When I first started diving into financial calculations in Excel, I quickly realized how useful the RRI function is. It’s a simple yet powerful tool to calculate the growth rate required for an investment to grow from its initial value to its future value over a given period. Think of it as a shortcut to determine the Compound Annual Growth Rate (CAGR).

In this article, I’ll walk you through what the RRI function does, its syntax, and how to use it effectively. By the end, you’ll feel confident applying this function to your financial models.

Key Takeaways:

- The RRI function in Excel simplifies determining the compound annual growth rate (CAGR) for investments.

- Enter the formula

=RRI(nper, pv, fv)to find the rate of return, using the number of periods, present value, and future value as inputs. - RRI helps project investment growth, aiding in retirement planning, business strategies, or comparing financial options.

- The function automates calculations, ensures accuracy with compounding effects, and saves time compared to manual methods.

- RRI isn’t just for investments; it’s also useful in analyzing exponential growth in non-financial contexts like population studies or scientific data.

Table of Contents

Introduction to RRI Function in Excel

Demystifying RRI: What It Is and Why It Matters

RRI stands for “rate of return on investment” and holds significance as a powerful Excel function to calculate the equivalent interest rate necessary for an investment to grow from its present value to a future value over a specific period.

It’s a key function for anyone involved in financial analysis or handling investments, simplifying the process of estimating growth rates and understanding the potential returns on investments over time. Harnessing RRI helps in making better, more informed financial decisions.

A Brief History of RRI in Financial Modeling

The concept of calculating the rate of return is deeply rooted in financial modeling and dates back to when spreadsheets were paper-based. With the advent of Microsoft Excel, financial modeling experienced a revolution, as complex calculations could be performed more efficiently.

Excel’s RRI function is a part of this evolution, introduced to offer an alternative to traditional financial formulas. This function embodies years of financial theory and practice, tailored to deliver precise growth measurements through a user-friendly and dynamic computational tool.

It incorporates the essence of compounding interest effects over time, a cornerstone in understanding long-term investment growth, which has been central to financial modeling since its inception.

How the RRI Function Simplifies Growth Measurement

The Basics of Calculating Growth Rates with Excel’s RRI Function

Calculating growth rates using Excel’s RRI function is straightforward. This function requires three essential inputs: the number of periods (nper), the present value (pv) of the investment, and the future value (fv) you aim to achieve. When I input these values into the RRI function, it computes the equivalent interest rate needed per period to grow the investment from the present value to the future value. This is particularly useful for evaluating the Compound Annual Growth Rate (CAGR) of an investment over time.

Here’s a simple breakdown of how the RRI function looks in Excel:

=RRI(nper, pv, fv)

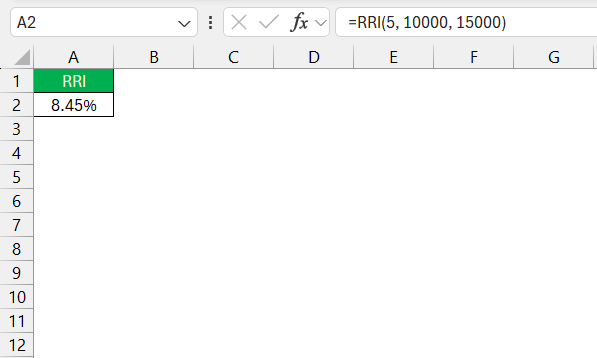

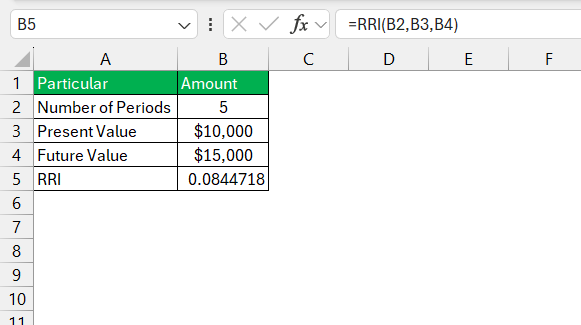

For instance, if I want to know the annual growth rate required for a $10,000 investment to grow to $15,000 over 5 years, I would input:

=RRI(5, 10000, 15000)

The RRI function returns the rate assuming compounding, which reflects real-world scenarios where earnings are reinvested at the calculated rate.

