When I first dived into the world of Excel’s financial functions, one function that caught my attention was XIRR. If you’ve ever worked with irregular cash flows and needed to calculate an accurate internal rate of return, XIRR is your go-to function. I’ve used it numerous times to evaluate investments, track project profitability, and make informed decisions.

In this article, I’ll guide you through everything you need to know about XIRR in Excel, from understanding its purpose to applying it in real-life scenarios.

Key Takeaways:

- XIRR calculates returns considering exact dates, making it ideal for real-world scenarios.

- More accurate than traditional IRR, XIRR factors in the time value of money for better insights.

- Useful in investments, loans, real estate, startups, and more where cash flow timings vary.

- Use

=XIRR(values, dates, [guess])with properly formatted data for quick results. - Resolve issues like #NUM! or #VALUE! by ensuring correct formatting and data entry.

Introduction to Excel’s XIRR Formula

The Basics of XIRR

Diving into the world of financial analysis, we often encounter complex cash flow streams that don’t fit neatly into regular intervals. This is where Excel’s XIRR formula shines, providing a more nuanced approach to evaluating investments.

Unlike traditional methods, XIRR accounts for the exact timing of cash flows, offering more precise insights into project or investment financial performance.

Real-World Applications of the XIRR Function

In practice, the XIRR function is a valuable tool for financial analysts and individual investors alike. It’s commonly used to understand the profitability of irregular projects, such as construction ventures with staggered payments or investments in startups that have uneven funding rounds.

For instance, a venture capitalist would rely on XIRR to determine the rate of return on investments with cash inflows and outflows occurring at unpredictable times. Likewise, it assists portfolio managers in assessing the performance of financial assets that do not pay dividends or interest periodically.

In philanthropy, organizations can utilize XIRR to evaluate the efficacy of long-term projects with dispersed expenditure and sporadic donations. Real estate agents, too, use XIRR for determining the return on property investments where rental income and maintenance costs may vary seasonally.

Understanding the XIRR Function in Detail

What is XIRR?

XIRR stands for Extended Internal Rate of Return. Unlike the regular IRR function, which assumes equal time intervals between cash flows, XIRR accounts for irregular intervals. This makes it particularly useful for scenarios like:

- Investment cash flows with inconsistent timings.

- Loan repayment schedules with varying dates.

- Any project where cash inflows or outflows occur on random dates.

XIRR calculates the rate of return on your investment based on the specific dates associated with cash flows. The syntax for XIRR in Excel is simple:

=XIRR(values, dates, [guess])

- values: A range of cash flows, including both inflows and outflows. The first value must represent the initial investment (negative value).

- dates: The corresponding dates for each cash flow in the same sequence as the values.

- guess (optional): An initial estimate for the rate of return. If omitted, Excel defaults to 10%.

XIRR vs. Traditional IRR: Distinguishing Features

When comparing XIRR with traditional IRR, the most noteworthy distinction lies in the treatment of time. While IRR assumes that cash flows occur at equal periodic intervals and aggregates them into annual periods, XIRR discerns the specific dates of each cash flow, providing a more accurate reflection of real-world situations.

XIRR triumphs in versatility and is capable of evaluating investments with random cash flows – a must in today’s dynamic financial landscape. It’s particularly crucial when the period between transactions varies or doesn’t align with regular intervals like quarters or years.

Imagine you’re assessing an investment with cash flows that come in every three months, then abruptly switch to every six months. A traditional IRR would skew the investment’s true performance, whereas XIRR would adeptly handle this irregularity.

It’s worth noting, that IRR can be sufficient when cash flows are periodic and predictable, such as with bonds or annuities. However, for most other scenarios, especially those that involve complex cash flow patterns, XIRR is the preferred measure due to its accommodation for timing variations – a more faithful representation of the investment’s potential.

