:

- Double-Check Entries: Simple miskeying can lead to significant errors, so always review the numbers you’ve entered against your source documents.

- Use Data Validation: Set up Excel’s data validation tool to restrict input to valid formats and ranges to minimize entry errors.

- Consistent Update Routine: Regularly update and cross-verify tax rates against trusted sources to prevent using outdated information.

Thoroughly vetting the inputs not only gives you confidence in your calculations but also safeguards the financial accuracy upheld by your Excel workbook.

FAQ: Expert Answers to Your Reverse Sales Tax Queries

What Exactly Is Reverse Sales Tax?

Reverse sales tax is the process of calculating the initial price of an item or service before sales tax has been added. It involves working backwards from the total cost that includes tax to figure out the original, pre-tax price. This is especially useful for businesses and individuals to determine net costs and ensure accurate financial reporting and budgeting.

How Do I Create a Reverse Sales Tax Calculator in Excel?

To make a reverse sales tax calculator in Excel, follow these steps:

- Open Excel and label two columns: ‘Total Price’ and ‘Tax Rate’.

- Input your data, including the total prices with tax and the applicable sales tax rates.

- Use the formula

=Total Price/(1+Tax Rate)in a new column to calculate the price before tax for each row. - Auto-fill the formula for all relevant entries.

There, you have your reverse tax calculator, ready to break down total amounts into pre-tax values and tax amounts.

Can I Use this Calculator for Different State Sales Taxes?

Yes, you can use this reverse sales tax calculator for different state sales taxes. Simply input the correct tax rate for each state into the calculator, and it will determine the amount of tax included in the total price. Remember, sales tax rates can vary widely between states, counties, and cities, so it’s crucial to use the precise rate for your specific location to get an accurate calculation.

What If My Total Amount Includes Multiple Items with Different Tax Rates?

If your total amount includes multiple items with different tax rates, you’ll need to calculate the reverse sales tax for each item separately using their individual tax rates. Once you have the pre-tax prices for each item, you can sum them up to get the total net amount. In Excel, you may set up separate rows or columns for each item and its corresponding tax rate to simplify this process.

What is the sales tax formula on Excel?

The sales tax formula in Excel to calculate the amount of tax included in a total price and to identify the price before tax is as follows:

Tax Amount = Total Price – (Total Price / (1 + Sales Tax Rate))

Price Before Tax = Total Price / (1 + Sales Tax Rate)

Where Total Price is the cell with the price inclusive of tax, and Sales Tax Rate is the cell with the tax rate expressed as a decimal.

In Excel, you would input these formulas into the cells where you want to display the tax amount and the price before tax.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.