Key Advantages of Using RRI over Traditional Methods

The RRI function offers distinct advantages over more traditional methods of calculating growth rates:

- Automation and Efficiency: Unlike manual calculations which are time-consuming and prone to human error, the RRI function automates this process, allowing for quick and efficient analysis.

- Accuracy: RRI assumes compounding, which is a more realistic reflection of investment growth over multiple periods. This results in a more accurate representation of potential growth compared to methods that may overlook the effects of compounding.

- Versatility: It’s applicable across a range of scenarios—from individual investments to corporate project evaluations—making it a versatile tool for anyone in finance.

- Simplicity: Even those with a basic understanding of Excel can easily apply the RRI function without delving into the complexities of finance formulas.

- Comparability: RRI standardizes growth rate calculations across different investments, making it easier to compare the potential performance of various options on a like-for-like basis.

Integrating the RRI function in Excel workflows significantly enhances my capability to analyze investment growth potential, ensuring both clarity and consistency in financial projections.

Mastering The Application of RRI Function

Step-by-Step Guide to Using RRI in Your Spreadsheets

When incorporating the RRI function into spreadsheets, I follow a systematic approach:

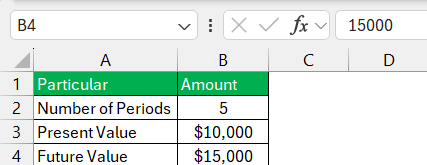

STEP 1: Open the Excel worksheet where the calculation will be performed. Ensure the data for time periods, present value, and future value are readily available within the spreadsheet.

STEP 2: Click on the cell where you want the RRI result to be displayed.

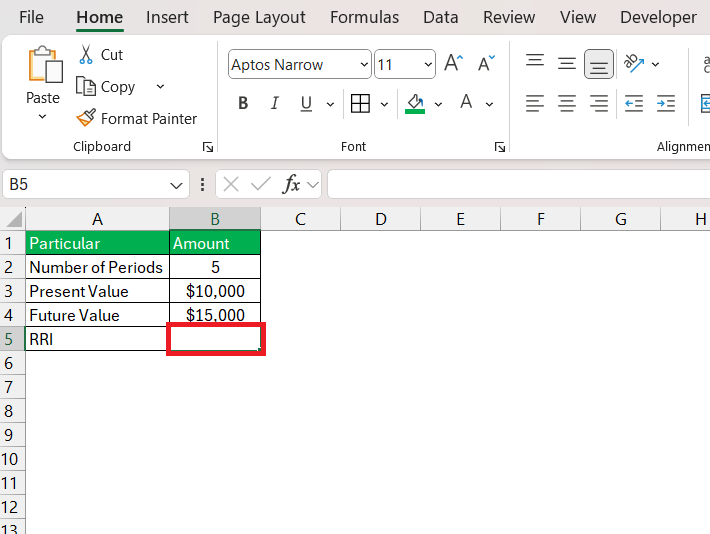

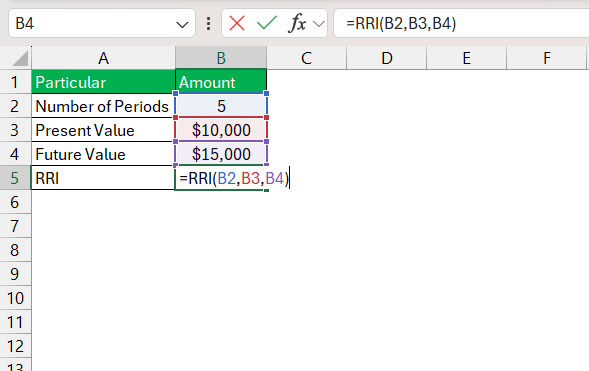

STEP 3: Enter the RRI formula: =RRI(nper, pv, fv).