How to Implement XIRR in Excel

Step-by-Step Guide to Using the XIRR Formula

Implementing the XIRR formula in Excel is straightforward once you get the hang of it. Here’s a guide to help you through the process:

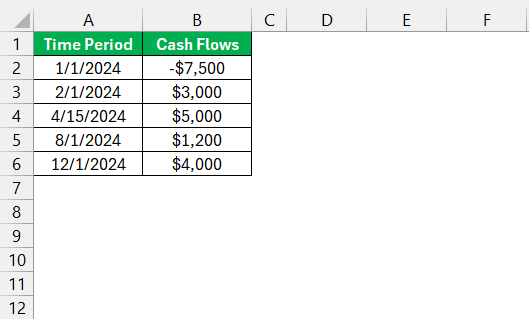

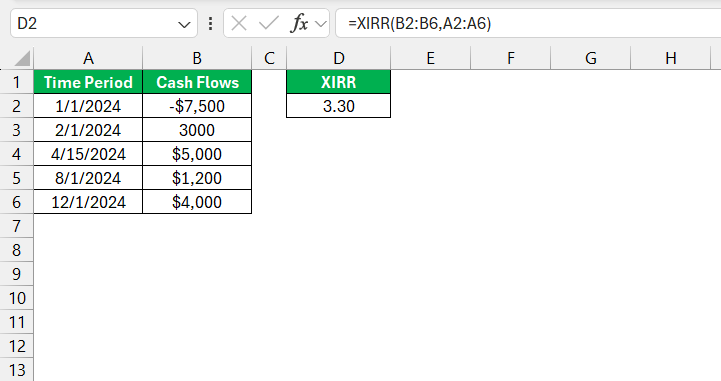

STEP 1: Organize your cash flow data into two columns: one for dates and one for corresponding cash flows. The initial investment usually has a negative value, and subsequent inflows are positive values.

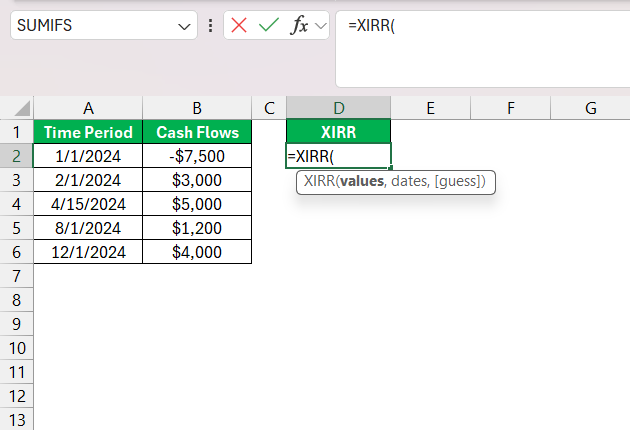

STEP 2: Click on the cell where you want the XIRR result to appear. Type in the formula =XIRR( to initiate the function.

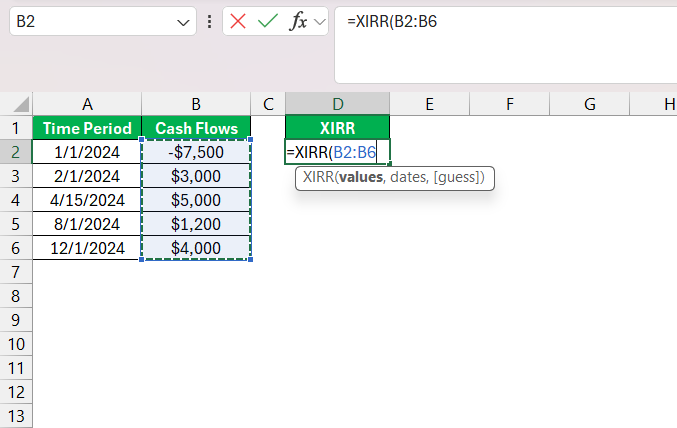

STEP 3: Select the range of cash flow values, followed by a comma.

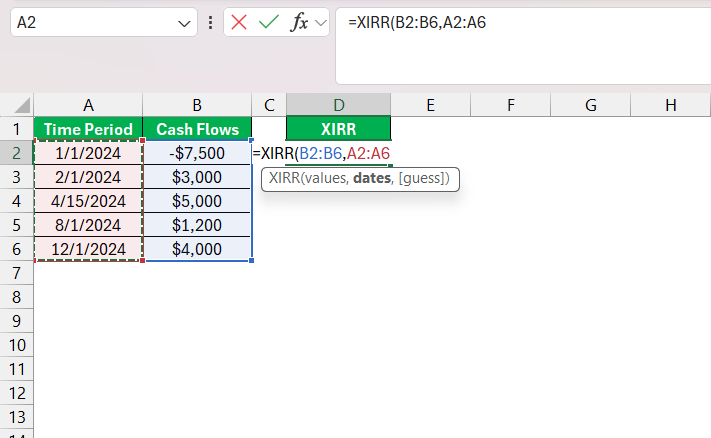

STEP 4: Next, select the range of corresponding dates.

Optionally, input a guess for the expected rate of return after another comma, which can help Excel converge on the solution quicker.

STEP 5: Close the formula with a parenthesis and hit ‘Enter.’

If all inputs are correct, Excel will return the XIRR value, representing the internal rate of return for the given cash flows and time periods.

Excel is remarkably robust, but it’s vital to ensure that your dates are in the proper format and that cash flows align with their respective dates for XIRR to work correctly. Otherwise, you might run into some common errors which can usually be resolved by double-checking the data organization.

Troubleshooting Common Issues with XIRR Calculations

As with any complex function, using XIRR can sometimes lead to errors or unexpected results. Here’s a quick troubleshooting guide to identify and fix common issues:

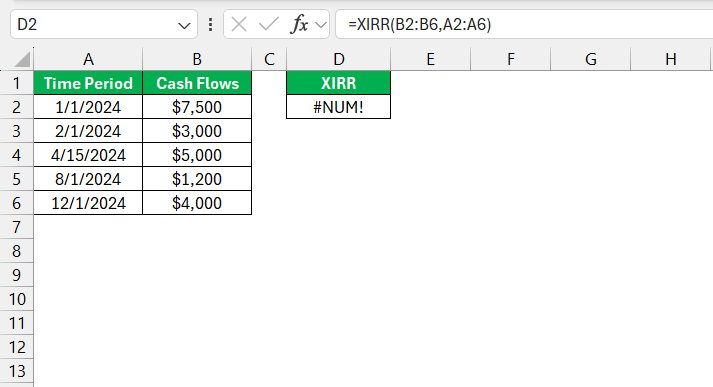

- #NUM! Error: This may occur if no rate of return makes the NPV zero. Check your cash flows; you must have at least one positive and one negative value.

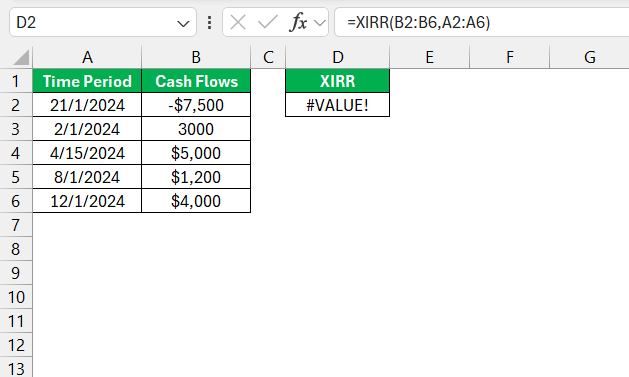

- #VALUE! Error: This usually happens if any of the dates aren’t recognized as valid Excel dates, or if any cash flow values are non-numeric. Ensure all entries in your date and cash flow columns are correctly formatted.

- Inaccuracy: If you’re seeing a result but believe it’s not accurate, revisit the cash flow data. It’s crucial that they’re entered in chronological order, as XIRR is date-sensitive.

- Slow Calculation: If Excel takes a long time to calculate XIRR, it could be due to a lack of a good initial estimate for the IRR. You can speed up the process by providing a ‘guess’ parameter closer to the expected IRR.

Remember, XIRR relies on iteration to solve the formula, so providing clear, correct, and well-organized data is pivotal to yielding an accurate and useful result.

Advanced Insights from XIRR Analysis

Fine-Tuning Your Financial Models with XIRR

Refining your financial models with the XIRR function can significantly enhance their precision. Incorporating XIRR allows us to present a more accurate picture by reflecting the true cost of capital and the time value of money. It’s a step up in financial analysis that aligns with the irregularity of the business world, where cash flows are seldom as neat as our models might initially assume.