STEP 4: The RRI function will automatically calculate the equivalent interest rate.

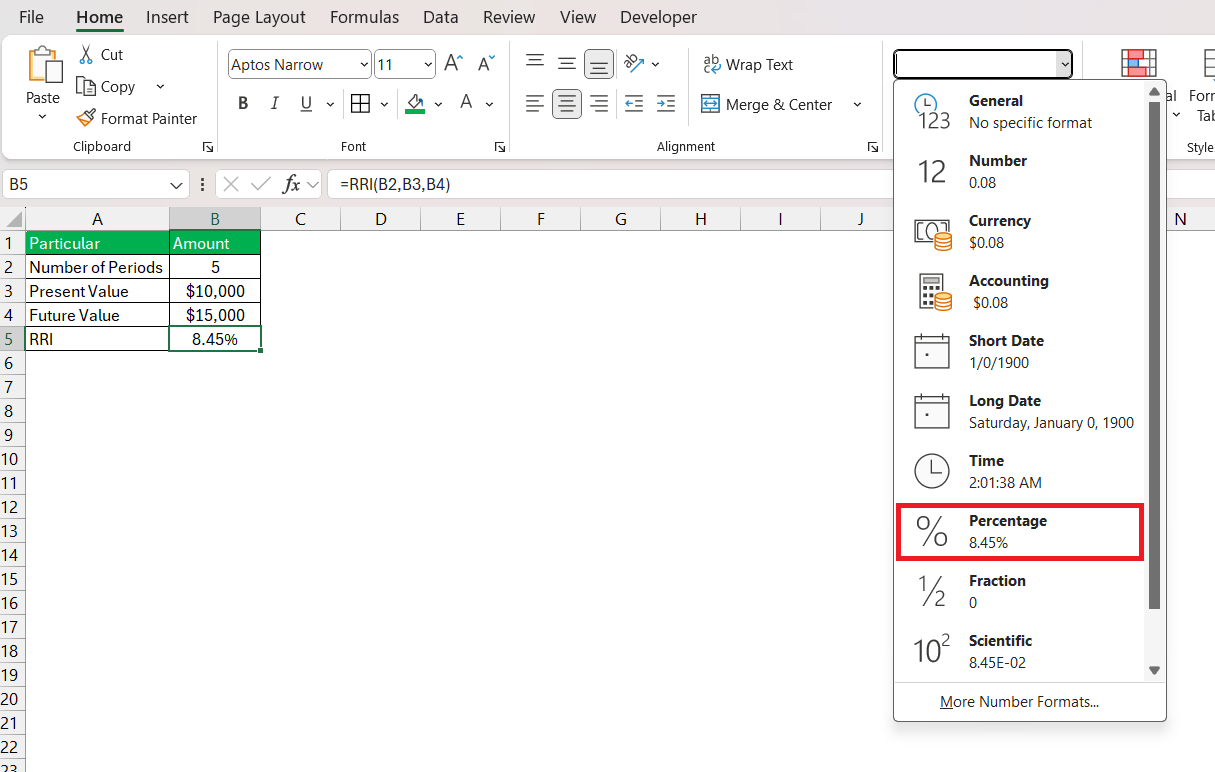

STEP 5: Go to the Home tab and select a percentage from the dropdown.

If you’re dealing with multiple sets of data, simply drag down the fill handle from the formulated cell, and Excel will replicate the RRI function for other rows, adjusting the references accordingly. It’s crucial to ensure that the references are correct to avoid any errors in the calculation.