To fine-tune your models, consider the chronology and amount of each cash flow. Accurately inputting the respective dates and amounts ensures that the XIRR function can work its magic. Also, reviewing the timing and frequency of expected cash flows allows for adjustments in scenarios, such as delayed payments or early receipts, which impact the final rate of return.

For models that forecast far into the future, sensitivity analysis via XIRR can reveal how changes to the timing and magnitude of cash flows could affect project viability. Beyond merely presenting figures, XIRR empowers us to offer a narrative that explains potential fluctuations, contributing to more informed decision-making.

Case Studies: XIRR in Action

Case studies serve as excellent demonstrations of XIRR’s real-world efficacy and versatility. By exploring scenarios where XIRR has been applied successfully, we can appreciate its profound impact on financial decision-making.

- The Growing Startup: A seed-stage startup receiving irregular tranches of funding and making variable expenditures over time presents a classic use case. The XIRR function helped the startup’s financial advisors calculate a realistic rate of return, enticing further investment into the company.

- The Real Estate Portfolio: A real estate investor with properties generating different cash flows at various times used XIRR to ascertain the actual returns on each property. This enabled a data-driven strategy for portfolio optimization.

- The Agricultural Project: An agricultural development project with upfront costs and returns that varied yearly due to production and market prices leveraged XIRR to forecast long-term viability, aiding in securing necessary funding and support.

- The Crowdfunded Invention: A product funded through a crowdfunding campaign, receiving an uneven influx of cash before and after hitting the market, employed the XIRR function to understand the investment’s true performance.

- The Philanthropic Fund: A philanthropic organization with an irregular donation stream and periodic project costs harnessed XIRR to evaluate the efficacy of its programs, enhancing its financial stewardship.

Each of these case studies encapsulate XIRR’s ability to unfold the intricate layers of financial data, allowing for a distilled understanding of an investment’s actual performance over time.

FAQ: Mastering Excel’s XIRR Formula

How do I calculate XIRR in Excel?

To calculate XIRR in Excel, arrange your cash flow values and corresponding dates in adjacent columns, ensuring the first cash flow is negative (investment outflow). Then select a cell for the XIRR result, input the formula =XIRR(values, dates, [guess]), selecting the cash flow values and dates ranges within the parentheses. Press Enter to obtain the internal rate of return for these cash flows at irregular intervals. Remember, if you don’t specify a guess, Excel defaults to 10%.

What are the requirements for the data used in the XIRR function?

For the XIRR function to work correctly in Excel, ensure that your data meets these requirements: You need at least one positive and one negative cash flow among your values to represent an outflow (investment) and inflows (returns). Dates must be valid Excel dates that correspond to the cash flows and can occur in any order. The function will not work accurately if these conditions aren’t met.

How does XIRR handle irregular intervals between cash flows?

XIRR is designed to handle irregular intervals between cash flows by taking into account the actual dates of each cash flow. Unlike the regular IRR function which assumes periodic cash flows, XIRR calculates the internal rate of return for a series of cash flows that occur at different, potentially random, periods. It assigns more weight to early cash flows and less to later ones, accurately reflecting each cash flow’s impact on the investment’s overall return.

Can XIRR be used to evaluate investments with both positive and negative returns?

Yes, XIRR can be used to evaluate investments with both positive and negative returns. It is designed to determine the internal rate of return regardless of the nature of cash flows. As long as the dataset includes at least one cash outflow (negative value) and one cash inflow (positive value), XIRR can provide insights into the overall performance of the investment over time, including scenarios where returns may fluctuate between gains and losses.

What are some common errors encountered with the XIRR formula, and how can they be fixed?

Common XIRR formula errors include:

- #NUM! Error: This can indicate no rate of return equating to a NPV of zero. Ensure there’s at least one positive and one negative cash flow.

- #VALUE! Error: It typically results from non-numeric values or improperly formatted dates. Ensure all cash flows are numbers and dates are in Excel’s date format.

These errors can be fixed by checking and correcting the cash flow and date ranges for accuracy and proper formatting.

John Michaloudis is a former accountant and finance analyst at General Electric, a Microsoft MVP since 2020, an Amazon #1 bestselling author of 4 Microsoft Excel books and teacher of Microsoft Excel & Office over at his flagship MyExcelOnline Academy Online Course.