Tips for Accurate RRI Function Input and Avoiding Common Errors

Ensuring the RRI function delivers accurate results hinges on proper input. Here’s how to avoid common errors:

- Verify Data Accuracy: Double-check that the

nper,pv, andfvvalues are correct and in the right places within the formula. - Consistent Time Periods: Ensure

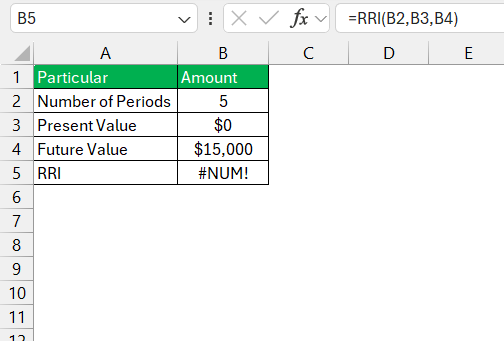

nperreflects the same time period forpvandfv. For example, ifnperis in years, both values should relate to year’s worth of growth. - Check for Dividing by Zero: If

pvis set to zero, Excel will return an error since it implies no initial investment, which defies the logic of growth calculations.

- Watch Cell References: When copying the RRI formula, confirm the cell references adapt correctly or fix them to absolute reference if needed.

Remember, accurate inputs are the basis for reliable outputs, so meticulous data entry and formula setup are essential for the successful use of the RRI function.

Real-World Examples: RRI in Action

Projecting Investment Growth with RRI

Projecting investment growth with RRI becomes intuitive with a solid grasp of its inputs. I often use the RRI function to simulate different growth scenarios and set realistic expectations for investment returns over time.

For instance, when considering a retirement fund or the expansion of the business, RRI helps chart the course by revealing the annual rate needed for an investment to reach its target value within a desired timeframe. This projection assists in making strategic choices about where to place funds, how to adjust timelines, or even whether to pursue or forego an investment strategy based on the calculated growth rate.

For an investor contemplating the future value of their portfolio, applying the RRI function allows them to see a clear picture of potential growth, factoring in the power of compounding interest, which is vital for long-term investments. This not only enhances decision-making with data-driven insights but also provides peace of mind through transparent and expected financial projections.

Strategic Planning and Analysis Using the RRI Function

Using the RRI function within strategic planning and analysis allows me to present a data-driven roadmap for future investments and business endeavors. By calculating the expected rate of return on new projects or asset growth, stakeholders are provided with an anticipated outcome, essential for informed planning.

For instance, if a business is deciding between different strategic investments—like market expansion or product development—the RRI function is indispensable. By plugging estimated future values and timeframes into the function, I can illustrate differing growth trajectories. This projection enables companies to prioritize investments that align with their long-term financial objectives and risk appetite, making it a vital component of strategic planning.

Moreover, periodic review of an investment’s performance with the RRI function allows for ongoing analysis, ensuring that the returns are in line with expectations and adjustments can be made if they are not.

FAQs on RRI Function in Excel

What Exactly Does the RRI Function Compute in Excel?

The RRI function in Excel computes the equivalent interest rate needed for an investment to grow from its present value to a future value over a specified number of periods. It simplifies the process of determining the compound annual growth rate for investments, accommodating for compound interest over the growth period.

How to use rri in Excel?

To use the RRI function in Excel, enter =RRI(nper, pv, fv) into a cell, replacing ‘nper’ with the number of periods, ‘pv’ with the present value, and ‘fv’ with the future value. Press Enter, and Excel will calculate the growth rate.

Can RRI Be Used for Non-Financial Data Analysis?

Yes, the RRI function can be used for non-financial data analysis, such as calculating growth rates of populations, metrics in biology, or any scenario where exponential growth is present and can be modeled similarly to financial compounding.

What Are the Limitations of the RRI Function for Growth Calculations?

The limitations of the RRI function include its assumption of constant growth, which may not reflect real-life variables and volatility. It also doesn’t account for additional investments or withdrawals over the time period, limiting its applicability in scenarios with cash flow variations.

Is RRI the same as CAGR in Excel?

Yes, the RRI function is essentially Excel’s way of calculating the Compound Annual Growth Rate (CAGR). It determines the steady annual rate at which an investment would need to grow over a period of time to reach a specified future value from a given present value.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.